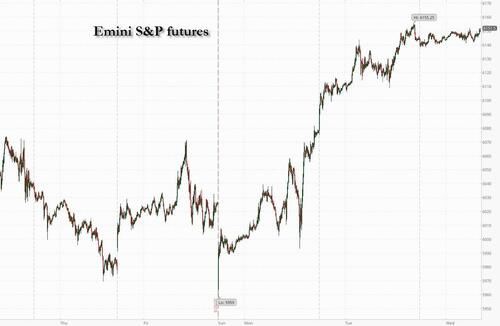

US equity futures reverse modest losses and trade flat, just shy of a new record, after the Nasdaq set a new all time high yesterday as the ceasefire between Iran and Israel remains intact (Pentagon intelligence report said US airstrikes had only a limited impact on Iran’s nuclear program, which President Trump disputed) and as the NATO Summit continues. As of 8:00am ET, S&P futures were up 0.1% ahead of Powell's second day of Congressional testimony; Nasdaq 100 futures rose 0.3% as a FOMO panic grows now that the index is back at all time highs. Pre-market Mag7/Semis are seeing a bid; with cyclicals mixed with financial higher but Industrials are dragged by FDX which is down 6% post earnings (q1 guide below cons/withheld full year guidance citing trade policy uncertainty). Asia closed higher (Shanghai +1.04%/Hang Seng +1.23%/Nikkei +39bps) on limited catalysts outside of comments from China’s Premier Li that Beijing was turning China into a “mega-sized” consumer powerhouse, while Europe is lower (FTSE -5bps/DAX -40bps/CAC -20bps) on light volumes (-20% vs 10dma). The US dollar is stronger, while commodities are weaker with Energy seeing a relief rally/deadcat bounce. As the market moves back to trade, taxes, and earnings there are incrementally positive headlines on US/Mexico looking at a lowering effective tariffs rates around a quota system and US/China where China is looking to reduce the flow of fentanyl precursors, a potential goodwill measure. Today brings a second day of testimony from Powell in front of the Senate (should be same message that the Fed is well positioned to wait for further clarity on the economy), the 5Y bond auction, and new home sales.

In premarket trading, Mag 7 stocks are higher alongside index futures (Nvidia +0.8%, Tesla +0.8%, Alphabet +0.6%, Apple +0.4%, Amazon +0.3%, Microsoft +0.3%, Meta +0.2%). Here are some other notable premarket movers:

With the S&P 500 trading within 1% of its all-time high after a sharp rebound from April’s tariff-driven turmoil, some analysts warn that complacency is setting in. Risks remain elevated, including the potential for renewed geopolitical tensions and the looming tariff deadline set by US President Donald Trump, now just two weeks away, with little progress on trade deals.

“Going into July 9, there is no tariff fear priced into the market,” Bhanu Baweja, chief strategist at UBS Group AG, told Bloomberg TV. “Caution is what is warranted right now. We won’t be chasing the market higher.”

Following a turbulent stretch in financial markets that was sparked by a near two-week war between Israel and Iran, traders are shifting their focus back to the US economy and how trade risks and fiscal pressures could affect corporate earnings and growth. A fragile ceasefire between Israel and Iran appeared to be holding on Wednesday, with both sides claiming victory in the war.

“The market is moving on to the next thing which is the tariffs deadline, and central banks,” said Lilian Chovin, head of asset allocation at Coutts. “We are in a sequence where slightly weaker growth momentum is being positively received by markets, because it’s causing renewed expectations for rate cuts.”

European stocks are little changed with gains in auto and technology shares offset by losses in media and telecommunications. The Stoxx 600 was little changed as auto shares outperformed, as data showed new-car registrations rose 1.9% last month from a year earlier. Media stocks were the biggest laggards. Here are some of the biggest movers on Wednesday:

Earlier in the session, Asian stocks climbed on optimism the Israel-Iran ceasefire will hold, while tech shares got a boost after the Nasdaq 100 hit a record high. The MSCI Asia Pacific Index rose as much as 0.6% on Wednesday, adding to the previous session’s 2.3% rally. TSMC, Alibaba and Nintendo were among the biggest boosts. Benchmarks in China, Hong Kong and Taiwan led gains in the region. Global risk sentiment is on the mend as Middle East tensions subside, though prospects for lasting peace remain unclear. The relief rally helped propel tech stocks in particular, with investors also hopeful the the US will seal trade deals with major trading partners.

