US equity futures are lower as the selling in Treasuries accelerates after strong US jobs data slashed bets on a big interest-rate reduction next month from the Federal Reserve and an overnight surge in oil pushed Brent to $80 (see last night's "A Historic Short Squeeze In Oil Has Only Begun"), which sent both the 2Y and 10Y above 4.00%. As of 8:00am ET, S&P futures are down 0.4% after closing just shy of an all-time high on Friday when the spike in yields failed to dent bullish sentiment, while Nasdaq futures drop 0.6% as most Mag 7s are lower; AMZN -1.9%, AAPL -1.4% and NVDA -1.2%. In rates, the entire curve is blowing out wider, with 2-, 5-, 10- and 30y yields up by 7bp, 6bp, 4bp and 2bp, respectively as swaps markets now price in less than a quarter-point rate cut next month, having expected a 50 basis-point move until recently. Oil has added another +2.3% amid growing fears of imminent Iran escalation with Israel launching a new offensive in Northern Gaza over the weekend; base metals are higher, while ags are lower. This week, the key macro focus will be CPI on Thursday and 12 Fed speakers throughout the week. We will have a number of Tech catalysts, including: NVDA’s AI Summit (Monday through Wednesday), AMZN’s Prime Day starting Tuesday, AMD’s Advancing AI event on Thursday, and TSLA’s Robotaxi unveil on Thursday. Q3 earnings will kick off with banks on Friday.

In premarket trading, Pfizer climbed more than 2% after Bloomberg reported activist investor Starboard Value had taken a stake of about $1 billion in the firm. Arcadium Lithium Plc. leapt 29% on news Rio Tinto Plc had made a non-binding takeover approach. Here are some other notable premarket movers:

The drop in rate cut expectations will likely to weigh on equity markets, which have rallied to record highs recently amid signs of a robust US economy, easing inflation and big rate cuts. In addition, crude oil prices pushed higher to approach $80 a barrel, as investors await Israel’s response to the recent Iranian missile strike. Marija Veitmane, head of equity strategy at State Street Global Markets, said she still remains constructive on the equity outlook as economies remain resilient and inflation is easing. However, “we have to be a bit careful in terms of drivers, as we will probably not get a lot of big aggressive rate cuts,” Veitmane said on Bloomberg TV.

Investors are now looking ahead to the US inflation data due Thursday, with economists surveyed by Bloomberg expecting year-on-year price growth at 2.3%, a slight slowdown from the previous reading. The earnings season also kicks off this week with reports from big US banks. Earnings growth is seen robust though it’s expected to slow from the second quarter.

European stocks also edged lower as bond yields rose across the continent. The Stoxx 600 falls 0.4% with rate sensitive sectors - real estate and technology - leading declines. Heidelberg Materials AG benefited from a report that the Adani Group has started talks to buy the company’s Indian cement operations, and luxury-goods firm Richemont rose after an announcement it would sell the online retailer YNAP to Mytheresa. Germany sank deeper into recession after Industrial Production tumbled a worse than expected 5.8%, prompting many to wonder if even China's bazooka can fix Europea this time.

Here are the top European movers:

Earlier in the session, Asian stocks snapped a three-day losing run, as a weaker yen buoyed Japanese equities and shares in Hong Kong extended their rally. The MSCI Asia Pacific Index rose as much as 1.2%. Exporters led gains in Japan as the yen slumped against the dollar following a stronger-than-expected US jobs report. TSMC and Recruit Holdings were among the biggest boosts to the regional gauge. Hong Kong-listed Chinese stocks continued to rally, despite a mid-day scare which saw stocks briefly dip, as traders awaited a press briefing by China’s top economic planner due Tuesday for more details on Beijing’s stimulus measures. Traders also prepared for the onshore market to reopen Tuesday after the week-long Golden Week holiday. Chinese equities have been cheap, and “we have added significant capital to China throughout the year,” said Vikas Pershad, a fund manager at M&G Investments, speaking on Bloomberg Television. “The initiatives coming out tomorrow may probably continue to support “consumer first and then moving on to other industries as well.”

