Matt Drudge's slide into mainstream media obscurity has been one of the more remarkable events of the post-Trump era, yet - like an insane uncle locked up in the attic - few would bring it up in polite conversation (especially since so little is known about what caused Drudge's striking U-turn in his one-time embrace of Trump). However, his tweet (or post) from last week that according to Wall Street, Kamala had a 72 chance to win (since deleted)...

... prompted us to respond.

We were the first, but hardly last, and shortly after our response to Drudge, both Goldman and JPMorgan chimed in, with reports that validated our criticism of Drudge's naive - and dead wrong - claim.

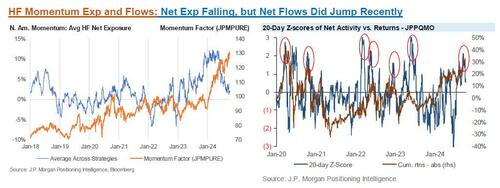

Later that day, JPMorgan's closely followed Positioning Intelligence team published a must read report (available to pro subs), in which John Schlegel summarized the recent hedge fund positioning rather simply: "all-in on Trump themes."

This is how the JPM trader summarizes the findings of his report:

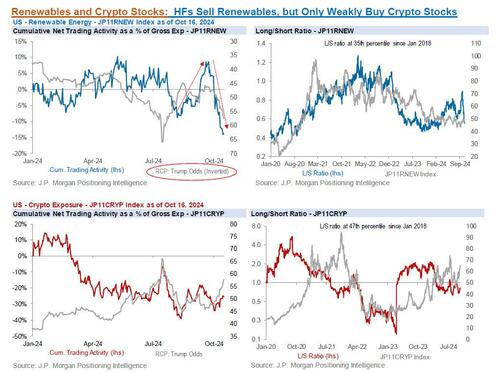

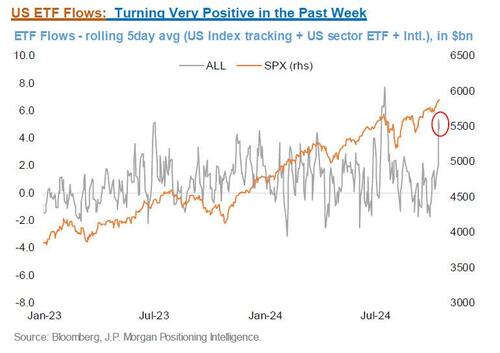

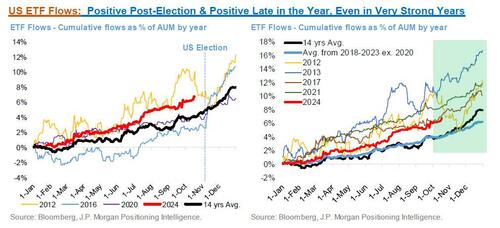

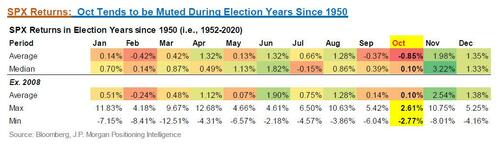

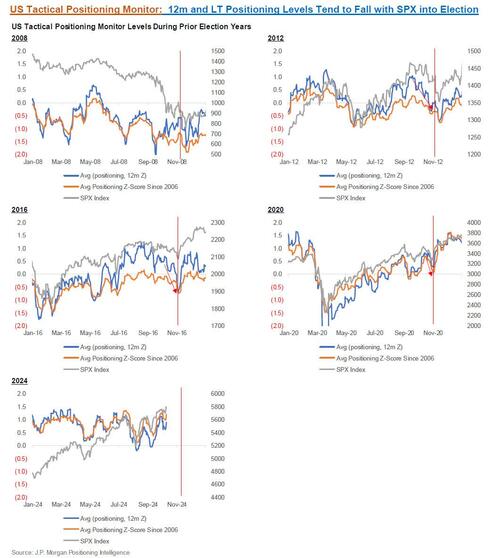

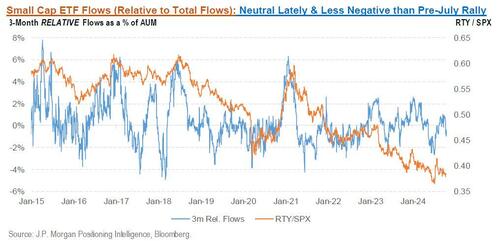

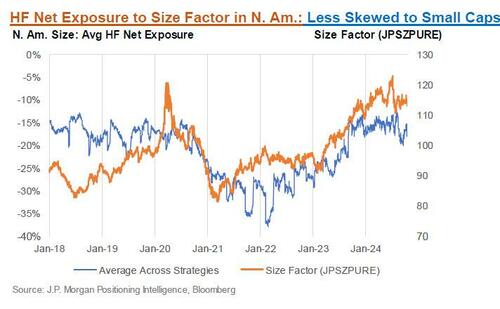

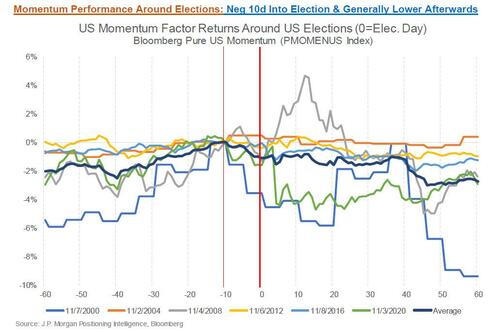

As odds of a Trump presidency and Red Wave have increased over the past few weeks, we’ve seen themes that are perceived to be Republican Winners (JPREPWIN) outperform Democratic Winners (JPDEMWIN) by ~7% over the past month. Crypto stocks and small caps have performed better, while Renewables have underperformed. In addition, the wider US equity market continues to make new ATHs and positioning appears to be elevated. Based on the thematic shifts, historical returns around elections, and elevated positioning, there’s room for a bit of disappointment and reversal in coming weeks if odds start to shift the other way.

