So much for the Fed's attempts to slowdown the US economy.

US GDP growth in the second quarter was much stronger than expected as activity proved resilient in the face of the Federal Reserve’s campaign of aggressive interest rate rises (or at least Biden's persistence to paint the economy as stronger has never been this articulate).

The world’s largest economy grew an unexpectedly strong 2.4% between April and June, so-called "data" just released by Biden's Commerce Department showed. This marked a rebound from an also stronger than expected 2% growth rate in the first quarter, and was a strong beat to the 1.8% rate predicted by economists.

Economists had an unusually wide range of predictions for Thursday’s growth data, with forecasts gathered by Refinitiv ranging from 0.3% to 3% growth rates. Economists at Pantheon Macroeconomics said forecasting this quarter was complicated by the fact that several pieces of data on international trade and durable goods orders, which are normally released in advance, are this month being published at the same time as the GDP figures.

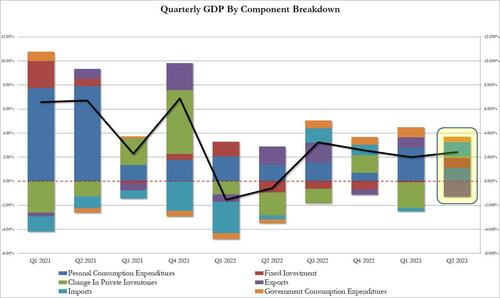

Looking at the component breakdown, consumer spending growth slowed after an unusually strong start to the year but the reduction was more than offset by strong business investment in both inventories and fixed assets.

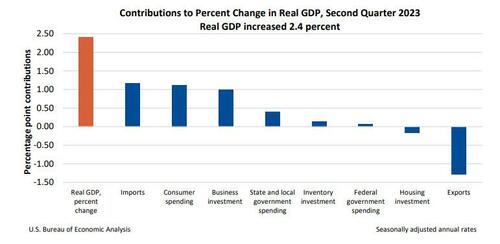

Compared to the first quarter, the acceleration in GDP in the second quarter primarily reflected an upturn in private inventory investment and an acceleration in business investment. These movements were partly offset by a downturn in exports, and slowdowns in consumer spending, federal government spending, and state and local government spending. Imports turned down.

Some more details:

In terms of bottom line contribution:

The data comes a day after the US central bank lifted its benchmark interest rate to the highest level in 22 years as part of its ongoing efforts to tame inflation. Clearly, Powell isn't doing enough to crush the US economy. Either that, or the Biden apparatchiks are simply doing everything in their power to reverse the optics of the ongoing economic slowdown, which according to the inverted yield curve, means the biggest recession this century is imminent.

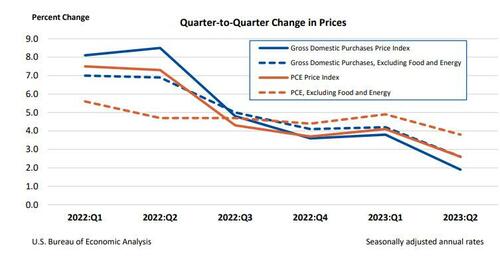

Turning to prices, gross domestic purchases prices increased 1.9% in the second quarter after increasing 3.8% in the first quarter. Excluding food and energy, prices increased 2.6 percent after increasing 4.2 percent.

Personal consumption expenditure (PCE) prices increased 2.6% in the second quarter after increasing 4.1% in the first quarter. Excluding food and energy, the PCE “core” price index increased 3.8% after increasing 4.9%, coming below the 4.0% estimate.

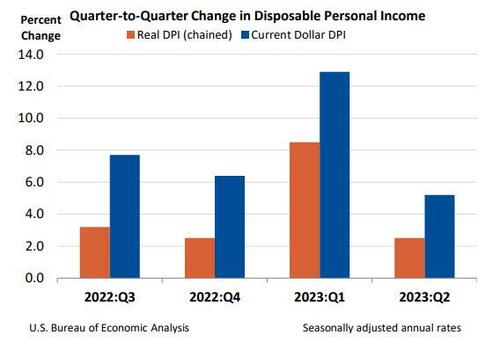

Finally, real disposable personal income (DPI) — personal income adjusted for taxes and inflation—increased 2.5% in the second quarter after increasing 8.5 percent in the first quarter.

Current-dollar DPI increased 5.2% in the second quarter, following an increase of 12.9% in the first quarter. The increase in the second quarter primarily reflected increases in compensation, personal income receipts on assets, rental income of persons, and personal current transfer receipts. Personal saving as a percentage of DPI was 4.4% in the second quarter, compared with 4.3% in the first quarter.

The unexpectedly strong recent data, which a growing number say is grotesquely manipulated (just compare the record delta between GDP and GDI) by the admin, has raised hopes that the Fed can achieve the rare feat of a “soft landing” — bringing inflation under control without major economic damage. But others are concerned that the economy’s resilience will make it harder to bring inflation all the way to the Fed’s 2% target.

On Wednesday, Fed chair Powell said his “base case is that we will be able to achieve inflation moving back down to our target without the kind of really significant downturn that results in high levels of job losses”. He also noted the risks: “At the margins, stronger growth could lead over time to higher inflation and that would require an appropriate response for monetary policy, so we’ll be watching that carefully.”