US equity futures are higher (duh) outperforming global counterparts, while the Nasdaq is on pace for a historic 10th day of gains. As of 8:00am ET, S&P and Nasdaq 100 futures were higher by 0.2% with Oracle rising more than 5% in premarket trading on news it may soon be handed control of TikTok. S&P 500 contracts edged higher after the US benchmark powered through the 6,600 mark on Monday. Pre-mkt, Mag7 is displaying strength across multiple members with add’l TMT support from AVGO (+1.4%) and ORCL (+3.7%). Cyclicals and Semis are poised to lead but with pockets of strength in Defensives (HC, Staples) also seen. Europe’s Stoxx 600 fell 0.2%. Bond yields are flat to down 1bps with the US Dollar broadly weaker ahead of a widely expected 25bp cut and the resumption of the Fed’s easing cycle which paused in Dec 2024 (right after Trump was elected). US Treasuries have been racing past peers, the euro is nearing four-year highs and Goldman strategists caution that the next pain point for bond traders may come in the five-year part of the curve. Both Cook and Miran will be a part of the vote. Today’s macro data focus is on Retail Sales where Feroli is below the Street seeing a 0.1% MoM print and 0.3% for the Control Group.

In premarket trading, Mag 7 stocks are mostly higher: Tesla rises 1.3%, paring earlier gains after the National Highway Traffic Safety Administration opened a probe over issues with door handles on certain Model Y vehicles. Alphabet gains 1.3% a day after the Google-parent on Monday joined an elite group of companies valued at more than $3 trillion (Nvidia -0.2%, Microsoft +0.1%, Apple -0.01%, Amazon +0.5%, Meta Platforms +0.6%)

Stock bulls are riding high ahead of a widely expected 25-basis-point Fed cut on Wednesday (potentially as high as 50), the first move in a policy easing round projected to run into 2026. Rate-sensitive tech shares have led the charge in the post-Liberation Day rebound, fueled by enthusiasm over artificial intelligence. Asset managers are growing even more bullish according to the latest BofA survey. But stretched positioning in pockets of the market, with some funds already “maximum long”, is leaving it vulnerable to a shock.

"Capex and profit forecasts linked to AI are overwhelming,” said Thomas Brenier, head of equities at Lazard Freres Gestion. “Look at Oracle, it seems that the sky is the limit.”

Expectations of aggressive Fed rate cuts drove the dollar toward its weakest level since July. The euro climbed 0.4%, nearing its highest mark since 2021. The divergence reflects the Fed’s shift toward easing, in sharp contrast with the European Central Bank, where policymakers have signaled an end to their own loosening cycle.

As the Nasdaq prints a nine-day winning streak, hedge funds net bought IT stocks at the fastest pace in seven months across all regions, according to Goldman's prime desk. With CTAs max long, corporates increasingly moving into buyout blackouts, and hedge funds likely only able to add at the margin, retail and discretionary investors are left to support equities.

Meanwhile, the tensions between the Fed and Trump administration escalated Monday. An appeals court temporarily halted the effort to oust Governor Lisa Cook, while the Senate separately approved Trump’s economic adviser Stephen Miran for a seat on the board.

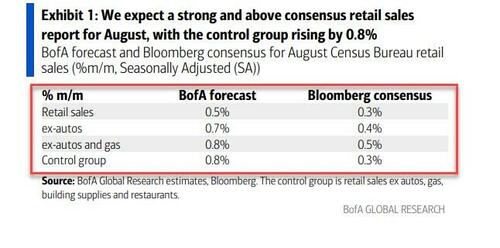

Later on Tuesday, traders are set for a final read on the American consumer. Retail sales data for August are forecast to show a 0.2% increase, following stronger advances in the previous two months, although real -time card spending data hints at an even higher print. Bloomberg economists Eliza Winger and Estelle Ou expect headline retail sales likely grew 0.2% in August, down from 0.5% in July, as auto sales slowed, noting spending remains modest overall with consumers concerned about tariffs and the economy. With the jobs market softening and prices rising, questions remain over how long consumers will keep spending freely.

“In the session ahead, we navigate US retail sales and that poses a degree of risk to markets,” wrote Chris Weston, head of research at Pepperstone Group. “However, with the Fed meeting looming large in the following session, it will likely take an outsized surprise in retail sales to really move the dial on risk.”

Stocks may have further upside as rising expectations for economic growth continue to buoy bullish sentiment, according to Bank of America’s Michael Hartnett. His latest fund manager survey found that a net 28% of global investors are overweight equities, the strongest reading in seven months. Views on growth also showed the biggest positive shift in nearly a year, with only a net 16% of respondents still anticipating an economic slowdown, Hartnett said.

