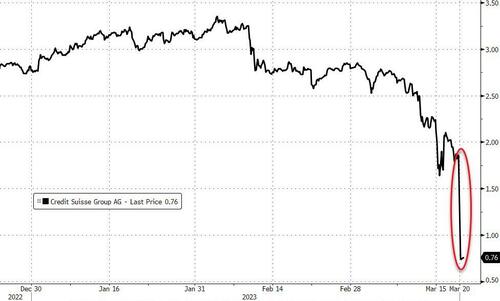

Unsurprisingly, CS shares collapsed to their UBS bid price...

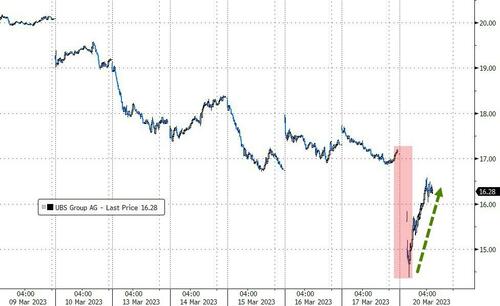

UBS share price is bouncing back from its ugly 16% opening plunge, but remains in the red...

But UBS CDS has jumped to its highest since July 2012...

...after a government-brokered deal for it to buy rival Credit Suisse prompted a slew of downgrades from analysts, who warned of risks to the lender’s future earnings.

KBW analyst Thomas Hallet cuts UBS to underperform from market perform, saying there is “considerable uncertainty around the earnings trajectory, while buybacks have been put on hold.” Buybacks were a key part of the investment thesis for UBS, he adds.

Another KBW analyst Andrew Stimpson expects that the move to wipe out AT1 bond holders to weigh on banks’ shares.

Oddo analyst Roland Pfaender also cuts UBS to underperform from neutral, citing high execution risk on the deal, which saw “very limited due diligence”.

Vontobel’s Andreas Venditti (buy) cuts price target to CHF19.5 from CHF22.5 citing higher cost of equity due to higher risk.

Manulife Investment Management (Marc Franklin, a portfolio manager of multi asset solutions).

But after all that negativity, there were some upgrades on UBS, praising the logic behind the deal.

BofA’s Alastair Ryan upgrades UBS to buy, praising the “impeccable” logic of the deal, due to cost synergies and enhanced scale.

ZKB analyst Michael Klien, however, raises UBS to outperform from market perform, saying that while the transaction increases the risk profile for UBS, the potential benefits are likely to outweigh the risks.

Morningstar analyst Johann Scholtz says “I think what will give investors confidence is the level of government support involved both in the form of liquidity and in the form of guarantees for future losses on the Credit Suisse portfolio and also restructuring costs”.

However, most were more pessimistic than optimistic in the longer-term...

IG Markets’ Hebe Chen says the deal is a “strong wake-up call” to those who still believe that financial markets are not yet in a crisis.

Jefferies analyst Flora Bocahut says the deal removes immediate tail risks, but it raises more questions; UBS’ capital requirement will likely be revised up, and management focus will be captured by this deal for many quarters, maybe years, she adds.

Citigroup analyst Andrew Coombs says UBS’ deal potentially has large cost synergies, but also carries the risk of sizable revenue attrition.

Charles-Henry Monchau, CIO at Banque Syz says “I really don’t like what happened on AT1.

BetaShares Holdings’ Chamath De Silva, a portfolio manager says that apart from specific bank credit spreads and CDS premiums, the wider corporate bond market is not displaying signs of severe stress, despite some softening.

And, as we noted earlier, that decision to wipe out CS' AT1 bonds spreads “realized losses” outside of the banking system.

Our understanding is banks don’t own much of each other’s AT1 paper as the treatment is onerous. So this means it is spread out throughout the financial system. Who knows what new trouble that might cause?