US equity futures are higher and approaching a new record high. Over the weekend, headlines were relatively muted in the US, while globally, Japan’s ruling party lost its majority in the upper house, but PM Ishiba still pledged to stay in office in a creeping setup for the latest Japanese political crisis. While the yen has rallied overnight after Japan’s ruling coalition loses its majority in the upper house election, this appears to be a kneejerk reaction with Japanese markets closed today; expect much more weakness for the JPY as Japan now opens the fiscal stimulus floodgates forcing the BOJ to monetize much more Japanese debt. As of 8:00am ET, S&P and Nasdaq futures are both up 0.2% and Europe’s Stoxx 600 Index posted small moves. In premarket trading Mag 7 shares are higher: TSLA (+1.6%) leading gains, followed by GOOGL (+0.9%) and META (+0.6%); the only exception is Microsoft which was down 0.2% after a cyberattack. Utilities and Consumer Discretionary are outperforming. The yen strengthened 0.7% while the dollar slipped. After last week's selloff, Treasuries yields are lower: 2-, 5-, 10-, 30yr yields are 2bp, 3bp, 4bp lower. Commodities are mixed with base and precious metals higher and oil lower.

In premarket trading, Mag 7 stocks are mostly higher with the exception of MSFT whose server software was exploited by unidentified hackers, with analysts warning of widespread cybersecurity breaches. Nvidia is said to have told clients that it only has limited availability of its H20 AI chips, the Information reported. (Tesla +1.4%, Alphabet +0.8%, Meta +0.5%, Apple +0.6%, Amazon +0.3%, Nvidia +0.1%, Microsoft -0.1%).

Markets seem to be paying less and less attention to tariff headlines, while strategists are making positive noises about earnings and the economy. Morgan Stanley strategists said investors should stay bullish on US stocks, as earnings momentum, positive operating leverage and cash tax savings are under-appreciated tailwinds. Peers at Goldman Sachs said the earnings season has had a solid start while recent dollar weakness should provide a small tailwind to US earnings.

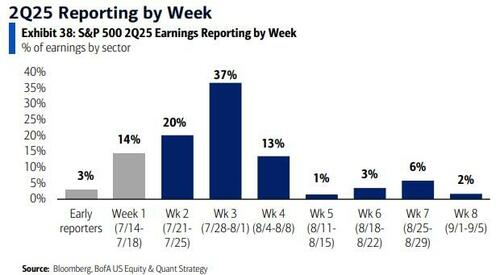

The positivity comes as a huge week of earnings (if quiet for macro) kicks off, with Verizon, General Motors, Tesla and Alphabet among companies reporting in the next few days. Investors will be watching a slate of corporate reports this week for signs of economic resilience in the face of tariff risks. Companies accounting for about a fifth of the S&P 500’s market capitalization are expected to post results this week. Tesla and Alphabet report Wednesday. Also up are Lockheed Martin Corp. and Coca-Cola Co. on Tuesday.

“Equities still have, particularly in the US, a little bit of room to run further,” Max Kettner, chief multi-asset strategist at HSBC Holdings Plc, said on Bloomberg TV. “Let’s remember that we were going into this reporting season with very low expectations.”

Outside of earnings, Bloomberg reports that Wall Street is looking for a “Powell hedge” to trade the possibility of Trump firing the Fed Chair. And the EU and US are heading into another week of intensive trade talks as they seek to clinch a trade deal by an Aug. 1 deadline. In options, investor demand for yield in the US is helping fuel growth in the market for S&P 500 Index dividend futures and options — a niche corner of the derivatives world where America has long trailed Europe. Trading in CME dividend futures climbed 40% in the first half of 2025.

European stocks are mostly steady as investors digest corporate earnings reports and contend with global trade jitters. The automotive and healthcare sectors are the biggest laggards, while miners outperform driven by demand optimism related to a mega dam project in Tibet and Chinese efforts to curb steel oversupply. Stellantis NV slid after reporting a €2.3 billion ($2.7 billion) net loss in the first half due to restructuring expenses, waning sales and the impact of tariffs. Here are the most notable movers:

Earlier in the session, Asian equities traded in a narrow range, with Japan stock futures overcoming initial decline to trade steady, after Prime Minister Shigeru Ishiba’s ruling coalition lost its majority in an upper house election. The MSCI Asia Pacific Index gained as much as 0.2%, erasing losses earlier during the session on Monday. Alibaba Group Holding Ltd., HDFC Bank Ltd. and Samsung Electronics Co Ltd. lifted the index, whereas Taiwan Semiconductor Manufacturing Co., Reliance Industries Ltd. and Commonwealth Bank of Australia were key decliners. Chinese, Indian and Korean equities advanced while Australia and Taiwan’s markets ended lower. Nikkei futures fell as much as 0.5% as Japan’s markets were shut for a public holiday. The ruling coalition’s loss of a majority in Japan could dampen global investor appetite for the country’s assets — particularly as it navigates sensitive tariff negotiations with the US. Ishiba said that he intended to remain in the role in spite of the loss, which would make him the first Liberal Democratic Party leader since 1955 to govern the country without a majority in at least one of the legislative bodies.