In FX, the Bloomberg Dollar Spot Index is little changed. The yen is the best performer among the G-10’s, rising 0.2% against the greenback, even as Goldman expressed surprise about the move: "Surprising to see JPY is still long. Given our house view that US economy will fare well and BoJ’s dovish rhetoric, JPY longs look vulnerable. We see good scope for market re-initiating JPY shorts next few weeks" FX trader Kerem Cirpan wrote. The pound is the weakest with a 0.4% fall.

In rates, treasuries added to Friday’s sharp fall where surprisingly robust September US payrolls data undercut chances for another large interest-rate cut from the Federal Reserve. The US 10-year yield rises 4 bps to above 4% for the first time since Aug. 8. Meanwhile the 2s10s yield curve uninverted for the first time since Sept 18. European bonds follow suit with Gilts faring worse than their German counterparts.

In commodities, oil prices rise after their best week since January 2023, with Brent crude futures up ~2% at $79.70 a barrel. Spot gold is steady around $2,653/oz.

Looking at the day's main event, US economic data calendar includes August consumer credit at 3pm. Ahead this week are CPI and PPI, as well as minutes of September FOMC on Wednesday Fed speakers scheduled include Bowman (1pm), Kashkari (1:50pm), Bostic (6pm) and Musalem (6:30pm)

Market snapshot

Top Overnight news

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week on the front foot following last Friday's gains on Wall St owing to the blockbuster jobs report, while Japanese stocks led the advances on the back of recent currency weakness. ASX 200 shrugged off early indecision as strength in tech, financials and miners picked up the slack from weakness in defensives. Nikkei 225 gapped above the 39,000 level with the rally facilitated by recent JPY weakness, while a Reuters analysis report suggested that a preference by Japan's new leadership for loose monetary policy raises the hurdle for rate hikes. Hang Seng climbed at the open ahead of tomorrow's resumption of trade in the mainland and the NDRC's news conference to discuss implementing a package of policies to promote economic growth, although the gains were initially capped by weakness in some property stocks and China-EU tariff frictions.

Top Asian News

European bourses, Stoxx 600 (-0.4%) began the session on a modestly firmer footing, but soon after the cash-open, sentiment soured. Indices are now mostly in negative territory and reside near session lows. European sectors initially opened with a modest firm bias which turned into a mixed picture within the first 15 minutes of cash trade and then mostly negative within the first half hour of trade, although no theme can be seen. Energy leads whilst Real Estate lags, given the relateively higher yield environment. US equity futures (ES -0.5%, NQ -0.7%, RTY -0.8%) are entirely in the red, continuing similar price action seen in Europe. US data docket ahead is light, but focus will be on Fed speak from Kashkari, Bostic & Musalem.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank speakers

DB's Jim Reid concludes the overnight wrap

Morning from what already looks like the start of a sunny day here in Berlin and welcome to a new week with the one we just left behind containing plenty of surprises, twists, and turns. Stronger US data, culminating in a blockbuster payrolls number, and increased geopolitical risk led to the largest weekly increase in US 2yr yields (+36.4bps) since June 2022, the largest weekly increase in Brent (+8.43%) since January 2023, and the largest weekly increase in the Dollar index for over two years.

Meanwhile, even with China closed until tomorrow, the Hang Seng (+10.2% on the week) hit its highest level since March 2022.

We're currently in-between US payrolls from last Friday and US CPI this Thursday which will be the highlight of this week. The first of these was a knockout report with the headline number up +254k as against expectations of +150k and with the unemployment rate falling a tenth to 4.1% (4.05% unrounded). My colleague Francis Yared always calls payrolls the "random number generator" but even with that caveat it was an impressive report and completely against recent fears. The main impact was a +21.6bps increase in 2yr US yields on Friday and the probability of a 50bps cut next month declining from around 33% to effectively zero in the process. My personal view was always that the amount of rate cuts priced in since mid to late summer was only likely if we had a recession. If we didn't, then the rates market overall was too pessimistic. I would still say that today.