In other words, the "smart market" is increasingly going all-in on a Trump victory.

Below we excerpt the main highlights from the report (much more in the full report available to professional subs):

Turning to Goldman Sachs, we find a similar bias. As we noted last week, a Republican Sweep Scenario, has emerged as one of the bank's preferred trades ahead of the elections. This is how Goldman put it:

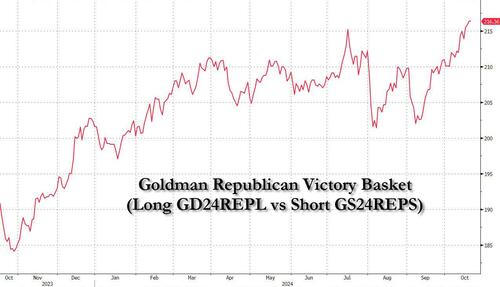

Long our Republican Policy Pair (GSP24REP), consisting of long Republican Policy Outperformers (GS24REPL, ex-commods version is GS24RLXC) vs short Republican Policy Underperformers (GS24REPS)

As shown below, the Goldman Republican victory pair trade discussed above just hit an all time high.

Decomposed into its constituents indexes, we find that the Republican Victory basket just hit an all time high, while the Democrat Victory basket is back to Biden levels.

In a new report from Goldman FICC vice president Vincent Mistretta (available here to pro subscribers), the trader confirms what we have said, namely that "positioning in markets leans toward Trump-win expressions. That has been the case since even before the recent run up in betting market odds for Trump." To help its clients, the bank has come up with a dashboard enumerating these aforementioned preconceived notions, and some trades that should perform well in scenarios that feel under-positioned, underappreciated or are anti-consensus.

GS Trading Views:

Much more in the Goldman note available to pro subscribers.

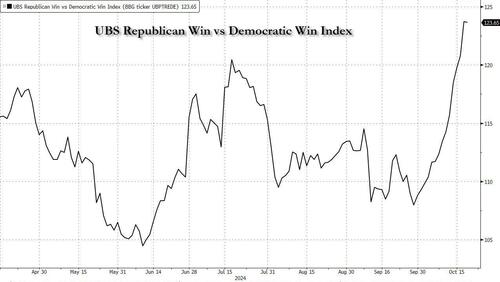

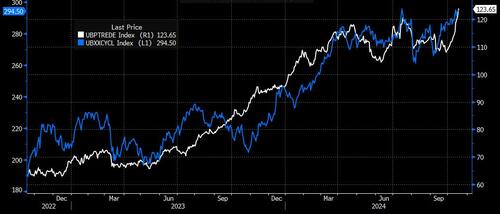

Taking a quick look at UBS, the bank has its own thematic pair trade, and writes that the recent surge in the "Republican Sweep" basket supported the S&P 500 rallying to an all-time high. Indeed, as shown below, the UBS Republican Win basket has trounced the Democrat Win having closed higher for 14 consecutive days! Also, UBS notes that the dramatic ascent in dollar has largely been driven by Chinese Yuan weakness thanks to the surge the Republican Sweep theme.

Elsewhere, in a note from UBS trader Michael Romano, he writes that "the UBS Republican vs. Democrat election pair trade is up 15% month to date to fresh highs in virtually a straight line, suggesting the market has largely priced former President Donald Trump's victory." Romano adds that "the election repricing, driven primarily by banks and solar, coincided with a growth re-pricing following a strong payrolls and strong earnings, making it less clear whether the recent moves are election or growth driven."

His conclusion: "While the end result is the same, i.e. banks higher, cyclicals/consumer/growth oriented stocks higher, the more the repricing was driven by an actual growth re-pricing, the more upside there still is on a Trump win. As most of the moves followed bank earnings, with strong follow-through on consumer, my money is on a lot more upside to come on a Trump win."

By now the big picture should be clear: whether due to his surge in online betting markets, or simply because Kamala's honeymoon is dead and buried, there has been a rush of sentiment - by people who put money where their mouths - into the Trump Victory/Republican sweep camps, which also largely explains why stocks continue to make new all time highs day after day. However, if one takes a step back and asks a more neutral question without assuming the outcome, such as How will markets react to different US election outcomes?

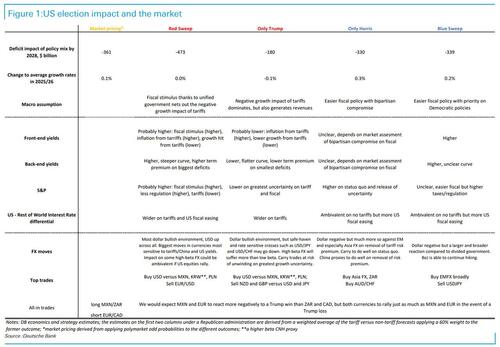

To help with the answer, we go to a recent note from Deutsche Bank's George Saravelos (available to pro subscribers), who took recently published Deutsche Bank Research economics estimates of the likely impact of different election outcomes and translated them in to a market reaction across asset classes with a specific focus on FX. The table is intended to capture the immediate market reaction to year-end rather than the long-term impact. Below are DB's four main conclusions:

Much more int he full notes from JPMorgan, Goldman, UBS and Deutsche Bank