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The Kiwi dollar tops the G-10 FX pile rising 0.2% against the greenback. The yen led G10 losses with USD/JPY as much as 0.5% higher to 145.68; other G10 currencies traded in a narrow range

In rates, treasuries are little changed after the benchmark 10-year yield shed five basis points Tuesday, as Powell’s comments before House lawmakers and weak consumer data boosted bets on the pace of rate cuts in 2025. US 10-year is around 4.30% with German counterpart lagging by around 1bp; UK 2- and 5-year yields trade about 1.5bp richer on the day, outperforming Treasuries. Swap traders are currently pricing in a 15% probability of a quarter-point cut next month, with expectations for at least two reductions by year-end. Powell is due to appear in the Senate on Wednesday. French bonds outperform. $70 billion 5-year note auction follows good result for Tuesday’s 2-year new issue; WI 5-year yield near 3.878% is ~19bp richer than last month’s; cycle concludes Thursday with $44 billion 7-year

In commodities, brent crude futures rise almost 1% to $67.74 a barrel before reversing some of their gains, after plunging the most since 2022 in the past 48 hours, as Trump expressed support for NATO and disputed an intelligence report that found the airstrikes he ordered on Iran had only a limited impact on its nuclear program. Spot gold hovers around $3,322/oz. Bitcoin rises 0.8% toward $107,000.

Looking at today's calendar, US economic data slate includes May new home sales at 10am. Fed speakers include Goolsbee (8am); Powell testifies before a Senate committee at 10am.

Market Snapshot

Top Overnight news

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded stronger following the firm lead from Wall Street, with gains capped as traders were cautious amid the fragility of the Israel-Iran ceasefire. From a central bank perspective, some attention in US hours was on Fed Chair Powell, who echoed his wait-and-see stance but left July options open during the Q&A. Thereafter, sentiment in APAC trade was somewhat capped after BoJ taper-dissenter Tamura struck a hawkish tone, suggesting the BoJ may need to raise rates decisively—even amid high uncertainty—if upward price risks heighten. He also noted that he does not see 0.5% as a barrier for BoJ rate hikes. ASX 200 fluctuated between modest gains and losses before a sub-forecast Aussie Monthly CPI print provided a mild boost. The monthly gauge came in at 2.1%, towards the bottom end of the RBA’s 2–3% target range, though market pricing barely shifted. Nikkei 225 saw choppy trade in limited ranges following commentary from BoJ’s Tamura, who said he does not see 0.5% as a ceiling for rate hikes. On the trade front, FBN's Gasparino suggested progress in US-Japan trade talks. The BoJ Summary of Opinions noted that the effects of tariff policies are likely yet to materialise. Hang Seng and Shanghai Comp conformed to the broader tone following a muted open as traders awaited the next catalyst. The indices saw upticks following remarks from China's Premier Li who said judging from key indicators, China's economy showed a steady improvement in Q2, and he is confident in China's ability to maintain a relatively rapid growth.

Top Asian News

European bourses (STOXX 600 U/C) opened mostly and modestly firmer and have traded choppily throughout the morning. More recently, some selling pressure has been seen taking a few indices modestly into the red. European sectors hold a positive bias, and aside from the top performer, the breadth of the market is fairly narrow. Autos is the clear outperformer today, lifted by strength in Stellantis (+4.5%) after the Co. received an upgrade at Jefferies. Telecoms is found at the foot of the pile, joined closely by Food Beverage & Tobacco; though losses which are modest by nature.

Top European News

FX

Fixed Income

Commodities

Central Banks

Geopolitics

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

When we first published the report in 2012, US cities were a bit of a bargain relative to their developed market peers. But fast forward a decade or so and the US is now jostling with Geneva and Zurich at the top of many of the charts. Admittedly a strong dollar helped – but the story runs deeper: it’s a tale of US exceptionalism, Wall Street strength, and a tech sector that’s gone global but remains American-led. However given our bearish structural dollar view, we think US cities would slip down these lists in the years ahead.

