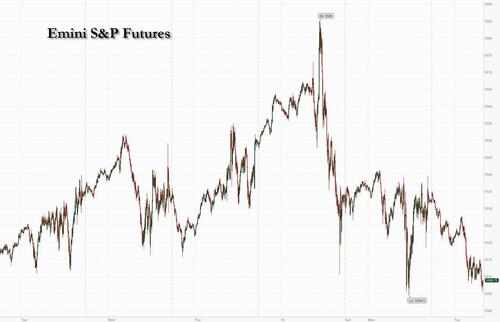

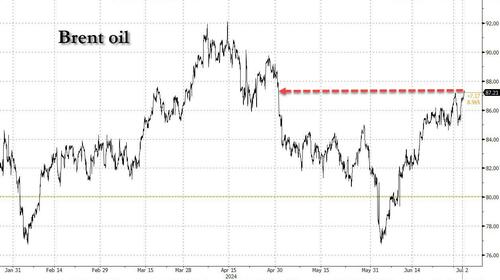

US equity futures are sliding, reversing all of Monday's gains and then some, with tech and small-caps stocks underperforming even though bond yields are lower by 2bps ahead of the latest JOLTS data that will give clues on the outlook for US interest rates while French stocks give up all of the post-vote gains as the relief rally reversed. As of 8:00am ET, S&P futures are down 0.5% and Nasdaq futures lose 0.6%. Treasury yields held most of Monday’s rise, which was fueled by speculation that a Donald Trump presidency would lead to greater US fiscal deficits and higher inflation. The US Dollar is stronger for a second day and commodities continue to find a bid, led by oil and energy. Today’s macro focus will be on JOLTS and Powell (9.30a) as the world adjusts to the new political outlook, one where Trump replaces Biden in November, and which appears to be the near-term driver of bond yields and commodity prices; the hurricane in the Atlantic is also supporting energy prices. These moves may be exacerbated by the low volume associated with the holiday week.

In premarket trading, Mag7 and Semis are lower with Energy names higher. Tesla fell more than 1% surrendering some of yesterday’s 6% gain. Nvidia, Meta and Apple also declined. Paramount Gobal gained 3% on a NYT report Barry Diller is considering making a bid. Here are some of the other notable premarket movers:

Recent data has showed inflation in the US moderating, which is supportive of stocks in the short term, according to UBS chief strategist Bhanu Baweja. But signs of slowing economic growth will weigh on shares more broadly in the medium term, calling for defensive positioning, he said on Bloomberg TV.

"The central pillar of how markets are likely to trade over the next six months is lower inflation first in the US, followed by lower growth in the US.” Baweja said. “We are risk-off in equities, broadly.”

European stocks dropped, wiping out the prior day’s gains as French political uncertainty lingers ahead of the final round of voting on Sunday. The Stoxx 600 was down 0.6%, as insurance and auto sectors underperform while France's CAC40 erased Monday's post-vote gains, sliding 1.1%. Here are the biggest European movers:

Earlier, Asian equities were little changed, with a rally in Hong Kong and Japanese shares countered by selling in South Korea.

The MSCI Asia Pacific Index rose as much as 0.4% to the highest level since May 28 before paring most of the gains. Shares of Japanese firms including Mitsubishi UFJ Financial Group, Daiichi Sankyo and Toyota contributed the most to the index’s gain as the Topix gauge closed close to a record high. Stocks declined in Taiwan and Australia. Chinese shares in Hong Kong advanced, boosted by a catch up rally in property shares after better-than-expected June home sales lifted investors’ enthusiasm for the embattled sector. Mainland China stocks closed lower after seesawing through the day.

“Some exposure to China still makes sense,” Vasu Menon, managing director for investment strategy at OCBC Bank Singapore told Bloomberg TV. With the third plenum coming up, “investors are hopeful that the Chinese government will unleash more measures to boost the economy,” he said.

In rates, Treasuries are marginally richer across the curve following an aggressive, two-day bear-steepening move. Treasury yields richer by as much as 1.5bp in belly of the curve which outperforms slightly, steepening 5s30s by almost 1bp on the day. The 10-year yield is around 4.44%, down 2bps vs Monday’s close with gilts outperforming by 2bp in the sector

European bonds outperform, led by gilts after June inflation in UK stores fell close to zero for the first time since October 2021. French government bonds fall, lagging their German peers and widening the 10-year yield spread by 2bps to 76bps as Eurozone inflation prints 2.5% though Core printed 2.9%, 10bps hotter than surveyed.