Europe's Stoxx 600 falls 0.1% as the rally that sent US and Asian stocks to fresh highs sputters in Europe. Italian banks dip on news that the government was drafting plans to raise another €1.5 billion ($1.8 billion) from lenders, while miners gained on the back of rising iron ore prices. Here are the biggest movers Tuesday:

Earlier in the session, Asian stocks surged to a fresh intra-day record, propelled by a rally in chip stocks after Beijing’s anti-monopoly ruling on Nvidia. The MSCI Asia Pacific Index rose as much as 0.8% to reach its highest level on record, as chip stocks such as TSMC and Samsung Electronics led gains. Investor sentiment remained upbeat also on expectations of a Federal Reserve rate cut this week. Chip stocks jumped on Tuesday after a Chinese regulator ruled that Nvidia violated anti-monopoly laws in its 2020 acquisition of networking gear maker Mellanox Technologies Ltd. The decision was interpreted by some investors as a signal of Beijing’s push to promote localization and self-sufficiency in chip technology, sparking gains in Chinese home-grown semiconductor firms. Asian equities have been on a tear recently, repeatedly testing a previous high set in 2021. Investor sentiment has gradually improved since April, boosted by easing trade tensions with the US and a resurgence in Chinese stocks due to AI developments and government efforts to cut overcapacity. Here Are the Most Notable Movers

In FX, the dollar weakens for a second day, boosting G-10 peers. The euro touches highest since July, closing in on its strongest level in four years. Sterling hits a two-month high too after UK jobs data backed a slower pace of cuts by the Bank of England.

In rates, US Treasuries were little changed, with the 10-year yield at 4.04% and European bond markets, mixed for gilts. US government bonds have outpaced global peers this year, delivering a 5.8% return as expectations for policy easing reversed widely held bearish views.

In commodities, gold hits another record high, trading about $19 higher on the session to around $3,697/oz. Oil prices dip, with Brent slipping closer to $67/barrel.

Today's economic data slate includes August retail sales and import/export prices and September New York Fed services business activity (8:30am), August industrial production (9:15am), and July business inventories and September NAHB housing market index (10am).

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid some cautiousness ahead of upcoming risk events and despite the fresh record levels on Wall St, where the mega-caps did most of the lifting as Alphabet joined the USD 3tln market cap club. ASX 200 marginally gained with the index led by strength in mining, resources and materials, but with gains capped by weakness in defensives. Nikkei 225 swung between gains and losses following an early unprecedented climb to above the 45,000 milestone on return from the extended weekend, while the calendar was quiet, although lower US tariffs on Japan took effect. Hang Seng and Shanghai Comp were subdued despite the recent talks in Madrid where the US and China reached a framework agreement on TikTok although the details were scarce, while US President Trump and Chinese President Xi are scheduled to talk on Friday.

Top Asian News

European bourses (STOXX 600 -0.1%) opened around the unchanged mark, but sentiment then slipped as markets turned risk-off across the board in the continent. That pressure has since slowed down a little and are off worst levels – but indices are still broadly lower. European sectors are broadly on the backfoot, in-fitting with the risk tone. IT is towards the top of the pile, boosted by strength across Dutch semiconductor names; nothing really driving the upside today, but it does come after ASML (+3%) once again overtook SAP, to become Europe’s largest company. Consumer Staples is found towards the bottom of the pile; Unilever (-1%) moves lower after it appointed a new CFO.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I woke up this morning the father of a 10-year-old daughter. Where did the time go? Don't tell my family as it's a surprise for tonight, but I spent part of the summer writing and recording a new song and creating a video celebrating Maisie's first decade. The world premiere at home will be after a night out at an escape room tonight... if we escape.

As we await tomorrow’s FOMC decision, markets have continued to power forward over the last 24 hours, with risk appetite supported by positive noises out of the US-China trade talks. That newsflow led to growing optimism that some kind of longer-term truce would eventually be reached between the two, and those hopes of a cooling in the trade war meant both the S&P 500 (+0.47%) and the NASDAQ (+0.94%) closed at another record high. Moreover, it was a decent session for sovereign bonds as well, thanks to mounting anticipation that the Fed would deliver another rate cut at tomorrow’s meeting. So, it was a strong day all round, and US Treasuries also rallied across the curve, with the 10yr yield (-2.8bps) falling back to 4.04%.

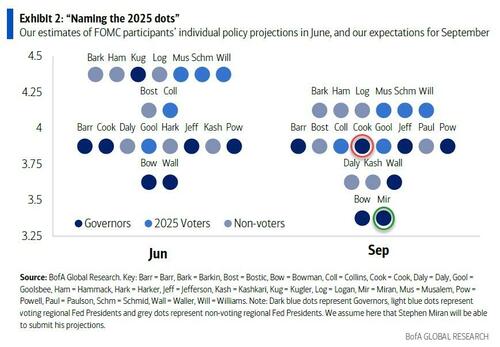

Ahead of today's start to the FOMC, an appeals court last night blocked Mr Trump from firing Lisa Cook from the Fed board before her appeal against her dismissal is heard. So, she will likely be at the meeting barring any additional legal action. Stephen Miran could also sit as he was confirmed in his new post by the Senate last night. So, it's shaping up to be an interesting 2-day meeting.

