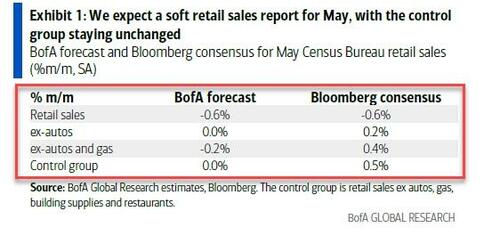

BofA's omniscient analysts warning ahead of this morning's retail sales data from the US is simple: Brace!

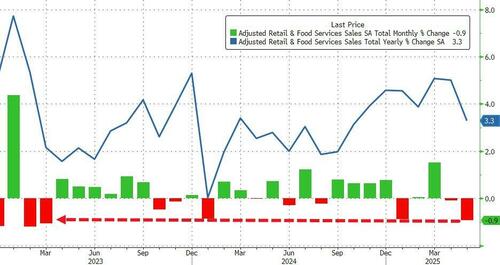

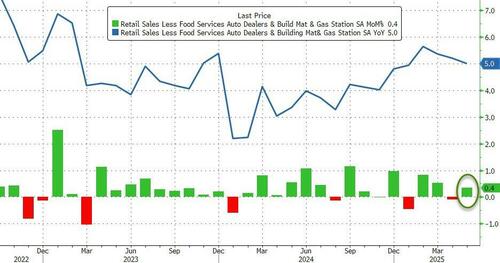

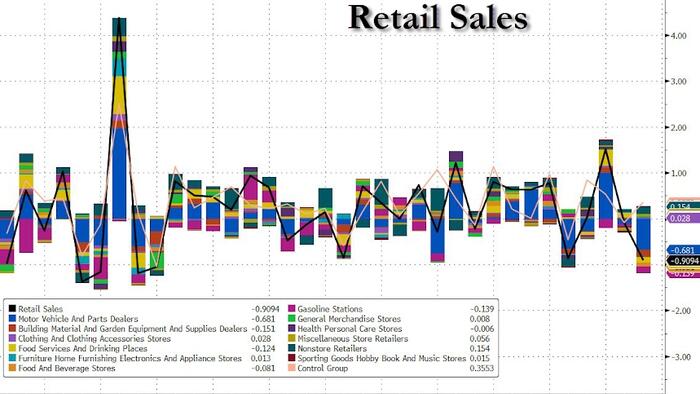

And after the small 0.1% MoM rise the prior month was revised to a 0.1% MoM decline, BofA was right again with Retail Sales tumbling 0.9% MoM in May - the biggest drop since March 2023...

Source: Bloomberg

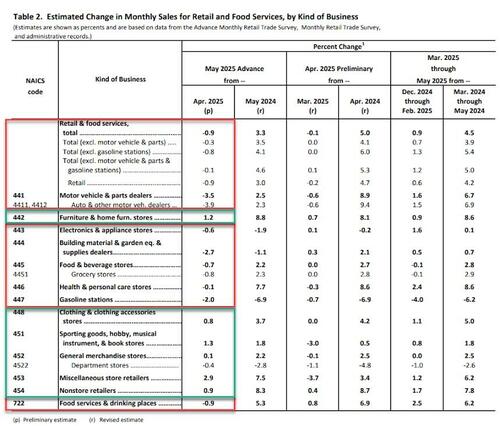

The big driver of downside was a drop in Gasoline Station sales - which makes some sense as gas prices have tumbled - and an even bigger drop in Auto Sales (as the tariff front running surge evaporates)...

The tariff front-running hangover hits...

Source: Bloomberg

Ex Autos and Gas, sales fell 0.1% MoM (worse than the +0.3% expected) and Ex-Autos sales dropped 0.3% MoM (worse than the +0.2% MoM expected).

So an ugly set of data reflecting sentiment's slump?

“There was front running in autos because of tariffs in recent months and now we're getting payback," said David Russell, head of market strategy at TradeStation.

"Data centers and tech investment are driving the economy now. Consumers are on the sidelines as the job market weakens and Americans grapple with higher prices. It could be a pause before confidence rebounds, or a warning before a broader slowdown."

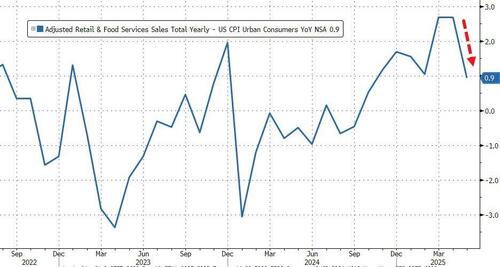

As a reminder, this data is nominal, so adjusting (very roughly) for inflation, retail sales rose 0.9% YoY, back to its lowest since Oct 2024... but still positive...

While the seasonally-adjusted sales print was down, unadjusted sales were higher in May (as they have been seasonally for years)...

However, there is a silver lining as the Control Group - which feeds directly into GDP - rose 0.4% MoM (better than expected) and considerably stronger than the upwardly revised 0.1% MoM decline in April...

So, the bad news is Americans seem to be spending less... but top-down GDP will be positively impacted in Q2.