One day after we asked if Jensen Huang's keynote speech at the NVDA GTC presentation would be a "sell the news" event, the answer is yes, because this morning US stock futures have slumped, after the AI chip giant's CEO disappointed markets by not revealing anything that the market wasn't already expecting. As a result, as of 7:50am, S&P futures were trading at session lows, down 0.5%, with Nasdaq futures sliding 0.6% and bitcoin dumping after an overnight fat-finger sent the crypto briefly to $8,900. And now that the BOJ has finally exited negative rates after a decade of with all eyes on the Federal Reserve’s policy meeting for clues on the rates outlook. Bizarrelly, the BOJ's historic rate hike has sent the yen sliding and thus, the dollar higher with 10Y yields unchanged around 4.32%. Commodities are flat with metals outperforming and Brent crude trading near a five month high of $87. Today’s macro data focus will be on housing data with an update on TIC flows.

In premarket trading, NVDA stock was down and Mag7 names were mixed with semis lower, despite a price target increase by Goldman which now expects NVDA to trade at $1000 in 12 months, up from $875 (full note available to pro subs).

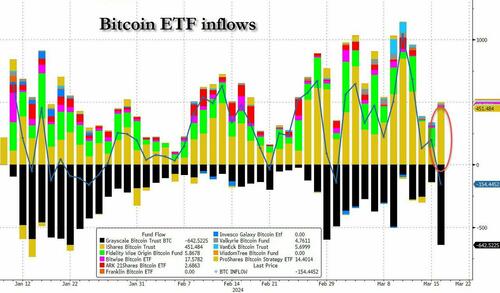

Elsewhere, cryptocurrency-linked stocks dropped as Bitcoin extended a retreat following a record daily outflow from the doomed GBTC ETN which may have precipitated yesterday's crypto rout, offset however by another BTFD burst in the Blackrock IBIT ETF. Among the bigger movers, Coinbase Global -5%, Riot Platforms (RIOT) -5%, Marathon Digital (MARA) -7%,

Here are some other notable premarket movers:

Finally, one month after we asked when Supermicro would sell stock to take advantage of its ridiculous stock price...

... we got the answer this morning when Super Micro Computer announced an offering to sell 2 million shares of common stock, sending the stock tumbling 8%.

Turning to the main overnight event, the yen paradoxically tumbled after the Bank of Japan brought an end to the world’s last negative interest-rate policy and emphasized that financial conditions will remain easy. The BOJ’s first hike in 17 years had been widely expected and Governor Kazuo Ueda struck a neutral tone at a news conference, saying there’s still a chance its inflation goal will not be hit. While the central bank scrapped its yield curve control program, it also pledged to keep buying long-term government debt.

“It’s a very, very dovish hike, as dovish hike as they come,” said Frederic Neumann, HSBC’s chief Asia economist, said on Bloomberg Television. Japanese bonds gained and the Topix closed at the highest since 1990 because the yen dropped 0.9% versus the dollar to 150.43, usually the opposite of what happens after a rate hike, and effectively dooms the BOJ to panic hiking as the plunging yen means Japan's inflation troubles will only get worse.

In a busy week for central bank decisions, attention now shifts to the Federal Reserve’s meeting on Wednesday, where investors will be focused on the US central bank’s projections — the dot plot — to gauge how many rate cuts policymakers are expecting to deliver this year.

“We are now thinking perhaps we get slightly higher dots — could we see fewer cuts being priced in?” said Andrea DiCenso, co-portfolio manager at Loomis Sayles, in an interview with Bloomberg TV. “We are seeing less than potentially three cuts priced into the market.”

European stocks are little changed following three straight days of declines. Energy and auto shares are outperforming and countering losses in utilities and consumer products. Investor confidence in Germany’s economic outlook jumped to the highest in more than two years, driven by expectations that the European Central Bank is ready to cut interest rates in the coming months. ECB President Christine Lagarde is due to speak Wednesday. Here are the most notable European movers:

Earlier in the session, Asian stocks traded mixed as markets digested the first of this week's central bank announcements.

