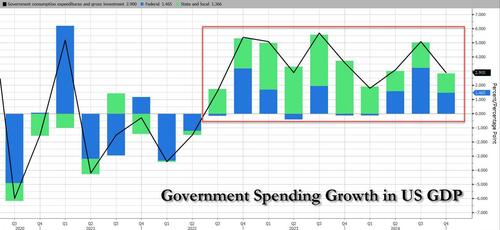

Almost two years ago we revealed "The $1 Trillion "Stealth Stimulus" Behind Bidenomics", which for the sake of brevity we exposed as budget-busting, debt-funded "stimulus" payments that flowed straight into the "government spending/investment" line item of the GDP ledger, providing a powerful and instant boost to GDP (through extremely inefficient and corrupt allocation of resources by govt bureaucrats), which cost $1 trillion in Federal debt every 100 days. And while nobody in the Biden admin cared about the massive debt incurrence it left in its wake, everyone was delighted by the artificial sugar rush this debt-fueled spending spree afforded GDP by way of the US government as shown below.

It is this artificial "growth" and the associated debt cancer that DOGE is trying to root out, while reviving the private sector. Unfortunately, that pernicious transition which took place gradually but (almost) irreversibly over the past decade, will be brutal and stubborn to reverse.

But while we have been banging the table and warning that the days of sugar highs for US "growth" will end in tears, and more recently both Trump and Musk/DOGE have become fervent converts to the church of fiscal prudence, it was unprecedented for Wall Street banks, whose gravy train depended on a continuation of the debt-funded status quo, to admit what was obvious for all to see.

Until now.

In his latest must-read report (full note available to pro subs), Bank of America's Research Investment Committee head

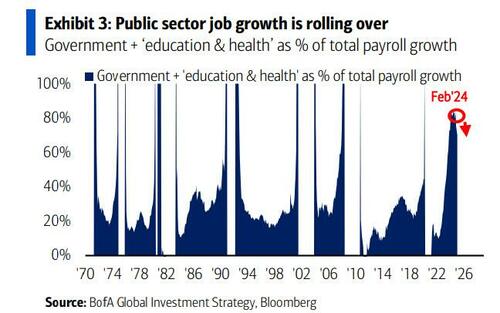

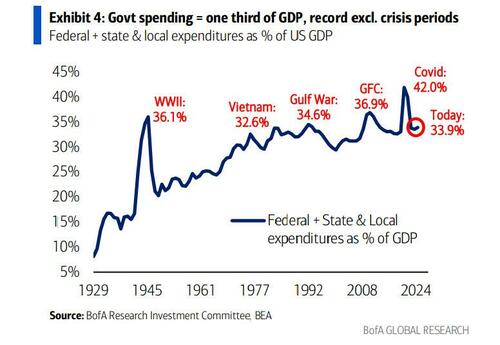

Jared Woodard writes that the US had never been more government-dependent: it relies on government for 85% of job growth, 33% of all spending and -- worst of all -- 6-7% budget deficits, all of which are at record high (excluding crisis and war).

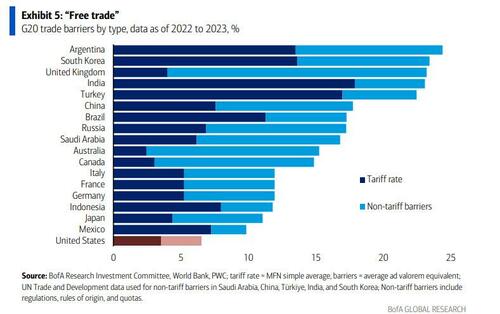

We agree with all of that - after all we have written about it for years... As for what the BofA strategist said next namely that "Economic growth has been enabled by unsustainable government support and protectionist policies", the White House should hang on billboards across the country. Here are the details from Bank of America:

We also agree with Woodard's much less pleasant conclusion, one which lays out the huge stakes gamble facing Trump as he tries to hand off US growth from unproductive, debt-funded government growth to productive, self-funded private sector growth.

As we first laid out over a month ago...

... and as the BofA strategist decries, "the global handoff from big government to the free market may prove slippery, but it seems necessary given large deficits and bloated debt burdens."

In other words brace for lots of pain as Trump tries to fix years and decades of uniparty graft and corruption.

And not just in the US: according to Woodard, the handoff is global: the public-to-private shift is happening everywhere.

Of course, the effects wont be seen overnight: BofA cautions that it may take some time for private sector job growth to accelerate, for government workers to resettle, for broad-based corporate profits to rise, and for global trade to find a new equilibrium. Not surprisingly, earlier today Howard Lutnick said that Americans will only feel the power of Trump's economy by Q4... meaning the economic slowdown and recession that hits in Q2 and Q3 will still be Biden's doing.

Ultimately, the good news outweighs the bad, and as Woodard concludes, "the likely productivity gains from a market-based economic reboot are greater than risks, while the risks from the unsustainable status quo of debt-financed, tepid, and narrow economic growth are severe."

We agree completely.

More in the full note available to pro subs