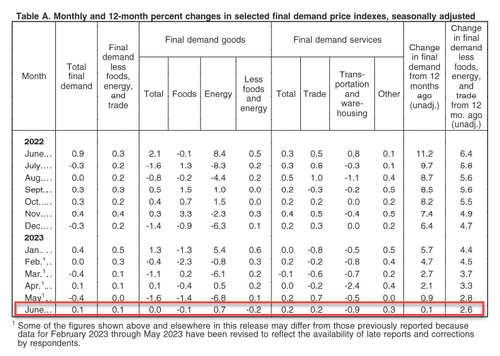

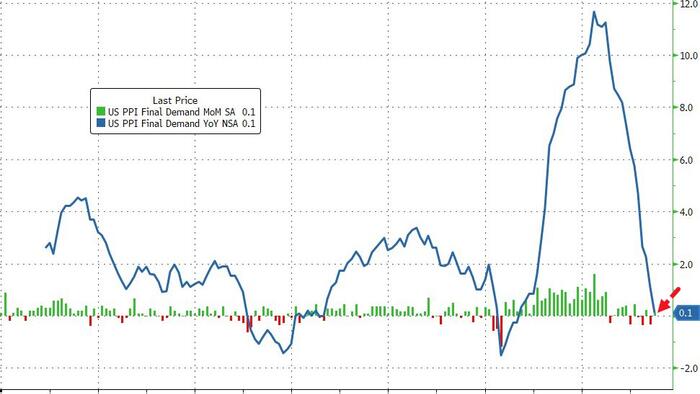

After consumer price inflation slowed faster than expected yesterday, all eyes are on the pipeline with producer price inflation expected to slow to just +0.4% YoY in June. Instead it fell further (+0.1% MoM), with PPI barely positive on a YoY basis (+0.1%)...

Source: Bloomberg

That is the slowest headline YoY PPI print since August 2020.

Under the hood, we note that core PPI (ex Food, Trade, & Energy) rose 2.6% YoY - the slowest since Feb 2021...

Final demand services: The index for final demand services increased 0.2 percent in June, the same as in May.

Product detail:

Final demand goods: Prices for final demand goods were unchanged in June after decreasing 1.6 percent in May.

Product detail:

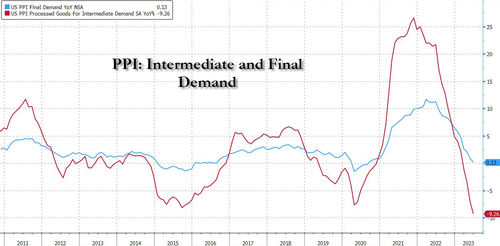

The pipeline for PPI signals further deflation is imminent with intermediate demand goods prices down over 9% YoY - worse than the trough of the COVID lockdowns...

Source: Bloomberg

This appears to be further 'good news' for The Fed (and the bulls)... or is the deflationary pressure a signal of recession?