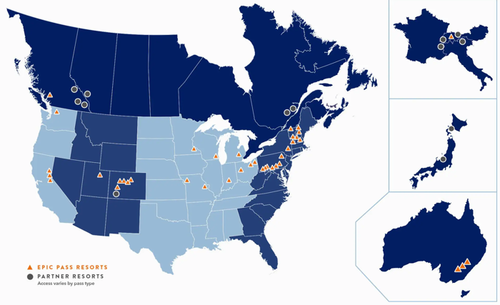

Ahead of the coming ski season, Vail Resorts, which operates 37 mountain resorts across North America, reported on Monday that it sold fewer ski passes than previously expected, and this potentially is a bellwether for the upcoming season that may suggest consumers are shifting away from winter sports, or simply that the passes have become too expensive.

"At the heart of our underperformance is that the way we are connecting with guests has not kept pace with the rapidly evolving consumer landscape," CEO Rob Katz said during a call with Wall Street analysts.

For the current fiscal year, Vail expects net income to be between $201 million and $276 million, down from $280 million last year and below the $286.2 million expected by analysts surveyed by Bloomberg.

Here's the snapshot of the profit guidance that came in light, while EBITDA is roughly in line with Bloomberg Consensus estimates:

In its latest fiscal quarter, Vail reported wider losses, although revenue increased, thanks to a tick up in ski resort traffic in Australia.

Here's a snapshot of fourth quarter results:

Through September 19, ski season tickets for the upcoming North American season were down by about 3% in terms of units and up about 1% in sales dollars. This is because passes are 7% higher than the previous season.

Comments from Wall Street analysts (courtesy of Bloomberg):

Barclays (underweight)

Pass sales update was disappointing and initial FY26 guidance is below consensus and will reset the bar, says analyst Brandt Montour

Incremental details on the turnaround plan show some potential, but still not complete and not likely to revert to sustainable growth until FY27 at the earliest

Jefferies (hold, PT cut to $158 from $163)

The impression is that both pricing and marketing strategies are being broadly retooled to drive growth for the FY27 season, which suggests FY26 is a transition operating year, says analyst David Katz

Says visitation from both pass and non-pass sales is pressuring FY26 outlook

Truist Securities (buy, PT cut to $237 from $244)

Investors were anticipating a modest beat for 4Q Ebitda given the strong snowfall in Australia, but actual results were only in-line with estimates, says analyst Charles Patrick Scholes

Pass sales in both units and dollar terms came in lower than expected and marked a modest deceleration from reported figures in May

In the markets, shares are down 1% in trading on the New York Stock Exchange. Year-to-date, shares are down 21% as of Monday's close. Short interest accounts for 11.88% of the float, or about 4.2 million shares, with a 6.2-day average trading volume to cover.

. . .