By Peter Tchir of Academy Securities

The probability that we see oil production targeted as part of the escalating fighting in the Middle East has increased. Academy’s General (ret.) Robeson, Rachel Washburn and Peter Tchir discuss this in a highly viewed webinar – Risk of Further Escalation in the Middle East. The webinar was very much driven by audience Q&A, which reflect the uncertainty managers are facing when dealing with the conflict. We highlight oil as disruptions in oil supply or production would have the largest impact on the global economy.

Academy also published a number of SITREPs which can be found here. (you may need t contact your Academy representative for access to all the reports). The most recent SITREP covers the Iranian Missile Attack. We also examine that incident and our outlook from a T-Report perspective in Fool Me Once, Shame on You, Fool me Twice, Shame on Me.

At its most simple level, there are two main reasons to expect further escalation, which could include targets connected to energy production and distribution.

The combination of those two factors is why escalation is likely, even in the face of pressure from many countries to de-escalate.

Friday’s job report was so strong, that the Fed can no longer just look at jobs data (which has been their modus operandi for the past few meetings). As discussed in NFP – WOW!! It was very important that we got the upward revisions we were expecting. Yet another “beat” on the headline data, but with downward revisions would be easy to ignore. If you, like us, believe that the BLS has corrected some of their model errors (primarily in the birth/death model), we should have more balanced revisions going forward. Speaking of that model, it actually came in at -100k jobs, which I think is encouraging. For too many months last year, the birth/death model was too great of a percentage of the entire number for my tastes (I have a natural aversion to data where the “plugged numbers” dominate the overall number). I also didn’t highlight, but we saw a big increase in fulltime jobs in the household part of the survey.

So, with the employment data so much stronger, with chatter about the Sahm “rule” dying down the Fed is likely to be more cautious in terms of their next steps.

While I am not particularly worried about inflation, there are some things that we should be watching for:

My view is that the Fed had tilted to being 90% fixated on jobs and now they have to increase the weighting on inflation risks, of which there are several.

Let’s not forget the expectations for CPI on the 10th are 2.3% for overall, and 3.2% ex food and energy. While comforting (from an ivory tower standpoint) and moving in the right direction, they are still above 2% and are impacting consumers (voters) at levels higher than those consumers are comfortable with.

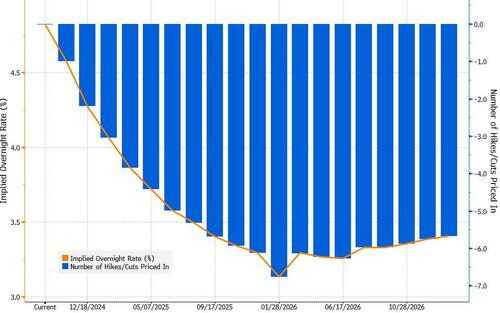

While the market has tempered Fed cut expectations, down to 4 cuts in next 4 meetings from 6 cuts in next 5 meetings, I think they will come down further.

Right now, and this is all data dependent, I think we need to be thinking 25 in November. No chance right now of another 50 (unless inflation is really low or jobs drop again) and 0 is probably off the table, because optically it makes 50 seem like it wasn’t a mistake (which I don’t think it was) and sets the stage nicely for a pause. Then maybe one more in December, but I would think they start moving at alternative meetings, so the very front end, as much as it has sold off, probably has more room to move to higher yields.

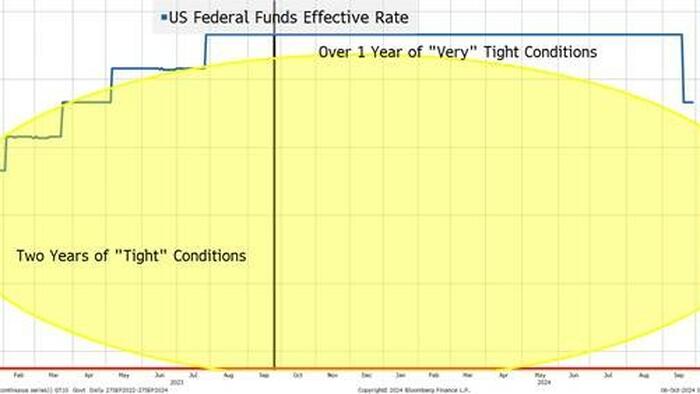

My simple view is that the “neutral rate” should be just that, a level of rates that allows the economy to function “normally”. We cannot measure what this normal rate is, so we rely on all sorts of estimates. What rates are considered “tight” or “loose” from a monetary policy standpoint? It really is difficult to determine what it is, but we will try to do that in any case.

Since the Fed’s goal should be to have “neutral” monetary policy as their desired outcome, the terminal rate (or longer term projections) in the dot plot should reflect what the Fed thinks about the neutral rate. Using that, we will run our little “thought experiment” on why we think the Fed will start talking about leaving longer term rates higher than the market is currently pricing in.

At the last meeting the terminal rate dots were:

At the meeting back in March, we saw a different picture:

There are two reasons I think this shift in neutral rates/terminal rate is occurring:

One of the biggest messes of all of this, is every smart corporation and individual who could, locked in long term debt during the era of ZIRP.

So, while those stuck borrowing short term have felt the increase in debt cost, for most companies and probably even more individuals the rates haven’t done much. There is even an argument, which I subscribe to, that the move to higher yields was beneficial to many as it added to their income, particularly through record holdings in money market funds. Also, the full impact of rate cuts didn’t bleed into the longer term yields as 2s vs 10s for example, were at -50 bps on average for the past two years.

Lots of difficulty measuring the neutral rate. Historical analysis is only marginally useful as the starting conditions change (one of the important ones here is average duration of borrowing).

So we might not get a big change in this, but I’m betting that they next hiccup for the bond market is less about how quickly we get rate cuts (market still a touch too aggressive there) but on where the Fed finally gets too (and I think the market needs to be looking to 3.5% or higher).

Moderately higher yields across the curve.

Equities.

Credit. Boring!

The Election.

Good luck and looking forward to seeing many of you in person at Academy’s events or some of the conferences where we are speaking this month!