In FX, the Bloomberg Dollar Spot Index rose 0.4% with Wednesday’s Fed decision now firmly in focus as the yen tumbles despite the BOJ's first rate hike in nearly two decades. USD/JPY rises as high as 150.60 after BOJ’s decision. AUD/USD falls under mid 0.65-0.66 as traders price in greater probability of a RBA rate cut this year following its policy decision. NZD/USD falls to hold under 0.61. The New Zealand dollar is sold by leveraged funds after comments from the NZ Treasury saying the economy is in a “severe economic slowdown,” according to Asia-based FX traders, who say the Aussie is also weighed by the news. EUR/USD remains under 1.09 while GBP/USD drifts down toward 1.27. The Bloomberg Dollar Spot Index falls for the fourth day

In rates, treasuries climb, with US 10-year yields falling 1bps to 4.31%. US rates had little reaction to Bank of Japan’s first interest-rate hike since 2007, which was anticipated, remaining near year-to-date highs ahead of 20-year bond auction at 1pm New York time. Front-end yields are lower by ~2bp, steepening curve spreads by around 1bp vs Monday’s closing levels; 10-year at around 4.31% is ~1bp richer on the day with gilts outperforming by 4bp in the sector. Bunds and gilts are also in the green with UK yields down 3bp-4bp. Treasury auctions resume with $13b 20-year bond reopening at 1pm; WI yield at around 4.562% is above auction stops since November and ~3bp cheaper than February’s result.

In commodities, oil prices decline, with WTI falling 0.3% to trade near $82.50. Spot gold falls 0.3%.

Bitcoin drops ~6% to near $63,000.

Looking at today's economic data calendar we get February housing starts/building permits (8:30am) and January TIC flows (4pm). There are no Fed speakers scheduled before March 20 policy decision

Market Snapshot

Top Overnight News

BOJ

A more detailed analysis of markets from Newsquawk

APAC stocks traded mixed as markets digested the first of this week's central bank announcements. ASX 200 finished with mild gains after a lack of hawkish surprises at the RBA policy announcement in which it kept rates unchanged and reiterated that the Board remains resolute in its determination, while there was also a slight tweak in its language as guidance around further tightening was softened. Nikkei 225 was underpinned after a widely telegraphed and dovish exit from NIRP, YCC and ETF/J-REIT buying which a Nikkei source report had flagged, while the central bank also announced its monthly bond purchase intentions and said it will make nimble responses with JGB purchases and could increase the amount of JGB buying or conduct fixed-rate operations in the event of a rapid rise in yields. Hang Seng and Shanghai Comp. lagged with the Hong Kong benchmark dragged lower by weakness in tech stocks as the EU mulls joining the US in reviewing risks of Chinese legacy chips and is flagging potential risks to national security and supply chains.

Top Asian News

European bourses, Stoxx600 (+0.1%) began the session on a mixed footing though have caught a slight bid in recent trade, and reside near session highs; the AEX (+0.4%) outperforms, lifted by gains in Unilever (+4.5%). European sectors are mixed; Energy takes the top spot, with Crude just off recent highs whilst Consumer Products and Services is hampered by broader weakness in Luxury names, after weak Chinese price action overnight. US equity futures (ES -0.1%, NQ -0.1%, RTY -0.3%) are modestly lower, with mild underperformance in the RTY as it continues the prior day's weakness.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I've been back from Asia for three days now but I continue to fall asleep in front of the telly every night, get prodded by my wife on the sofa, and then wake up bright awake 90 minutes before my alarm in the morning. Today was one of those days that it was useful as I got to see the first BoJ hike in 17 years live this morning. So far their policy moves are pretty much as leaked over the last few days so there are no real surprises. They lifted rates from -0.1% to a range of 0-0.1%. They also scrapped YCC and ended ETF and REIT purchases but these programs had been pretty dormant of late. They are continuing JGB purchases at the same rate for now but, according to our Japanese economist Kentaro Koyama, the fund supplied through the Loan Support Program (similar to the TLTRO, with a current balance of JPY81 trillion yen) will decrease going forward given the conditions for the program have become stricter. As a result, the monetary base and the BoJ's balance sheet will decline going forward.

Forward guidance is a bit dovish, according to Kentaro. In the statement, the bank says that it anticipates that accommodative financial conditions will be maintained for the time being given the current outlook for economic activity and prices. In our view, this does not exclude policy rate hikes in the near future and could change depending on the economic and inflation outlook. So all paths are open. We will see what the press conference brings.

Against this well flagged move, the Japanese yen (-0.78%) is weakening, trading above 150 again for the first time in two weeks while 10yr JGB yields (-2.6bps) have moved lower to 0.74%. So for now, it's buy the rumour and sell the fact. The house view is that the market is underestimating where terminal rates might end up in Japan but that it will be a steady process discovering that.

