Following yesterday's disappointing existing home sales print, this morning sees new home sales confirm the disappointment with a mere 0.6% MoM rise (well below the 4.3% MoM rebound expected after tumbling 11.6% MoM the month prior)...

Source: Bloomberg

That is the worst YoY decline in new home sales since Oct 2024, leaving the total SAAR at 627k - hovering near post-COVID lockdown lows and well below expectations...

Source: Bloomberg

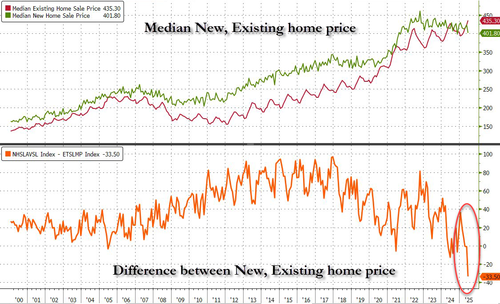

The Median new home prices plunged in June (near 5 year lows), now well below that of existing homes...

Source: Bloomberg

This week, Atlanta-based PulteGroup relieved investors by posting better-than-expected earnings, despite reporting a slowdown in new home orders.

Sales incentives have grown to 8.7% of its houses’ gross sale price, more than double a “normal” incentive load, executives said on an earnings call.

“I long for the days of more normal incentive loads of kind of 3% to 3.5%,” Chief Executive Officer Ryan Marshall said on the earnings call.

“Hopefully as we get out into kind of future years, that will become possible again.”

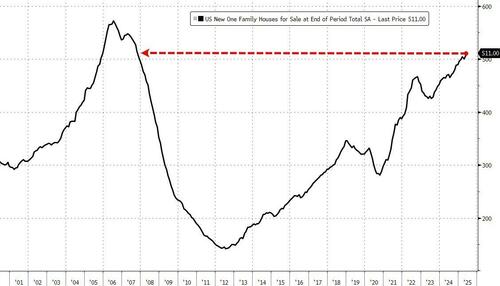

Thursday’s government report showed the supply of new homes for sale in June increased to 511,000, still the highest level since 2007.

Source: Bloomberg

And for those hoping for rate-cuts to fix all this, think again...

Source: Bloomberg

Rate cuts have steepened the yield curve and pushed mortgage rates up; but as the chart above shows, the relationship between home sales and actual mortgage rates has decoupled in recent weeks...

So be careful what you wish for.