In FX, the Bloomberg Dollar Spot Index rises 0.1% while the euro dips, falling 0.2% against the greenback. ECB policymakers reiterated that there is no convincing evidence yet that inflation threat is over, biding their time for more data while at their annual retreat. Meanwhile, traders looked past euro area CPI, which slowed as expected in June.

In commodities, oil prices advance, with WTI rising 0.7% to trade near $84 a barrel with Brent trading above $87 and a fresh 2 month high. Spot gold is steady around $2,330/oz. Under modest pressure as the USD remains bid and BTC takes a breather from Monday's upside around this time.

Looking at today's calendar, US economic data slate includes May JOLTS job openings at 10am ET. Fed’s Powell is on a panel with ECB President Lagarde and Brazil’s Campos Neto beginning at 9:30am

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed amid the backdrop of rising global yields and recent soft US data. ASX 200 was subdued by weakness in real estate and miners, while RBA Minutes did little to shift the dial. Nikkei 225 recouped early losses and eventually reclaimed the 40,000 level for the first time since early April. KOSPI retreated after North Korea claimed it successfully test-fired a new tactical ballistic missile on Monday capable of carrying a super large warhead, while index heavyweight Samsung Electronics traded indecisively after its workers' union announced a 3-day strike. Hang Seng and Shanghai Comp. were marginally positive as the former gained on return from the long weekend in which property stocks briefly lifted the index to just shy of 18,000, while the mainland index was rangebound and attempted to reclaim the 3,000 status.

Top Asian News

European bourses are softer across the board to varying degrees with losses deepening since the cash open despite a lack of fresh fundamentals, Stoxx 600 -0.5% & Euro Stoxx 50 -0.9%. Energy bucks the trend and is the only sector in the green given ongoing crude upside; other sectors lower but choppy. Insurance names in focus as Hurricane Beryl continues to intensify and has made landfall. US futures are lower across the board (ES -0.4%, NQ -0.5%, RTY -0.6%) with price action generally in-fitting with European peers ahead of Fed's Powell & JOLTS; Tesla (-1.2%) in focus ahead of their Q2 delivery report.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Markets got Q3 off to a mixed start yesterday, with a pretty divergent performance across countries and asset classes. On the positive side, there was a noticeable recovery for French assets after the election results, with the Franco-German 10yr spread (-5.8bps) seeing its biggest decline since President Macron announced the election last month. However, that came alongside more weakness in US markets after investors became increasingly focused on the fiscal outlook, with the presidential election now just four months away. That saw the 10yr Treasury yield rise a further +6.5bps to 4.461%, building on its +11.0bps move on Friday and closing +20.3bp higher than the lows that came after Friday's soft core PCE. So had you got that data print right in advance you may have got bond markets totally wrong. I thought some of it was month-end shenanigans from Friday but a narrative has built up that due to the aftermath of the Trump/Biden debate, markets should be pricing in a higher probability of a Trump victory and larger fiscal deficits.

In terms of the French situation, the main news yesterday (as we discussed 24 hours ago) was that Marine Le Pen’s National Rally slightly underperformed the opinion polls from before the election. But DB’s economist thinks that their underperformance relative to polls likely reflected stronger participation in urban areas to some degree, in seats that the National Rally were unlikely to win anyway. He writes (link here) that the probability of a National Rally government (minority or majority) is actually now marginally higher than it was before round 1, and there is also the possibility that other MPs on the right or centre-right could implicitly support a minority government. So a slightly different view to the prevailing market narrative yesterday that a far-right majority was less likely. The house view is still a hung parliament though.

The second round will take place on Sunday, but the other parties are now attempting to keep the National Rally from gaining power, and there are negotiations on candidates standing down from districts where they wish to give another party a better chance of victory. For reference, candidates who receive more than 12.5% of registered voters can go forward to the second round, but there is a deadline tonight (6pm CET) for candidates to file papers to go forward, so it’s possible that those who did pass the threshold will withdraw, particularly if they came in third place. So once we know who’s actually standing where, we should get a better idea of the likely prospects going into Sunday’s vote.

