In his first public address, the new governor of Japan’s central bank disappointed policy hawks as he signaled that he plans no drastic changes in its ultra-low interest rate policy, sticking to earlier messaging on the topic.

“Markets have calmed and, as far as the impact on the Japanese system, we have maintained the easy monetary policy, and there is ample capital and fluidity,” Ueda said.

Ueda inauguration comes after his predecessor Kuroda presided over a decade-long monetary stimulus program centered around zero or minus long-term interest rates to nurture economic activity.

“As a result of appropriate policy from both the BOJ and the government we’re now in a situation where we’re not in a state of deflation,” Ueda told reporters in Tokyo Monday after meeting with Kishida at the prime minister’s office.

“We agreed the thinking behind the joint statement is appropriate, and there’s no need for an immediate review.”

Japan’s benchmark rate has been at minus 0.1% for years, and, as a reminder, Japanese inflation remains near 40-year cycle highs...

Ueda has repeatedly indicated he won’t take drastic action given Japan's slow wage growth, shrinking and aging population and other challenges. He said it was vital to ensure the trend toward inflation will continue.

“There are difficult problems. But for right now, and we are speaking about Japan here, the situation is not such that there is a major raising of interest rates. For now, the financial system remains basically stable,” he said.

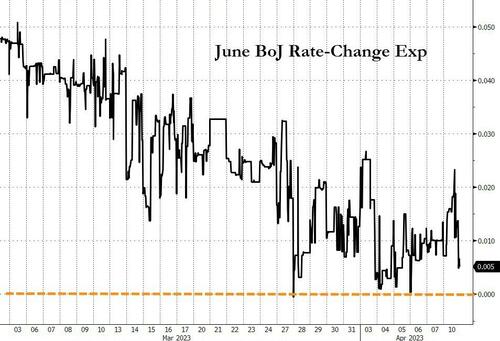

The 71-year old is scheduled to host his first policy meeting between April 27-28. Mainly due to increasing signs of deterioration in financial market functioning, most BoJ watchers expect some kind of policy tightening by June...

...but Ueda's comments poured cold water on that to some extent...

“Right now, the yield curve control is considered most appropriate for the economy while tending to market functionality,” he said.

“Given the current economic, price and financial conditions, I think it’s appropriate to keep up the current yield curve control.”

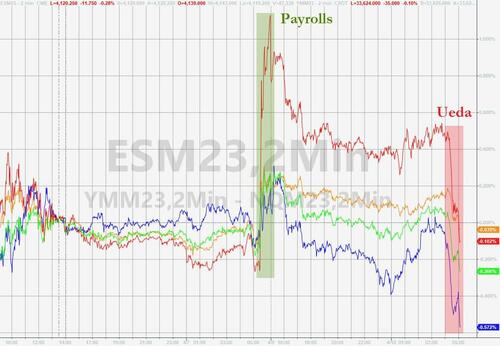

The reaction was swift with Yen dropping to its weakest in a week...

And US equity futures tumbling (stronger USD), erasing all of the payrolls spike gains...

Ueda did offer a bone to an inflation-fighting stance as he concluded by saying he’s open to the idea of a policy review from a longer-term standpoint, although he’d like to discuss it with other board members before any decision.

But then again, Kuroda has been promising progress for years...