The report covers lots of measures, including who has the best quality of life, where are salaries soaring, how much an apartment will cost, and where’s the cheapest place to go on a “cheap date” with your partner. It’s got a bulleted summary section followed by further commentary, and includes the full tables across all 69 cities. The financial market city with the best quality of life is 90 places ahead of its FIFA world football ranking. Can you guess who it is? Please delve into the report at your leisure for this and much much more.

When it comes to the last 24 hours, near-term inflation fears have rapidly diminished as the ceasefire in the Middle East led to further oil price declines. Indeed, Brent crude was down another -6.07% yesterday to $67.14/bbl, meaning that the two-day decline over Monday and Tuesday is the biggest since March 2022, at -12.82%. It’s also their lowest level since June 10, so just before fears of Israeli strikes against Iran began to surface. This fading geopolitical premium also led to a huge risk-on move across multiple asset classes, with the S&P 500 (+1.11%) seeing its best day in four weeks and closing less than 1% beneath its record high from mid-February. This morning in Asia, US equity futures are flat and oil prices (+1.36%) have edged back up, trading at $68.06/bbl.

The decline in oil yesterday got some extra momentum from Trump’s post that “China can now continue to purchase oil from Iran”, suggesting that the US might reduce enforcement of sanctions against Iranian oil. Although it's fair to say that the statement seems to catch the Treasury and State Departments by surprise. Meanwhile, the truce between Israel and Iran appears to be holding after Trump earlier blamed both sides for initial breaches. Israel’s Prime Minster Netanyahu confirmed that he agreed to the truce with Iran, claiming a “historic victory”. The UN nuclear watchdog has urged a rapid restart of inspections of Iran’s nuclear facilities, with The New York Times and CNN reporting that a preliminary assessment by US intelligence was that the recent strikes likely did not fully cripple Iran’s underground facilities and may delay its nuclear programme by less than six months. White House spokeperson Leavitt called the reporting “flat-out wrong” though.

Turning back to yesterday’s market moves, the key reason the market rallied so much was because lower oil prices (and hence lower inflation) are keeping the prospect of rate cuts in play this year. Indeed, futures priced in more rate cuts from the Fed in response, with the amount expected by the December meeting up +4.3bps on the day to 59bps. That’s the most rate cuts priced in six weeks, just before the US-China tariffs were slashed by 115 percentage points, which reassured markets that there wouldn’t be a downturn. This time around, lower inflation rather than growth fears have been the main driver of the repricing, and US Treasuries rallied strongly across the curve as a result. For instance, both the 2yr and 10yr yield hit their lowest level since early May, with the 2yr yield (-3.8bps) down to 3.83%, whilst the 10yr yield (-5.3bps) fell to 4.30%. That said, the decline in yields also gained considerable momentum from the Conference Board’s consumer confidence indicator, which unexpectedly fell to 93.0 in June (vs. 99.8 expected) with the share of responders who said that jobs were plentiful falling to their lowest level since the pandemic.

But even as markets were pricing in a growing chance of a rate cut this year, there was little sign of any rush from Fed Chair Powell in his latest testimony. He reiterated his message from last week’s press conference that they were “well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.” Looking forward, he also said that the tariff inflation would be evident in the June and July numbers, so that implicitly leant in favour of waiting until September before any further rate cuts. Meanwhile, Cleveland Fed President Hammack also said that it “may well be the case that policy remains on hold for quite some time”. She also said that “I would rather be slow and move in the right direction than move quickly in the wrong one.” Just after the European close NY Fed Williams' comments were similar to Powell’s with him saying that it was "entirely appropriate" to maintain the current policy stance and that it was still “early days” in terms of the impact of tariffs on inflation. Fed Governor Barr also struck a “wait and see” tone, noting the potential for “some inflation persistence” due to second-round effects.

Nevertheless, those more hawkish comments failed to halt the rally, as the market view was that the deflationary impulse from lower oil prices would bring about quicker rate cuts. So that provided a significant boost to equities on both sides of the Atlantic. The S&P 500 was up +1.11%, and tech stocks led the way as the NASDAQ advanced by a bigger +1.43% while the narrower NASDAQ 100 (+1.53%) reached a new record high. Meanwhile in Europe, the STOXX 600 (+1.11%) posted its biggest gain in six weeks, alongside fresh moves higher for the DAX (+1.60%) and the CAC 40 (+1.04%).

