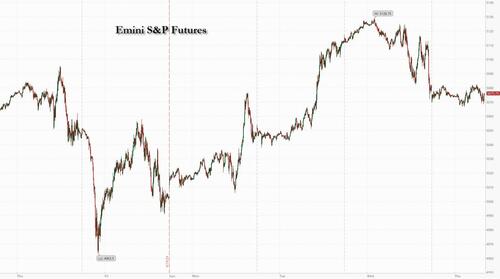

The three-day rebound from last week's rout ended with a thud after the close yesterday when Meta imploded, plunging as much as 17% and losing $200 billion in market cap, after the company revealed disappointing revenue guidance coupled with higher capex projections. The report sent US futures lower, and as of 7:50am, S&P futures are down 0.6% with Nasdaq futures sliding 1% (Meta accountied for more than half of the decline) dragged by Mag7 names (META -12.6%, AMZN -2.2%, MSFT -1.5%, GOOGL -2.8% but Semis are broadly stronger, buoyed by META’s capex spend (at least $70bn over next 2 years). Bond yields are flattish with the 10Y trading at 4.65% and the curve slightly steeper as the USD is moving lower but not for the yen which continues its historic implosion as the hopeless BOJ sits in shock and watches its currency collapse (there is a BOJ meeting tonight where we expect nothing from the headless chickens). Commodites are rising today with strength in Energy and Metals. In macro, we get Q1 GDP numbers today with an update on March inventories and the normal jobless claims, but tomorrow's s PCE is the more impactful number. After the close we get earnings from GOOG/MSFT which take on heightened importance given META’s price reaction.

In premarket trading, Meta tumbled as much as 15% after it projected second-quarter sales below analyst expectations and increased spending estimates for the year (JPM tech trader Jack Atherton says he would buy the dip with META). Alphabet Inc., which reports earnings later along with Microsoft Corp., also dropped. IBM shares are also down over 8% following weak demand for the company’s consulting unit. Here are the most notable US premarket movers:

Hopes for tech megacaps have been red hot after the frenzy around artificial intelligence powered Wall Street’s record-breaking rally. But gains at the start of the week are flagging, suggesting wagers on an AI-driven profit boost may be overdone. US data due Thursday could turn the focus back to the timing of Federal Reserve policy easing.

“I think we are just hitting a little bit of a reality check,” Sonja Laud, chief investment officer at Legal & General Investment Management, said on Bloomberg Television. “This doesn’t take away the excitement around the potential going forward, but it’s probably valuation coming back to a more realistic pathway.”

Beyond corporate results, traders are also bracing for US economic growth figures after scaling back expectations for Fed interest-rate cuts for weeks. Economists predict GDP cooled to around 2.5% in the first quarter from 3.4%, with the figures still potentially suggesting persistent inflationary pressures.

“Any downside surprises could see markets bringing expected Fed interest rate cuts earlier — after having been pushed out to much later this year,” economists at Rand Merchant Bank in Johannesburg said. “However, upside surprises could see continued market volatility as the market tries to ascertain the risk that a hotter-than-expected economy poses to anticipated interest-rate cuts.”

Meanwhile, Secretary of State Antony Blinken said the world’s largest economies must “lay out our differences,” as he began two days of talks in China, with the threat of US sanctions targeting Beijing over its support of Russia’s war in Ukraine looming over his visit.

Europe’s Stoxx 600 Index edged lower with food beverage and industrial goods sectors leading declines, while mining and personal care drug shares are the biggest outperformers as traders processed a deluge of corporate updates on the busiest day of the earnings season. Anglo American Plc soared 14% after rival BHP Group made an all-share takeover proposal valuing it at £31.1 billion ($38.8 billion) in a deal that would create the world’s largest copper miner. Here are the biggest movers Thursday:

In FX, the Bloomberg Dollar Spot Index falls 0.1% while the pound is among the best performing G-10 currencies, rising 0.4% versus the greenback. The yen extended losses after weakening beyond 155 per dollar for the first time in more than three decades on Wednesday, heightening the chances of intervention ahead of Bank of Japan’s policy decision Friday. The Japanese currency weakened to 155.74 per dollar on Thursday, a new 34-year low. The BOJ is forecast to keep its interest rate settings unchanged, while the yen’s plunge makes it more likely the bank will tone down its stance on keeping policy easy. Governor Kazuo Ueda’s press conference “is expected to take a hawkish tone, and even if depreciation in the yen doesn’t accelerate, the government is likely to intervene at the same time and swing the yen stronger by about 5 yen,” said Eiji Dohke, a strategist at SBI Securities. The first intervention would probably be for trillions of yen, followed by smaller long-term purchases, he said.

