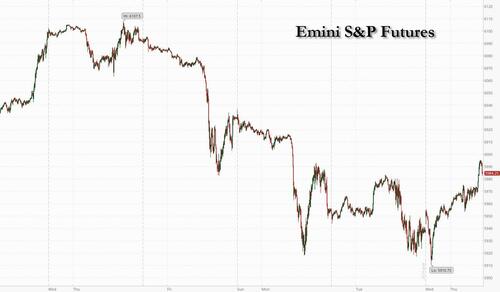

US equity futures rebounded strongly on the first trading day of 2025 after 4 straight days of losses, ending 2024 on a soggy note, thanks to - what else - a bounce in tech stocks, even as China suffered its worst start to a new year since 2016. Nasdaq 100 and S&P 500 contracts rallied by at least 1%, although gains eased modestly by 8:00am ET. All the Mag7 names traded higher (Nvidia (NVDA) +1.7%, Microsoft (MSFT) +1%, Alphabet (GOOGL) +1%, Amazon (AMZN) +1.4%, Meta Platforms (META) +1% and Tesla (TSLA) +1%). European energy shares outperformed after a sharp increase in natural gas prices. The euro fell to the weakest against the dollar in over two years. Treasuries and European government bonds gained. Bitcoin extended its rally to a third day. Macro data today includes initial and continuing jobless claims, as well as the Mfg PMI and construction spending.

In premarket trading, Mag7 names all gained pushing the Nasdaq more than 1% higher: Apple (AAPL) is little changed, Nvidia (NVDA) +1.7%, Microsoft (MSFT) +1%, Alphabet (GOOGL) +1%, Amazon (AMZN) +1.4%, Meta Platforms (META) +1% and Tesla (TSLA) +1%. Here are some other notable premarket movers:

US stocks are poised to snap a losing streak that took some shine off the S&P 500’s best two-year run dating back to the days of the Clinton administration. The index has surged more than 50% since the start of 2023, driven by the Mag7 tech megacaps amid enthusiasm about the boost to profits from artificial intelligence.

“At the beginning of the year, analysts tend to be pretty optimistic — you have pretty robust year-on-year earnings forecasts,” Daniel Morris, chief market strategist at BNP Paribas Asset Management, said on Bloomberg TV. “Even if we don’t quite get say 20% earnings growth for Nasdaq, the way analysts might suggest, if it’s only 15, likely markets will do well.”

Meanwhile, an attack on revelers celebrating New Year’s in New Orleans thrust US domestic security back into the spotlight less than a month before Donald Trump is sworn in as president. The FBI is probing that incident as well as the deadly explosion of a Tesla Cybertruck outside of Trump’s hotel in Las Vegas.

Going back to markets, investors will have some early 2025 economic data to process Thursday, including US jobless claims. In the months to come, the growth outlook in Europe and China, the Federal Reserve’s policy path and Trump’s agenda will be among the most pressing items on traders’ radars.

In Europe, the Stoxx 600 fell 0.2%, reversing earlier gains as auto and bank shares dragged. Energy stocks outperformed, tracking gas prices which rose to the highest since October 2023 as the transit deal between Russia and Ukraine expired on New Year’s Day, with no alternative in place.and as the region braced for freezing winter temperatures without Russian supplies delivered via Ukraine.

In Asia, sentiment was subdued, with Chinese equities leading declines as data pointed to a slowing economy and traders looked ahead to potentially higher tariffs. The MSCI Asia Pacific index fell as much as 0.6%, sliding for the 3rd day in the past four, and posting the biggest decline in nearly two weeks as key markets reopened after the New Year holiday, with TSMC, China Construction Bank and ICBC contributing the most to the drop. Chinese stocks had their worst start to the year since 2016, with the CSI 300 index closing 2.9% lower. The country’s manufacturing activity slowed in December, further raising concerns about a recovery for the continent’s largest economy. Stock benchmarks also fell in Taiwan and Hong Kong, while Australia’s climbed. Japanese markets are closed through Jan. 6 and New Zealand remains on holiday.

“As we position our funds into 1Q 2025, it just seems far more likely that downside risk is far greater than upside for China,” said Xin-Yao Ng, an investment director at abrdn Plc.

In FX, the Bloomberg Dollar Spot Index rose 0.1%, trading at session highs as the Euro plunged. The Aussie dollar is the best performer among the G-10’s, rising 0.5% against the greenback, while the pound fell 0.4%. However, all eyes are on the euro which tumbled to 1.031, the lowest since 2023. The euro’s slump against the greenback reflects concerns about European growth and monetary policy divergence with the US. There are concerns export-orientated European economies will be hit by US trade tariffs and expectations the European Central Bank will cut rates more aggressively than the Fed. Many strategists are forecasting a slide to parity with the dollar or even lower this year.