Staying in Europe, the German government yesterday agreed on a budget draft for 2025 as well as on benchmark budget figures for 2026-2029. According to our economists’ piece here, the fiscal package sends a strong signal: the government intends to lose no time in ramping up public investment in Germany’s defence and infrastructure.

While the medium-term fiscal plan is largely in line with their assumptions, the budget draft for 2025 implies greater front-loading of the fiscal stimulus than we expected. The government plans to spend more than EUR 200bn on defence and infrastructure this year, and to raise more than 3% of GDP in fresh debt to fund this investment spree. This implies a sharp fiscal easing in the second half of the year. Although it may be difficult to spend these funds in their entirety by the end of the year, the ambitiousness of the fiscal expansion should spur the recovery in private investment. There is near-term upside risk to growth from this. On this theme, yesterday’s Germany Ifo business climate indicator moved up to a one-year high of 88.4 in June (vs. 88.0 expected). Together with the stronger German PMIs on Monday, this adds to the sense of the new government’s policy shift translating into stronger business confidence.

While the German fiscal announcement had been substantially flagged in recent reporting, it still drove 10 yr German bund yields +3.7bps higher on the day, with the Italy-Germany spread (-5.5bps) seeing its biggest tightening in ten weeks. French OAT yields (+2.0bps on 10yr) also moved slightly higher amid news that its government is expected to face a no confidence vote in the next couple of days following a collapse of talks on pension reform.

With everything else going on, the US tax bill currently in the Senate has received less attention recently. However, President Trump reiterated his call yesterday for a quick passage, with the administration still trying to get it done by their July 4 deadline. In a post on Truth Social, Trump called on Senators to “lock yourself in a room if you must, don’t go home, and GET THE DEAL DONE THIS WEEK.” It’s already passed the House by a single vote, but both chambers have to pass the same version of the bill, so the revised version by the Senate would need to go back to the House for a vote. In terms of the latest timeline, Treasury Secretary Bessent suggested that House and Senate Republicans could reach agreement on the state and local tax deduction in the next two days, while Senate Majority leader Thune said he expects the Senate to start voting on the bill on Friday, setting up a potential weekend of votes. Beyond that, NEC director Kevin Hassett said that after the bill was passed, they’d be announcing trade deals with other countries, which comes with just two weeks now remaining until the July 9 deadline for the 90-day reciprocal tariff extension. Hassett said that “we’re very close to a few countries and are waiting to announce after we get the Big Beautiful Bill closed”.

In Asia calm seems to have broken out with the Hang Seng (+0.79%) the top performer so far this morning, with the CSI (+0.34%), the Shanghai Composite (+0.26%), and the Nikkei (+0.18%) also higher. The KOSPI (-0.10%) is slightly lower.

Early morning data revealed that Australia’s headline consumer price index inflation (+2.1% y/y) cooled more than anticipated in May (compared to +2.3% expected), marking its slowest pace in seven months. It decreased from the +2.4% recorded in April. Underlying inflation, as indicated by the annual trimmed mean CPI, increased by +2.4% y/y in May, down from +2.8% in April. This print indicated that underlying inflation is at its lowest level since November 2021, likely providing the RBA with more flexibility to further reduce interest rates. Consequently, our economists now expect the RBA to reduce rates by 25bps at its upcoming meeting on 8 July. Initially, we anticipated no changes in July, with a 25bp cut expected at the August meeting. We continue to foresee an additional 25bp cut in August, followed by another 25bp reduction in November. Thus, the only modification to our RBA outlook for this year is the inclusion of an additional cut in July. For further insights, please read our economists' perspective on RBA policy.

In Japan, a summary of opinions from the BOJ’s latest policy meeting suggested that some policymakers supported maintaining steady rates amid uncertainty regarding the effects of US tariffs on Japan’s economy. Some board members observed stronger-than-expected inflation, with one member proposing that the central bank may need to raise rates decisively despite the prevailing economic uncertainty.

To the day ahead now, and we’ll hear from Fed Chair Powell again at the Senate Banking Committee, as well as BoE Deputy Governor Lombardelli. Data releases include US new home sales for May, and France’s consumer confidence for June. Finally, it’s the second and final day of the NATO summit, with Trump joining for meetings with European leaders.