In rates, treasuries were little changed after yields rose in the previous session. US 10-year yields around 4.64% are near flat on the day with bunds and gilts outperforming by 1.5bp and 2.5bp in the sector. Core European rates outperform Treasuries, with little reaction in Spanish short-end bonds to Prime Minister Pedro Sanchez’s threat to resign, made after European markets closed on Wednesday. The week's treasury coupon auction cycle concludes with $44b 7-year note sale at 1pm New York time, following solid results for both 2- and 5-year sales earlier this week; WI 7-year yield at ~4.652% is roughly 47bp cheaper than last month’s, which stopped 0.8bp through in a strong result.

In commodities, oil prices are little changed, with WTI trading near $82.80 a barrel. Spot gold rises 0.4% to around $2,325/oz.

Bitcoin was flat in choppy trade and briefly approached the $64,000 level before fading back.

Looking at the calendar, US data releases include the initial Q1 GDP reading from the US, along with the weekly initial jobless claims, pending home sales for March, and the Kansas City Fed’s manufacturing index for April. Meanwhile from central banks, we’ll hear from ECB President Lagarde, the ECB’s Schnabel, Vujcic, Nagel and Panetta. And we’ll also get the ECB’s latest Economic Bulletin. Finally, today’s earnings releases include Microsoft, Alphabet, Caterpillar and Intel.

Corporate Highlights:

Earnings

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued after the uninspiring handover from the US where futures were pressured after-hours following Meta's underwhelming guidance, while the region also digested several earnings releases and markets in both Australia and New Zealand markets were closed for ANZAC Day. Nikkei 225 underperforms and retreated beneath the 38,000 level amid tech weakness and with earnings releases influencing price action, while the BoJ also kick-started its 2-day policy meeting. KOSPI was dragged lower amid losses in tech heavyweights despite stronger-than-expected GDP data and a blockbuster earnings report from SK Hynix. Hang Seng and Shanghai Comp. were positive with the Hong Kong benchmark underpinned amid resilience in the property industry, while the mainland eked slight gains after Premier Li noted China seeks to enhance development momentum and with US Secretary of State Blinken calling for the US and China to manage differences responsibly during a trip to China.

Top Asian News

European bourses, Stoxx600 (-0.1%) initially opened mixed, though sentiment quickly soured and indices now hold a negative bias. European sectors hold a negative tilt; Basic Resources is the clear outperformer, with Anglo American (+11.5%) taking the lion’s share of the gains on BHP takeover reports; positive price action in the metals complex is also helping. Food Beverage & Tobacco is found at the foot of the pile, following post-earning losses in Nestle (-3.9%) and Pernod Ricard (-2.9%). US Equity Futures (ES -0.5%, NQ -0.9%, RTY +0.5%) are mixed, with clear underperformance in the tech-heavy NQ, dragged down by Meta (-13%) post-earnings, with IBM (-8%) also fuelling the downside.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets have had a challenging 24 hours, and futures on the S&P 500 are down -0.66% overnight after Meta reported a disappointing outlook after the market close. Ahead of that, risk assets had already experienced a mediocre session yesterday, with equities flat in the US but down in Europe, as a bond selloff and geopolitical tensions weighed on sentiment. The losses for bonds didn’t have a single catalyst, but they gathered pace throughout the day, and in Europe it left 10yr yields at their highest levels of 2024 so far. To be honest, there were few assets that did particularly well, with the dollar index (+0.17%) the notable exception. Today will see more tech results come out as well, with Microsoft and Alphabet reporting after the US close.

Kicking off with Meta, its shares fell -15% in after-hours trading yesterday, as even though its Q1 results slightly exceeded revenue and earnings estimates, revenue guidance for Q2 came towards the lower end of analysts’ expectations. The company also raised its cost expectations for 2024, seeing capex spending totalling $35-40bn (vs. $30-37bn earlier guidance). All this led to what was in many ways a mirror image of the reaction to Tesla’s results the day before, with Meta’s outlook disappointing relative to lofty expectations that had seen its shares rise +39.4% year-to-date. Adding to more negative tech sentiment overnight, IBM slumped -8.5% after-market after its own results.