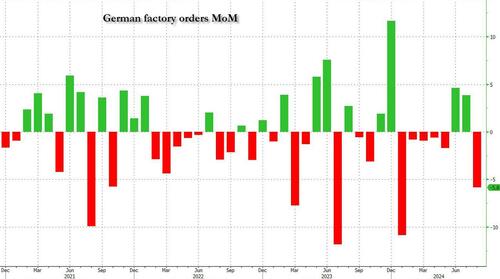

In terms of moving this argument on, it's a relatively quiet week in the US apart from Thursday's CPI but in terms of the main global day-by-day highlights we have the following. Today sees Germany factory orders and Eurozone retail sales, tomorrow sees German Industrial Production, and Swedish CPI, Wednesday sees the last FOMC minutes and a 10yr UST auction, Thursday sees the release of the account of the last ECB meeting, France present its budget proposal, Japanese PPI, German retail sales, Italian industrial production, Norway and Denmark CPI, and a 30yr UST auction, with Friday home to US PPI, the US University of Michigan survey, UK August monthly GDP and US Earnings season kicking off with JPMorgan, Wells Fargo, BlackRock, Bank of New York Mellon all reporting.

In terms of this week's US CPI, DB is expecting headline CPI (+0.05% forecast vs. +0.19% previously, consensus +0.1%) to be tame with core (+0.24% vs. +0.28%, consensus +0.2%) edging lower but more elevated than headline. If DB is correct, headline YoY CPI would dip a couple of tenths to 2.3%, with core staying around the same level at 3.2%. However, the six-month annualised core rate would fall from 2.7% to 2.4%. Rents will again take centre stage after recent strength. As for PPI on Friday, DB and consensus expect headline (+0.1% vs. +0.2% last month) and core (+0.2% vs. 0.3% last month) to be directionally similar to CPI. The market will as ever pay closest attention to the categories that feed into the core PCE deflator – namely, health care services, airfares and portfolio management. Staying with inflation, Friday's preliminary University of Michigan consumer sentiment survey will have inflation expectations which last month picked up a tenth to 3.1% for the long-run measure but fell the same amount to 2.7% for the 1yr measure.

As you'll see in the day-by-day calendar of events, it's also a busy week of Fed speakers. So it'll be interesting to see how they all react to the bumper payrolls print. The last FOMC meeting minutes on Wednesday will be a bit stale but may give us a better understanding as to how policy might evolve under various scenarios.

As noted above, Friday will mark the start of the Q3 earnings season with several US banks releasing results. Samsung, PepsiCo and BlackRock also report throughout the week. Our equity strategists put out a preview of the upcoming earnings season here. They expect S&P 500 earnings growth to slow from 11.8% in Q2 to 9% in Q3, driven by a narrow group of sectors such as energy and mega cap growth & tech, with growth for the others staying steady in the mid-single digits.

Asian equity markets are strong this morning with the Nikkei up +2.1% and the Topix rising +1.9%. The Kospi (+1.52%), Hang Seng (+1.15%) and S&P/ASX 200 (+0.7%) are also strong. US futures are fairly flat. The Yen had briefly nudged up above 149 earlier this morning, the weakest since early August but has since rallied to be +0.15% higher at 148.44.

Looking ahead in Asia, three central banks are scheduled to announce their interest rate decisions this week: the Bank of Korea (Friday), the Reserve Bank of New Zealand and the Reserve Bank of India (both Wednesday).

Remember also that today is the one-year anniversary of the attacks by Hamas on Israel and with the region of high alert following last week's attacks on Israel from Iran, we are subject to events and risks this week. Oil has actually started the week a touch lower following on from weakness late on Friday after President Biden publicly tried to persuade Israel from attacking Iran's oil fields.

Looking back at last week now, risk appetite took a hit thanks to mounting geopolitical risk in the Middle East, even as the macro data turned decisively more positive. That was particularly evident from Friday’s US jobs report, with fears of a recession continuing to decline. Markets had been pricing in 34bps of cuts for the Fed’s November meeting prior to the release, so a 35% likelihood of a 50bp cut, but that fell to just 25bps by the close on Friday and effectively wiping out the pricing of 50. And looking further out the curve, an entire rate cut was taken out of the 2025 profile, with the rate priced in by December 2025 moving up +26bps on Friday alone.