In rates, treasuries climbed, with US 10-year yields falling 5 bps to 4.52%, following similar moves across core European rates ahead of weekly jobless claims data at 8:30am New York time. Treasury yields are lower by 3bp to 4.5bp across maturities with gains led by intermediates, richening the 2s10s30s fly by around 2bp. Focal points include an expected raft of corporate bond issuance during January, with up to $200 billion of offerings expected. Bunds also rise, albeit to a lesser extent with German 10-year borrowing costs falling 3 bps.

In commodities, oil prices advanced, with WTI rising 1.4% to $72.70 after an industry report signaled US crude stockpiles continued to shrink. A report from the American Petroleum Institute showed inventories fell by 1.4 million barrels last week, which would be a sixth straight drop. Gold rose. Spot gold climbs $21 to $2,646/oz. Bitcoin rises above $96,000.

The US economic data calendar includes jobless claims (8:30am), December final S&P Global US manufacturing PMI (9:45am) and November construction spending (10am). December ISM manufacturing is ahead Friday. No Fed speakers are scheduled for Thursday. Barkin is scheduled to speak Friday at an event hosted by the Maryland Bankers Association

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

ASX 200 +0.5%; CSI 300 -3.1%; Hang Seng -2.2%; Nikkei 225 closed overnight. China's manufacturing PMI slowed to 50.5 in December from 51.5 in November, missing expectations. Capital Economics said that while the Caixin manufacturing PMI suggests that factory activity softened in December, wider economic momentum still looks to have improved thanks to faster growth in services and construction, and adds that increased fiscal support should continue to lift growth in the near-term given that deficit spending is likely to be front-loaded at the start of 2025. Ahead, Bloomberg writes that investors are anticipating further economic stimulus, especially amid concerns over potential tariffs from President-elect Trump's return to the White House.

Top Asian News

European bourses began the European session on a firmer footing, in contrast to a mostly negative APAC session; China considerably underperformed after the region’s poor Manufacturing PMI figures. Soon after the cash open, equities then gradually dipped lower with Europe now displaying a mostly negative picture, but without a clear catalyst. EZ Manufacturing PMI were revised a bit lower, but ultimately sparked little move in the complex. European sectors initially opened with a positive bias, but now display a mixed picture. Energy is the clear outperformer today, for two reasons; firstly, crude oil prices are a touch higher today, helping to prop up the likes of Shell and BP. Secondly, gas companies such as Saipem, and Eni both benefit from the strength in gas prices after Gazprom halted natgas supplies via Ukraine. Banks are found at the foot of the pile today, joined closely by Consumer Products; the latter weighed on by Luxury names, which is being hit following the poor Chinese Manufacturing PMI metrics overnight.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Welcome back, hope you all had a relaxing break, and Happy New Year. As it’s the start of the new year, we’ve just published our annual performance review for 2024 (link here), looking at how different assets performed over the year just gone. Overall, 2024 was another strong year for asset returns, with economic growth surprising on the upside and central banks finally beginning to cut rates. That meant the S&P 500 posted a total return of +25%, marking the first time since the late-1990s that we’ve had back-to-back annual returns above 20%. However, with rate cuts taking longer than expected, bonds struggled to gain traction. Indeed, the 10yr Treasury yield moved up for a 4th consecutive year for the first time since the 1980s. And with several lingering concerns around inflation and geopolitics, gold prices saw their biggest gain since 2010. See the report for a full recap of the year just gone.

So with 2024 out of the way, obviously all minds are now thinking about what’s going to happen in 2025. But don’t expect to get many clues today from the first trading day of the year. In fact, for the last 4 years, the first trading day has been a contrarian indicator, with the S&P 500 ending the year in the opposite direction it moved on the first day. For example, we began 2024 with three consecutive daily declines, before the index ended the year up more than +20%. By contrast, 2022 saw an all-time high on day one, before we then witnessed the S&P’s worst annual performance since 2008.