Prior to this, the sizeable bond selloff was the bigger story yesterday. This was most prominent in Europe, leaving yields on 10yr bunds (+8.6bps) at 2.59%, which is their highest level since November. One factor behind that were comments from Bundesbank President Nagel, who cautioned that a rate cut in June “would not necessarily be followed by a series of rate cuts.” So that adds to the suggestions that an initial cut doesn’t have to be followed by lots of further cuts. On top of that, we then got the Ifo’s latest business climate indicator from Germany, which rose to 89.4 in April (vs. 88.8 expected). That was its highest level in 11 months, and the expectations component also hit a one-year high of 89.9 (vs. 88.9 expected). So several headlines leant in a hawkish direction, and that came on top of the positive European PMIs the previous day.

Against that backdrop, markets dialled back their expectations for ECB rate cuts, and the amount priced in by the December meeting came down -3.9bps on the day to 73bps. That meant sovereign bonds lost ground across the continent, and yields on 10yr gilts (+9.3bps), OATs (+9.2bps) and BTPs (+13.8bps) all reached their highest levels year-to-date. Meanwhile in the US, yields on 10yr Treasuries (+4.1bps) closed at 4.64%, just beneath last week’s high for the year, and the 30yr yield (+4.4bps) hit a post-November high of 4.77%.

Higher rates had led to a mixed day for equities prior to Meta’s results. The S&P 500 was flat on the day (+0.02%), with the Magnificent 7 (+0.66%), posting a third consecutive gain thanks to a significant boost from Tesla (+12.06%), which surged after its own results the previous day. But there were also pockets of weakness, especially for the more cyclical sectors, with industrials (-0.79%) seeing the biggest declines, whilst the small-cap Russell 2000 was down -0.36%. Over in Europe, equities saw moderate losses, as the STOXX 600 (-0.43%) erased its earlier gains to close lower.

Sentiment wasn’t helped yesterday by geopolitical developments, and Israel said they had struck around 40 Hezbollah targets in Lebanon. Currently, investors don’t appear as concerned as they were last week after Iran’s strikes, and Brent crude oil prices actually came down -0.45% to $88.02/bbl. However, there are still nerves about the prospect of a further escalation, and the Israeli shekel (-0.26% against the US Dollar) lost ground after the headlines came through. Otherwise, the VIX index of volatility ticked up again, with a +0.28pts rise to 15.97pts.

Overnight in Asia, equity markets are struggling for the most part, with the Nikkei (-2.00%) experiencing a significant decline. That comes as the Japanese Yen (-0.09%) has posted further losses, falling to its weakest level since 1990 against the US Dollar, at 155.49 per dollar. T he Bank of Japan will also be making their latest policy decision tomorrow. Meanwhile in South Korea, the KOSPI (-1.20%) has also lost ground, even though the Q1 GDP data was much stronger than expected, with quarter-on-quarter growth of +1.3% (vs. +0.6% expected). Nevertheless, other equity indices did post a stronger performance, including the Hang Seng (+0.55%), the CSI 300 (+0.24%) and the Shanghai Comp (+0.17%).

Looking forward, we’ll get the first estimate of US GDP for Q1 today, which follows some very strong growth over the previous couple of quarters. Those previous releases showed an annualised growth rate of 4.9% in Q3 and +3.4% in Q4, and for today, the consensus is expecting a deceleration to an annualised 2.5% pace. Otherwise yesterday, US durable goods orders were up +2.6% in March (vs. +2.5% expected), but the previous month’s growth was revised down six-tenths to +0.7%. And for core capital goods orders, they were up +0.2% as expected, but the previous month’s growth was also revised down three-tenths to +0.4%.

To the day ahead now, and US data releases include the initial Q1 GDP reading from the US, along with the weekly initial jobless claims, pending home sales for March, and the Kansas City Fed’s manufacturing index for April. Meanwhile from central banks, we’ll hear from ECB President Lagarde, the ECB’s Schnabel, Vujcic, Nagel and Panetta. And we’ll also get the ECB’s latest Economic Bulletin. Finally, today’s earnings releases include Microsoft, Alphabet, Caterpillar and Intel.