“If uncertainty lingers, I think equities will take the brunt of the hit, especially domestic-facing stocks sensitive to policy shifts,” said Dilin Wu, a research strategist at Pepperstone Group Ltd. However, some losses might be pared if Ishiba signals a clear recovery plan or reshuffles his cabinet effectively, Wu added.

Elsewhere in the region, the Hang Seng Index briefly topped 25,000 points to reach its highest level since February 2022. The rally in Hong Kong stocks is set to extend on increasing optimism for tech shares and more southbound investment from the mainland.

In FX, the yen is rallying after Japan’s ruling coalition loses its majority in the upper house election. It’s the best performer in the G-10 sphere against a broadly weaker dollar. A public holiday means Japanese stocks and bonds aren’t trading. Beyond the yen, the dollar has fallen 0.3% to session lows against most of its G-10 peers, with sterling and the Swedish krona also outperforming.

In rates, Treasuries and European bonds are higher, with gilts marginally underperforming. Failure of trade negotiations to reach an agreement that would avert a 30% US tariff on most EU exports is driving sentiment. US yields are lower by 2bp-4bp across tenors with 2- to 10-year at lowest levels in more than a week; the 10-year near 4.36% is lower by about 6bps vs declines of 5bp to 7bp for UK and most euro-zone counterparts. Treasury auctions this week include $13 billion 20-year bond reopening Wednesday and $21 billion 10-year TIPS new issue Thursday.

In commodities, iron ore and copper gained, gold is up about $15 to $3,365/oz. Brent futures are choppy but in a tight range, trading down about 0.6% to slightly under $69/barrel.

US economic data calendar includes only June Leading Index (10am). Later this week, housing data will be closely watched: The data is “the canary in the coalmine, and it’s looking queasy,” according to Bloomberg Economist Anna Wong. Fed officials are in external communications blackout ahead of their July 30 rate decision, anticipated to be no change in the fed funds target range of 4.25%-4.5%

Market Snapshot

Top Overnight News

Trade/Tariffs

Japanese Upper House Election

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week mostly in the green but with gains capped following relatively light macro catalysts from over the weekend, aside from Japan's upper house election with the ruling coalition set to lose a majority, although markets in Japan were shut for a holiday. ASX 200 retreated with the index dragged lower by underperformance in its top-weighted financial sector, while miners were showing some resilience as South32 gained following its quarterly and full-year production update. Hang Seng and Shanghai Comp were kept afloat amid strength in tech and energy stocks, while China's LPRs were unsurprisingly maintained and there were also recent reports that US President Trump could meet with Chinese President Xi ahead of or during the October APEC meeting in South Korea.

Top Asian News

European bourses (STOXX 600 -0.1%) opened mixed and on either side of the unchanged mark. Though as the morning progressed, sentiment waned a touch to display a modestly negative picture in Europe. European sectors are mixed. Travel & Leisure was buoyed by post-earning upside in Ryanair (+5%); the Co. beat on its headline metrics and noted that Q2 demand is strong. Elsewhere, more bad news for Autos which is pressured by losses in Stellantis (-2.5%) after the Co. reported significant net losses. US equity futures (ES +0.3% NQ +0.3% RTY +0.7%) are modestly firmer across the board, ahead of a week which includes earnings from the likes of Alphabet and Tesla. Deutsche Bank turns Neutral from Overweight on European equities vs US equities.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

It's all about Japan this morning as the ruling coalition has lost their majority in the upper house, with a lot of uncertainty around what happens next. Out of 125 seats up for grab they’ve won 47 but needed 50 to maintain a majority in the 248-seat chamber. This is better than expected and Prime Minister Shigeru Ishiba’s (from the LDP) has vowed to stay on but history suggests this will be a challenge even if they still comfortably have the largest number of seats. In a trend reminiscent of many other countries’ mainstream parties, the long dominant LDP party has been losing support relative to populists and others. This is the first time they’ve been in power with a minority government in both houses since the party was formed in 1955 and they've been in government for around 64 of those 70 years. The fact that we’re under two weeks away from the August 1st trade deadline complicates things further. On the positive side only being three seats short may allow the coalition to pass legislation with non-affiliated independents. Ishiba is holding a press conference after I press send on this but details will likely be out by the time this hits your inbox. Ahead of that the Yen has settled +0.24% higher after being as high as +0.74% at the open. Nikkei futures are slightly lower with cash Japanese markets closed for a holiday.

Markets in the rest of Asia are mostly starting the week on the front foot with the Shanghai Composite (+0.50%), the Hang Seng (+0.38%), and the CSI (+0.28%) all experiencing gains following the PBOC's decision to maintain the benchmark lending rate at historic lows. In addition, the KOSPI (+0.58%) is also higher. Australia’s ASX 200 has been the poorest performer in the region, declining by -1.12% after achieving a series of record highs last week. S&P 500 (+0.12%) and NASDAQ 100 (+0.19%) futures are edging higher.

