Ahead of tomorrow's CPI, traders are eyeing this morning's Producer Prices for any hints that the disinflation trend will return...or not.

The answer is "not!"

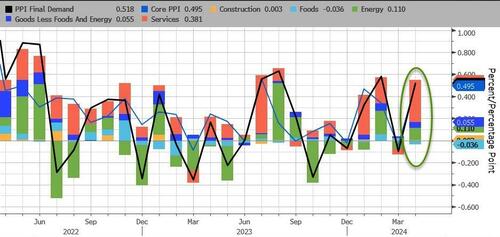

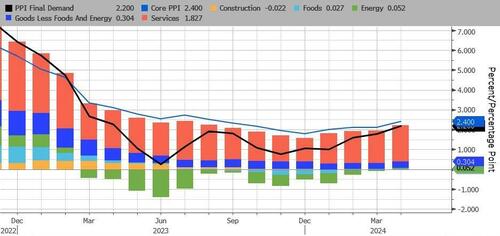

April Producer Prices rose 0.5% MoM (vs +0.3% exp), with March's +0.2% MoM revised down to -0.1% MoM. The downward revision did not stop the YoY read rising to 2.2% (from +2.1% in March)...

Source: Bloomberg

This is the highest YoY read since April 2023 and is the fourth hotter than expected headline PPI print...

Source: Bloomberg

Producer Prices have been aggressively downwardly revised for 4 of the last 7 months...

Source: Bloomberg

Services costs soared, dominating April's PPI gains with Energy the second most important factor. Food prices actually declined on a MoM basis.

Source: Bloomberg

On a YoY basis, headline PPI's rise was dominated by Services (rising at their hottest since July 2023). For the first time since Feb 2023, none of the underlying factors were negative on a YoY basis...

Source: Bloomberg

After last month's farcical 'seasonally adjusted' gasoline price, April saw the PPI Gasoline index rise (with actual prices at the pump) but still has a long way to go...

Source: Bloomberg

Core PPI was worse - rising 0.5% MoM (more than double the +0.2% MoM expected) - which pushed the Core PPI YoY up to +2.4%...

Source: Bloomberg

And finally US PPI Final Demand Less Foods Energy and Trade Services rose by 0.4% MoM and 3.1% YoY (the highest in 12 months).

Worse still the pipeline for primary PPI is not good as intermediate demand is starting to accelerate...

Source: Bloomberg

Over the past month, 'higher prices' have dominated 'lower prices' in recent survey data...

Higher producer prices:

Lower producer prices:

Do you see the 'flation' now, Jay?

So, no, The Fed does not have inflation under control.