With a recession being priced out, that led to a massive sell-off in US Treasuries, with the 2yr yield up +21.8bps on Friday and +36.4bps over the week as a whole, leaving it at 3.92% by the close on Friday. That made it the biggest weekly gain for the 2yr yield since June 2022, when the Fed was about to accelerate to a 75bps hiking pace. In the meantime, the 10yr yield was up +21.6bps over the week, and +12.1bps on Friday, taking it up to 3.97%, which is its highest level since early August.

That pattern was echoed globally, albeit to a lesser extent. For instance, the 10yr bund yield ended the week up +7.7bps (+6.6bps Friday) at 2.21%, even as investors grew more confident that the ECB would cut rates at their October meeting. That confidence partly came about thanks to continued falls in inflation, and the latest data last week showed Euro Area headline inflation was beneath the ECB’s target in September for the first time in over three years.

Geopolitics was the other major theme last week, as growing tensions in the Middle East led to a significant rise in oil prices. In fact, Brent crude ended the week up +8.43% (+0.55% Friday) at $78.05/bbl, marking its strongest weekly gain since January 2023. The rising geopolitical risk premium coupled with stronger US data saw the US Dollar index rise every day last week to post its strongest weekly gain in over two years (+2.13%).

Lastly, equities saw a mixed performance, with the boost from stronger data narrowly outweighing the geopolitical fears for US stocks. The S&P 500 just about posted a fourth consecutive weekly gain (+0.22%), thanks to a +0.90% increase following payrolls on Friday. In Europe, the sentiment was more negative, with the STOXX 600 down -1.80% (+0.44% Friday), whilst Germany’s DAX fell by a similar -1.81% (+0.55% Friday). However, the Hang Seng surged by another +10.20% last week (+2.82% Friday), building on its +13.00% gain from the previous week to close at its highest level since March 2022.

Day-by-day calendar of events

Monday October 7

Data: US August consumer credit, China September foreign reserves, Japan August leading index, coincident index, Germany August factory orders, Eurozone August retail sales

Central banks: Fed's Kashkari, Bowman, Bostic and Musalem speak, ECB's Cipollone, Lane, Nagel and Escriva speak

Tuesday October 8

Data: US September NFIB small business optimism, August trade balance, Japan August labor cash earnings, household spending, BoP current account and trade balance, September Economy Watchers survey, Germany August industrial production, France August current account balance, trade balance, Canada August international merchandise trade, Sweden September CPI

Central banks: Fed's Kugler, Bostic and Collins speak, ECB's Nagel speaks

Earnings: Samsung Electronics, PepsiCo

Auctions: US 3-yr Notes ($58bn)

Wednesday October 9

Data: US August wholesale trade sales, Japan September machine tool orders, Germany August trade balance

Central banks: Fed FOMC meeting minutes, Jefferson, Bostic, Logan, Goolsbee, Collins and Daly speak, ECB's Villeroy and Elderson speak, RBNZ decision

Auctions: US 10-yr Notes ($39bn, reopening)

Thursday October 10

Data: US September CPI, initial jobless claims, UK September RICS house price balance, Japan September PPI, bank lending, Germany August retail sales, Italy August industrial production, Norway and Denmark September CPI, Sweden August GDP indicator

Central banks: Fed's Barkin and Williams speak, ECB account of the September meeting

Earnings: Domino's Pizza, Fast Retailing, Seven & I

Auctions: US 30-yr Bonds ($22bn, reopening)

Friday October 11

Data: US September PPI, October University of Michigan survey, UK August monthly GDP, Japan September M2, M3, Germany August current account balance, Canada September jobs report, August building permits

Central banks: Fed's Goolsbee and Logan speak, BoC's business outlook

Earning: JPMorgan, Wells Fargo, BlackRock, Bank of New York Mellon