Moving forward, this week looks pretty quiet in terms of planned events but this year has been as busy as I can remember outside of a crisis in terms of unplanned events so the first part of this sentence will likely be proved to be meaningless.

In terms of the known highlights, we have the global flash PMIs on Thursday alongside what is universally accepted to be an ECB on hold meeting. With the Fed on their blackout ahead of next week's FOMC, the only noise will come from how hard Trump wants to continue to push on with criticising Powell. Powell does open a regulatory conference tomorrow but won't discuss monetary policy given the blackout.

The key US data are some regional manufacturing surveys tomorrow, existing home sales on Wednesday, new home sales, jobless claims and the Chicago Fed survey on Thursday, and then durable goods on Friday.

In Europe our economists highlight that the key to the ECB meeting is how long they're expected to pause. See more in their full preview of the meeting here. The central bank will also release its bank lending survey tomorrow.

In terms of economic data, other sentiment indicators out in the region will include consumer confidence in Germany (Thursday), the UK, France and Italy (Friday). The German Ifo survey is out on Friday.

In Asia after the dust settles on the Japanese election, we have Tokyo CPI for July due on Friday. Our Chief Japan economist sees core inflation ex. fresh food declining to 3.0% YoY (3.1% in June), while core-core inflation ex. fresh food and energy should ease to 3.0% (3.1%). Note that behind the headline softness in last Friday's country wide CPI there was strength in core-core inflation.

We will start to see Q2 earnings get fleshed out a little more this week with 135 S&P 500 and 189 Stoxx 600 companies reporting. Two of the Magnificent 7, Alphabet and Tesla, will report on Wednesday. Other tech firms releasing results this week include IBM, ServiceNow and Intel. Defence firms including RTX, Lockheed Martin and Northrop Grumman also report.

In Europe, earnings will be due from the region's largest company, SAP tomorrow. Three others from the top 10 by market cap - LVMH, Roche and Nestle - also report, along with several European banks. See the full day-by-day calendar of events as usual at the end

Recapping last week, US bond markets saw sizable intra-week moves amid questions about Fed independence and hawkish details from within the latest US CPI release. The major drama came on Wednesday following media reports that Trump was on the verge of dismissing Fed Chair Powell, though this was soon denied by Trump even as he maintained his call for the Fed to lower rates. At one point, pricing of a September rate cut rose from 57% to 80%, before swiftly reversing. This inched up again to 64% on Friday though, following comments by Fed Governor Waller, a potential candidate to replace Powell, who is in favour of a 25bps cut at the upcoming late July meeting. With all said and done, the Treasury curve saw a noteable steepening as the 2yr yield was -1.6bp lower on the week (-3.5bps Friday) while 30yr yields were up +3.8bps (-2.0bps on Friday) to 4.99%. The 10yr also rose +0.7bps (-3.5bs on Friday) to 4.42%.

Friday’s Treasury rally was also supported by the July University of Michigan survey that saw long-run inflation expectations decline for a third consecutive month (from 4.0% to 3.6%), while sentiment ticked up (+61.8 vs +60.7 previously). So that eased some of the concerns over second-round inflationary risks, The impact of tariffs on goods prices had become more visible in Tuesday’s US CPI data, even as softer services brought a downside headline surprise. Otherwise, last week’s data, including stronger retail sales and lower jobless claims, painted an optimistic picture on the US economy.

Against this backdrop, US equities saw new all-time highs. The S&P 500 was up +0.59% (-0.01% Friday), posting a record high on Thursday. Tech stocks outperformed, with the NASDAQ rising +1.51% (+0.05% Friday) to a new record high of its own. The Mag-7 were up +1.74% (+0.68% Friday), led by Nvidia’s +4.54% gain (-0.34% on Friday) after the US lifted some restrictions on its AI chip exports to China. The positive US mood also saw the dollar index (+0.64% on the week) post its best two-week run since early January.

Tariff news also jostled for the spotlight, with the FT reporting after Friday’s European close that Trump had escalated his demand on the EU to a 15%-20% minimum baseline tariff (previously 10%) ahead of his August 1 deadline. Ahead of the news, the STOXX 600 was largely flat over the week (-0.06%), with the DAX up +0.14% (-0.33% on Friday) supported by Thursday’s positive ZEW survey. Separately, Trump threatened to impose 100% secondary tariffs on importers of Russian energy if a ceasefire with Ukraine is not reached in 50 days, though this sizeable delay meant that Brent crude actually fell -1.53% on the week to $69.28/bbl. Meanwhile, European government bonds saw modest moves with 10yr bunds -2.9bps lower (+2.1bps Friday), though an ongoing curve steepening saw 30yr bunds (+0.6bps to 3.23%) and OAT yields (+2.1bps to 4.22%) post new post-2011 highs.

Lastly, crypto saw a significant run amidst last week’s “Crypto Week” in D.C., where the US House approved three landmark crypto bills. This includes the GENIUS Act, signed into law by Trump on Friday, which defines stablecoin legislation in the US. Bitcoin saw a record high of ~$123,000 on Tuesday, finishing +9.59% over the week, while the total crypto market exceeded $4trn for the first time.