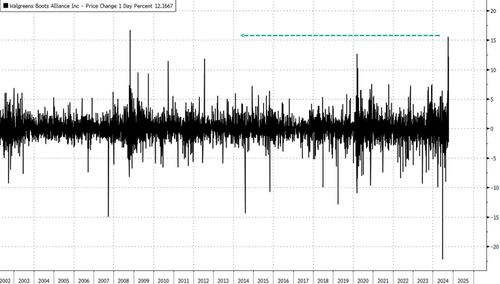

Walgreens shares in New York surged the most in 16 years on Tuesday after the struggling pharmacy chain delivered an unexpectedly optimistic forecast for 2025. Simultaneously, Walgreens announced plans to shutter over a thousand stores nationwide as its turnaround plan gains steam.

Fourth-quarter earnings were 39 cents, beating the Bloomberg consensus of 36 cents. This indicates that the struggling drugstore chain is executing on its aggressive cost-cutting measures in an ambitious turnaround plan after years of pain.

Here's a snapshot of the quarterly results (courtesy of Bloomberg):

With the fourth quarter print not so bad, Walgreens issued profit guidance for 2025 that was in line with the average analysts tracked by Bloomberg:

CEO Tim Wentworth wrote that the "turnaround will take time, but we are confident it will yield significant financial and consumer benefits over the long term."

Walgreens also announced that 14% of its US stores, or around 1,200 locations, will close over the next three years. About 500 of those stores will close in 2025.

In June, the drugstore chain announced that 300 underperforming locations would close as part of the turnaround plan. It also noted about a quarter of all stores were unprofitable and would usher in "imminent" changes.

Here's analyst commentary about Walgreens's ER and turnaround plan:

Leerink Partners, Michael Cherny (market perform, PT $9)

Evercore ISI, Elizabeth Anderson (in line, PT $7.50)

Barclays, Stephanie Davis (underweight, PT $7)

Jonathan Palmer, an analyst with Bloomberg Intelligence

WBA shares jumped as much as 15% in markets—the most in 16 years. Shares peaked at the $96 handle in August 2015 and have since tumbled 91%. The latest downward pressure comes from budget-conscious consumers.

We wonder how many of the Walgreens stores slated to close next are in lawless progressive cities.

Sigh.