On those US-China headlines, Trump himself posted that the meeting in Madrid “has gone VERY WELL!” and that he would be speaking with President Xi on Friday. Separately, Treasury Secretary Bessent said that “we do have a framework for the deal with TikTok”. This collectively led to a fresh burst of optimism, particularly around stocks which are more exposed to US-China trade. For instance, the NASDAQ Golden Dragon China index (+0.87%) outperformed, which is an index made up of US-listed companies who do a majority of their business in China.

That positive trade narrative spread across markets, helping to lift global equities as investors grew more hopeful on the path of US-China relations. After all, there’s still a lot of tension between the two sides, and it’s worth remembering that the tariffs are still subject to a temporary 90-day truce in place between the two sides, which currently runs out in November. The hope is that continued engagement will eventually lead to a more durable truce, avoiding the possibility of US tariffs jumping back up to the 145% rate seen after Liberation Day. Indeed, US Trade Representative Greer said on the tariff extension, that “We’re certainly open to considering further action there, if the talks continue in a positive direction”.

This backdrop led to a fresh global advance, with the S&P 500 (+0.47%) at another all-time high whilst in Europe the Stoxx 600 (+0.42%) closed 1% from its all-time high reached back in March. In fact, the S&P 500 is now on track to have risen for 6 of the last 7 weeks, which would be the most sustained advance of 2025 so far. Those moves were led by tech stocks, with both the NASDAQ (+0.94%) and the Magnificent 7 (+1.95%) hitting fresh highs of their own. Alphabet (+4.49%) became the fourth company to reach a $3trn valuation while Tesla (+3.56%) also outperformed following news that Elon Musk had purchased around $1bn worth of Tesla shares. Nvidia lost ground after China found they’d violated their antitrust law with a deal in 2020, but its stock was only down -0.04% by the close. The strong day ended with the S&P 500 up +12.47% for the year, even as most of its constituents were lower on the day.

For sovereign bonds, it was generally a strong day as well. But French bonds saw a relative underperformance after Friday’s news that Fitch Ratings had downgraded their credit rating from AA- to A+. Yields on 10yr OATs (-2.8bps) were only down a bit to 3.48%, whilst those on Italian BTPs fell by a larger -4.7bps to 3.47%. That’s a significant move, because it’s the first time since 1999 that France’s 10yr yield has closed above Italy’s, having briefly moved above on an intraday basis last week. Clearly this trend has been apparent for some time, but it’s a striking re-ordering of how investors perceive the risk of different sovereigns, having been in a completely different place at the height of the Euro crisis in the early 2010s.

In absolute terms however, it was still a strong day for sovereign bonds on both sides of the Atlantic. For example, US Treasury yields came down across the curve, with the 2yr yield (-1.9bps) falling to 3.54%, whilst the 10yr yield (-2.8bps) fell to 4.04%, which further helped to ease fears about the fiscal trajectory. The bond rally got a further push from the NY Fed’s Empire State manufacturing survey for September, which fell to a 3-month low of -8.7 (vs. +5.0 expected), coming in beneath every economist’s estimate on Bloomberg. So that helped to boost expectations for a faster cycle of Fed rate cuts, with the amount of cuts priced in by the June meeting up +2.0bps on the day to 120bps. And that move lower for yields was clear across the rest of Europe too, with those on 10yr bunds (-2.4bps) and gilts (-3.9bps) both falling as well.

The lower rates backdrop weighed on the dollar, with the dollar index (-0.25%) falling to its lowest in almost eight weeks. Meanwhile, gold (+0.98%) reached a record high for the ninth time in twelve sessions at $3,679/oz.

In Asia, the KOSPI (+1.18%) is leading gains, touching a new peak as heavyweight chipmakers Samsung Electronics and SK Hynix are sharply higher while the Nikkei (+0.50%) is also trading in positive territory after returning from a holiday. Elsewhere, the Hang Seng (+0.12%) is swinging between gains and losses while on the mainland the CSI (-0.39%) and the Shanghai Composite (-0.10%) are bucking the positive regional trend with both drifting lower after strong recent gains. Meanwhile, the S&P/ASX 200 (+0.31%) is also edging higher. S&P 500 (+0.09%) and NASDAQ 100 (+0.14%) futures are also trading slightly higher.

To the day ahead now, and data releases include US retail sales and industrial production for August, the German ZEW survey for September, Canada’s CPI for August, and the UK’s latest employment report. Central bank speakers include the ECB’s Escriva.