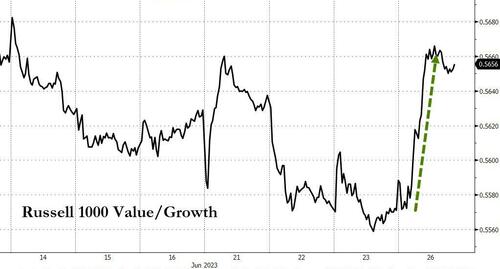

A quiet start to the last week of the month/quarter with bonds and the dollar down a bit, gold up a smidge, and all the volume in a rotation from growth to value (for a change) in equity-land.

Source: Bloomberg

A weaker than expected Dallas Fed survey confirmed manufacturing is still f**ked in 'Murica as Independence Day looms, but on the day long-duration stocks (tech) significantly underperformed Small Caps (value-dominated). Late on, the entire market sold off (no obvious catalyst) with The Dow turning red along with the S&P and Nasdaq...

BTFD? As a reminder, the Nasdaq has not had a 'down July' since 2007...

Source: Bloomberg

Notably the Nasdaq/Russell ratio found resistance once again and reversed...

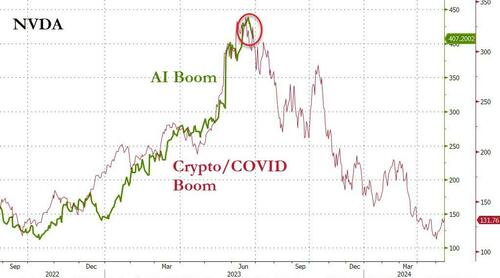

NVDA had an ugly day...

Treasuries were mixed on the day with the belly outperforming and the long-end lagging (30Y +1bps). NOTE that bonds were bid as Europe opened/Asia closed and then sold off on the US cash equity open - other than that, sideways...

Source: Bloomberg

The dollar opened weaker on Sunday night and has barely moved since...

Source: Bloomberg

Bitcoin slipped back from almost $31,500 to $30,000 (and found support) for a small close lower...

Source: Bloomberg

Oil managed gains on the day, but WTI was unable to break above $70...

Gold clung on to very modest gains after a pump and dump intraday...

Finally, Nomura's Charlie McElligott warns that despite many long-term investors anticipating an eventual return to a larger thematic “Secular Disinflation” world as driven by the long-term realities presented from the “3 D’s” (Demographics, Debt and Disruption—potentially supercharged now by AI) - many discretionary / tactical Macro investors are continuing to voice a conviction that it's unlikely to be a smooth glide path back to "the old world", and that we will continue to see overshoots in positioning and narratives as the "Frankenstein cycle" continues:

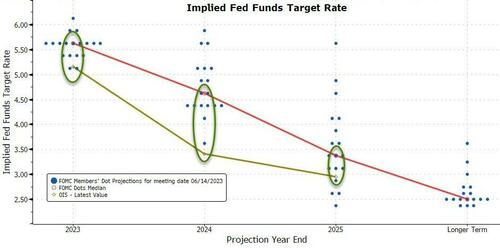

But the market remains convinced The Fed will fold and start easing much more aggressively (i.e. weights a hard-landing/market-collapse with a higher probability than The Fed's Dots)...

Source: Bloomberg

Perhaps it will be the collapse of the AI-Boom (or put another way, the demand pull-forward extrapolation error)...

Source: Bloomberg

It's different this time though.