Separately, the Reserve Bank of Australia (RBA) kept the benchmark rate at 4.35%, a 12-year high for the third meeting in a row, aligning with broad market expectations. In its post-meeting statement, the RBA indicated that it can’t rule out the possibility that interest rates will need to be raised further while acknowledging that inflation is moderating, consistent with its latest forecasts but remains too high and that the "economic outlook remains uncertain". In response, the Aussie dollar (-0.50%) is losing ground, trading at a two-week low of 0.6527 versus the dollar with the policy-sensitive 3yr government bond yield dropping -5.3bps to 3.69% as I check my screens.

In terms of wider Asia moves, the Nikkei (+0.36%) is reversing initial losses as the Yen falls, with the S&P/ASX 200 (+0.36%) also edging higher while the KOSPI (-1.15%), the Hang Seng (-1.06%), the CSI (-0.31%) and the Shanghai Composite (-0.17%) are lower. S&P 500 (-0.13%) and Nasdaq (-0.27%) futures are lower with 10yr UST yields ticking down -1bps to 4.31%.

Ahead of the BoJ decision, US markets put in a strong performance yesterday, with the S&P 500 (+0.63%) bouncing back from two small weekly declines. That was driven by the Magnificent 7 (+2.00%), particularly after the news came through that Apple (+0.64%) was in talks to use Google’s Gemini for new iPhone features, meaning that Alphabet (+4.60%) saw its best daily performance in over three months. But even outside of big tech, risk appetite remained mostly firm among investors, as the equal-weighted S&P 500 (+0.28%) also rose, whilst US HY spreads closed at their tightest level in over two years. The small cap Russell 2000 was a notable underperformer, down -0.72%.

The main point of caution came on the inflation side, with investors becoming increasingly concerned about how persistent it’s been proving. For instance, 1yr US inflation swaps (+1.5bps) closed at their highest level since October, at 2.64%. And there were fresh signs of price pressures elsewhere, as Brent crude oil prices (+1.82%) rose to $86.89/bbl, which is their highest level since the end of October and up +12.8% YTD.

With this backdrop, markets’expectations for near-term rate cuts continued to inch lower, with pricing of a rate cut by June down to 60% for the Fed and to 80% for the ECB, in both cases the lowest since last October. Markets had priced a 90% likelihood of an ECB June cut as recently as Thursday, so that’s a notable move considering how much ECB commentary has coalesced around June as the most likely timing for a first cut. On a related topic, overnight Peter Sidorov published a report diving into the state of the credit cycles across the US and Europe, and discussing what implications these have for the economic outlook and prospects for rate cuts on both sides of the Atlantic.

The pro-inflationary risk-on tone meant that US Treasuries continued to sell off across the curve, and both the 2yr yield (+0.4bps) and the 10yr yield (+1.8bps) closed at their highest level since November, leaving the 10yr yield at 4.325%. Both 2yr and 10yr yields have risen for the past six sessions, the longest such run since May 2023. These sovereign bond losses were echoed in Europe, with yields on 10yr bunds up +1.8bps, whilst the 2yr German yield (+0.3bps) hit its highest level since November, at 2.95%. That said, it wasn’t all bad news for European sovereigns, as there was a narrowing in spreads in line with the broader risk-on move. For example, the spread of Italian 10yr yields over bunds tightened by -3.6bps to 1.22%, the lowest since November 2021.

For equities, there was a rather different pattern in Europe, as the STOXX 600 ended the day -0.17% lower. That marked a 3rd consecutive daily decline for the index, and there were larger losses for Swedish equities, with the OMX Stockholm 30 down -1.14%. Elsewhere, there wasn’t a massive amount of movement, however, with the FTSE 100 (-0.06%), the CAC 40 (-0.20%) and the DAX (-0.02%) all seeing little change.

Lastly, there wasn’t much data yesterday, although we did get the NAHB’s housing market index from the US for March. That rose to 51 (vs. 48 expected), which marks a 4th consecutive monthly gain for the index.

To the day ahead, and data releases include Canada’s CPI for February, US housing starts and building permits for February, and in Germany there’s the ZEW survey for March. From central banks, we’ll hear from ECB Vice President de Guindos, and the ECB’s de Cos.