As we look forward to the year ahead, it’s also worth remembering that none of the last 5 years have exactly gone to plan or consensus in the macro sphere. 2020 was the best example of that, with the pandemic making the 2020 outlooks redundant by the end of Q1. And since then, the surprises have kept on coming. After all, the surge of inflation in 2021 surprised virtually everyone if you look back at consensus forecasts. Then in 2022, markets were caught completely off guard by the most aggressive rate-hiking cycle since the 1980s. By 2023, the consensus was then expecting a US recession that didn’t happen. And in 2024, the upside growth surprises continued, and the S&P 500 has just seen its strongest two-year performance since the late-1990s. For some thoughts on potential curveballs that could happen this year, Jim and I put out a chartbook last month looking at some positive and negative tail risks for 2025 (link here).

In terms of what the year ahead might bring, Q1 is set to bring several political events, including the inauguration of Donald Trump for a second term as US President on January 20. In addition, tomorrow will see the new session of Congress begin, where the Republicans will have a majority in both the House of Representatives and the Senate. So for markets and the economy, a big question will be how the new administration moves on new tariffs, and which countries they’re focused on.

Thus far, we’ve already seen markets react in response to Trump’s social media posts, having discussed new tariffs on China, Canada and Mexico. But it’s still an open question as to whether various deals might be reached with other countries to avoid higher tariffs, or whether they’ll get imposed, which in turn opens up the risk of retaliatory tariffs in response. So there’s the potential for a significant shift in global trade patterns, and we know from Trump’s first term that markets can be very reactive to any tariff news.

Staying on politics, on February 23 we’ve then got the German federal election taking place, which has been brought forward by several months following the collapse of the federal coalition last year. For investors, a key focus is on whether there might be any changes to the constitutional debt brake after the election, which in turn could enable a more expansive fiscal stance with more borrowing. But in economic terms, even if there is a change, any easing in the debt brake would more likely be a 2026 story, given that it normally takes a few months for a government to be formed after coalition negotiations, and it would then take time for those policies to be implemented. For more information, see our economist’s Germany outlook here.

In the meantime, central banks are set to stay in the spotlight in 2025. Over the course of 2024, most of the major central banks finally began to ease policy, with both the Fed and the ECB cutting rates by 100bps. Moreover, they’ve signalled that further rate cuts are ahead, with the Fed’s dot plot pointing to another 50bps of cuts this calendar year. But for both the Fed and the ECB, headline and core inflation rates are still lingering slightly above the 2% target, and we know that there are potential price pressures in the pipeline, not least from any new tariffs. So it’s going to be interesting to see if we do get the additional rate cuts that markets are pricing in, or whether this will be another year (as with the last three) where market expectations prove to be too dovish.

Elsewhere, the Bank of Japan are still moving the other way and normalising policy, with markets pricing in further rate hikes for this year. The BoJ was a big focus for markets in 2024, particularly around the summer, when their rate hike was a contributing factor to the unwinding of the yen carry trade and the significant turmoil in early August. So that’s an important story to keep an eye on, and whilst we’ve been away the 10yr JGB yield closed at its highest level since 2011 on December 27.

Otherwise, geopolitics will remain in focus, and another key story over the break has been that Russian gas has stopped flowing via Ukraine to Europe following the expiry of a transit deal. So this is a potential issue for central European countries in particular, who’ll have to find alternative supplies. Moreover, European natural gas futures closed at a one-year high on New Year’s Eve of €48.89/MWh. Now it’s worth bearing in mind that prices are still well beneath their levels seen throughout the entirety of 2022, but European gas storage ended 2024 at its lowest year-end level in three years, and the recent increase in prices is set to add further to inflationary pressures.

Overnight in Asia, 2025 hasn’t got off to a particularly good start in trading so far. Weak data hasn’t helped matters with China’s Caixin manufacturing PMI coming in softer than expected in December, at 50.5 (vs. 51.7 expected). Against that backdrop, the CSI 300 (11.56%), the Shanghai Comp (-1.21%) and the Hang Seng (-1.51%) have all seen clear declines this morning, whilst South Korea’s KOSPI (-0.22%) has also lost ground. Japanese markets remain closed until next week.

Those declines overnight come on the back of a clear risk-off move since Christmas. Indeed, the S&P 500 has lost ground for 4 consecutive sessions for the first time since September, falling -2.62% over that time. That’s been driven by losses among tech stocks, with the Magnificent 7 down by a larger -5.30%, which took some of the shine off a very strong overall performance last year. That said, futures are pointing towards a recovery this morning, with those on the S&P 500 (+0.41%) and the NASDAQ 100 (+0.58%) both advancing. Meanwhile in Europe, futures on the Euro STOXX 50 are up +0.53% this morning.

To the day ahead now, and data releases include the US weekly initial jobless claims, along with the December manufacturing PMIs from around the world. There’s also the Euro Area M3 money supply for November.