In terms of the market reaction, there was an initial surge for equities at the open, with the CAC 40 up by +2.79% first thing. But those gains were then pared back, and the index “only” closed +1.09% higher. Other indices also advanced in Europe, but the gains were concentrated in the south, with Italy’s FTSE MIB (+1.70%) and Spain’s IBEX 35 (+1.04%) both outperforming. Meanwhile for sovereign bonds, the gap between French and German yields tightened back to 74bps, which is its tightest level in over two weeks, whilst Italian and Spanish spreads also fell. Nevertheless, yields still moved higher across the continent, and in absolute terms, the French 10yr yield (+5.1bps) was up to 3.349%, which is its highest closing level since November, whilst those on 10yr bunds were up by +10.7bps on the day. The US bond move from Friday afternoon was a big influence.

Well after the European close, ECB President Lagarde spoke at the annual retreat in Sintra, Portugal. She struck a slightly more hawkish tone, saying that Europe’s “still facing several uncertainties regarding future inflation, especially in terms of how the nexus of profits, wages and productivity will evolve and whether the economy will be hit by new supply-side shocks.” She added, “ It will take time for us to gather sufficient data to be certain that the risks of above-target inflation have passed.” There is now 38.2bps of cuts priced in by year-end, down -5.0bps from Friday’s close.

As discussed earlier, US Treasuries continued their significant last 36 hour decline from Friday as investors moved to focus on the upcoming election and the fiscal implications. That led to another fairly sharp curve steepening yesterday, with the 2s10s curve up +6.1bps to -29.9bps, having been at -49.6bps just one week earlier. For what it’s worth, this week is actually the second anniversary of the 2s10s inversion in July 2022, so we’re on track for yet more records in terms of this being the longest ever 2s10s inversion. And in terms of the specific moves, the 2yr yield was largely unchanged (+0.2bps) at 4.755%, but the 10yr yield saw a larger +6.5bps move to 4.461%. With the attention on the long end, fed futures were barely changed as the amount of cuts priced in by the December meeting was up just +1.0bps to 45bps. This morning in Asia, yields on the 10yr USTs have edged back down -2bps to around 4.44% as I type.

Risk appetite in the US was dampened by some weak data prints, with the ISM manufacturing for June falling to 48.5 (vs. 49.1 expected). Moreover, the subcomponents for new orders (49.3) and employment (49.3) were in contractionary territory as well so there was little respite in the report. The bright spot came on the inflation side, with the prices paid component down to a 6-month low of 52.1. That backdrop meant that US equities were mixed with tech once again saving the day with the Magnificent 7 surging +1.76%, even as the small-cap Russell 2000 was down -0.86%. The S&P 500 split the difference and was up +0.27%, even while 76% of the index members were lower on the day. S&P 500 (-0.23%) and NASDAQ 100 (-0.38%) futures are both trading notably lower this morning.

In Asia, the Nikkei (+0.38%) is trading higher with the Hang Seng (+0.57%) also gaining after returning from a public holiday. Elsewhere, Chinese stocks are struggling to gain traction with the CSI (-0.08%) and Shanghai Composite (+0.04%) relatively flat. Meanwhile, the KOSPI (-0.82%) is losing ground after a busy morning of inflation data. Indeed, South Korea’s inflation cooled more than expected, rising +2.4% y/y in June (v/s +2.6% expected), its slowest pace since July last year. It followed a +2.7% increase in the prior month. Meanwhile, core CPI came in +2.2% higher in June than a year before, in line with May’s reading.

In FX, the Japanese yen (-0.13%) is weakening to a fresh 38-year low of 161.68 against the dollar despite some verbal intervention from the authorities. Japanese Finance Minister Shunichi Suzuki stated that he is "closely watching FX moves with vigilance" while refraining from commenting on specific levels.

Finally, minutes from the RBA’s June monetary policy meeting indicated that board members discussed raising interest rates but eventually decided to hold rates steady at 4.35%. The board emphasized the need to remain vigilant to upside risks to inflation, noting that May’s inflation data hadn’t been enough to derail its inflation outlook of returning to target in 2026. However these minutes are slightly dated as a week after the meeting we had a strong CPI print. So our economists believe an August hike is likely.

To the day ahead now, and data releases include the Euro Area flash CPI print for June, along with the unemployment rate for May. Over in the US, there’s also the JOLTS report of job openings for May. From central banks, we’ll hear from Fed Chair Powell, ECB President Lagarde, ECB Vice President de Guindos, and the ECB’s Elderson and Schnabel