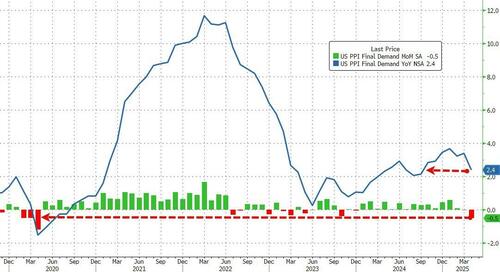

Following the cooler than expected CPI, US Producer Prices plunged in April, down 0.5% MoM (vs +0.2% MoM exp) - the biggest drop since April 2020 (but we note that last month's 0.4% MoM decline was revised up to unchanged). The headline print was dragged down to +2.4% YoY (the lowest since Sept 2024)...

Source: Bloomberg

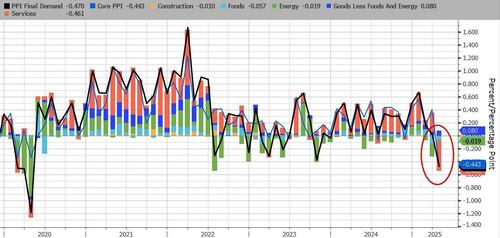

Under the hood, Prices for final demand services moved down 0.7 percent in April, the largest decline since the index began in December 2009.

Source: Bloomberg

Core Producer Prices plunged by the most on record (back to 2010)...

Source: Bloomberg

PPI Final Demand Services

Prices for final demand services moved down 0.7 percent in April, the largest decline since the index began in December 2009. Over two-thirds of the broad-based decrease can be traced to margins for final demand trade services, which dropped 1.6 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.) Prices for final demand services less trade, transportation, and warehousing and for final demand transportation and warehousing services fell 0.3 percent and 0.4 percent, respectively.

PPI Final demand goods

Prices for final demand goods were unchanged in April following a 0.9-percent decrease in March. In April, the index for final demand goods less foods and energy increased 0.4 percent. In contrast, prices for final demand foods and for final demand energy declined 1.0 percent and 0.4 percent, respectively.

Margin pressure remains on American corporations...

Source: Bloomberg

It would appear that despite all the FUD, companies are soaking up any tariff price increases and NOT passing them on to customers.

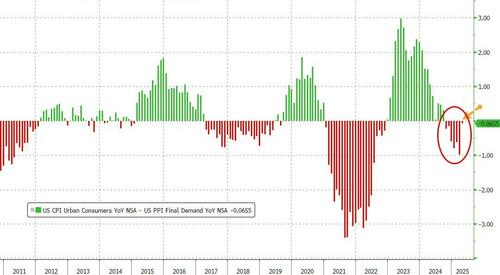

Finally, energy prices are set to drag CPI and PPI even lower in the next month or so...

Source: Bloomberg

But, but, but... the PhDs said tariffs were inflationary!!