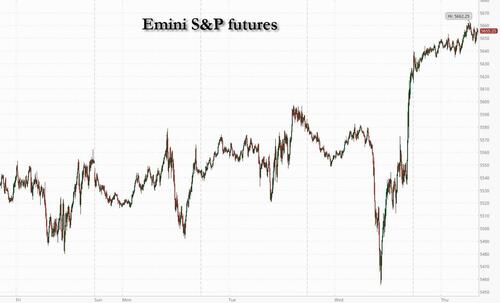

US equity futures are sharply higher, erasing all of April's losses on blowout earnings from MSFT and META, and relief over signs the Trump administration is stepping back from its harshest tariff threats. As of 8:00am ET, S&P futures rose 1.2% to 5655, the highest level since before Trump's Liberation Day announcement and pointing to an eighth consecutive session of gains for the cash index; Nasdaq futures gained 1.7%, as META and MSFT added +6.3% and +7.8%, respectively; most Mag 7 names, NVDA (3.7%) and semis are higher given META’s CapEx increase and MSFT’s reiteration on CapEx guidance. The dollar is higher after the BOJ finally flipped dovish and slashed its growth target pushing USDJPY to 144.5 this morning. It's light on overnight news as most of Europe is closed today ex-UK along with China; US/Ukraine signed an agreement over the country’s natural resources, UK Manf PMI printed better but remained in contraction, and Trump reiterated that there is a “very good chance” of a deal with China on NewsNation last night. Commodities are mostly lower: WTI -1.2%; Gold -1.7%. The US economic calendar includes weekly jobless claims (8:30am), April manufacturing PMI (9:45am), ISM manufacturing and March construction spending (10am). Fed’s external communications blackout ahead of the May 7 FOMC meeting. Apple and Amazon results are due after the market close.

In premarket trading, the Magnificent Seven are mostly higher: Microsoft (MSFT) gains 8% after the company reported stronger-than-expected quarterly sales and profit growth. Meta (META) jumps 6% after the company’s advertising sales quelled Wall Street concerns about the impact of the Trump administration’s trade war. Apple was the only tech giant in the red, falling 1.4% after a federal judge said in a ruling that it violated a court order requiring it to open up the App Store to third-party payment options (other Mag7s are up Nvidia +4.6%, Amazon +3.7%, Alphabet +1%, Tesla +0.7%).

McDonald’s Corp. (MCD) declines 1.4% as sales fell in the first quarter, reflecting a deterioration in consumer sentiment that’s making it harder for restaurants to lure in diners. Eli Lilly & Co. (LLY) drops 5% after the company cut its earnings outlook. Here are some other notable premarket movers:

Tech giants added to investor optimism that deals between the US and its partners would limit the damage from Trump’s trade war. Wall Street ended a tumultuous month on a day in which the S&P 500 erased an intraday drop of more than 2% to close 0.2% higher. Traders sought reassurance in bets on Federal Reserve easing after the US economy contracted for the first time since 2022.

“So far we’re seeing big tech companies deliver on earnings, which is reassuring, and it’s this reassurance which is supporting equity market futures,” said Georgios Leontaris, chief investment officer for EMEA at HSBC Global Private Banking. “The other element of the story beyond earnings is obviously the ongoing debate as to whether we’ve seen peak tariff noise or not.”

Apple results are due after the market close. Analysts will be listening closely for any further detail on how the company, whose supply chain is reliant on China, Vietnam, and India, views the impact of tariffs

The White House said it was nearing an announcement of a first tranche of trade deals with partners that would reduce planned tariffs. Sentiment was also helped by a report that the US has been proactively reaching out to China through various channels. At the same time, Trump said he would not rush deals to appease nervous investors.

The US and Ukraine reached a deal over access to the country’s natural resources, offering a measure of assurance to officials in Kyiv who had feared Trump would pull back his support in peace talks with Russia.

Elsewhere, most markets in Europe and many in Asia are shut for holidays. The UK’s FTSE 100 index was steady, following 13 days of gains, the longest winning streak since 2017. Gains in material and industrial names are offset by losses in energy and health care.

In FX, the Bloomberg Dollar Spot Index rises 0.3%. the yen is the weakest of the G-10 currencies, falling 0.9% against the greenback after the Bank of Japan pushed back the timing for when it expects to reach its inflation target and slashed its growth forecasts. The pound and euro are little changed.

In rates, treasuries climb, pushing US 10-year yields down 2 bp to 4.14%. Treasury spreads remain within a basis point of Wednesday’s close, as gains remain broad-based across the curve. Gilts are steady, with UK 10-year borrowing costs flat at 4.44%. Treasury futures edge higher into the early US session, on the day’s highs with yields lower by 1bp to 2bp across the curve. US session focus includes weekly jobless claims along with both ISM and PMI manufacturing reports.

In commodities, oil prices decline, with WTI falling 2.3% to below $57 a barrel; the drop followed the biggest monthly drop since 2021, as signs that the Saudi-led OPEC+ alliance may be entering a prolonged period of higher output added to concerns the trade war will hurt demand. Spot gold is down $65 at $3,223/oz, falling for a third day on signs of potential trade-talk progress between the US and several other nations, quelling demand for havens even as signs of slowdowns have emerged in the largest economies. Bitcoin rises 1% and above $95,000.

Looking at today's calendar, we get the April Challenger job cuts (7:30am), weekly jobless claims (8:30am), April manufacturing PMI (9:45am), ISM manufacturing and March construction spending (10am). Fed’s external communications blackout ahead of the May 7 FOMC meeting

Market Snapshot

Top Overnight news

Tariffs/Trade

Notable Earnings

A more detailed look at global markets courtesy of Newquawk

APAC stocks traded higher but with gains capped in severely thinned conditions owing to mass holiday closures across the region and in Europe for Labour Day. ASX 200 eked mild gains as the outperformance in tech, real estate and consumer staples was offset by losses across the commodity-related sectors, while trade data was mixed as Australian monthly exports returned to growth but imports contracted. Nikkei 225 advanced at the open after having reclaimed the 36,000 level and with further upside seen after the BoJ policy announcement where the central bank kept rates unchanged at 0.50% and provided some dovish rhetoric despite maintaining its rate hike signal.

Top Asian News

Due to Labour Day across Europe, cash and derivatives markets are closed across Euronext services and those run by other European exchanges such as Deutsche Boerse, SIX and Nasdaq (Scandinavia closed ex-Copenhagen). The UK’s FTSE 100 is one of the few indices in Europe which is open today; currently flat.

Top European news

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar