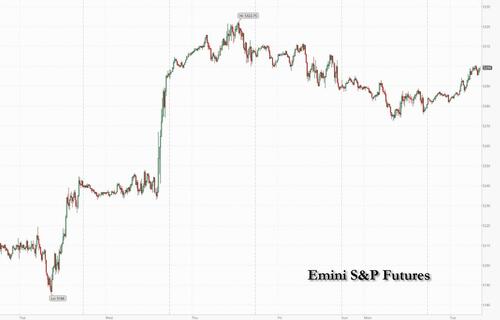

It's as if Monday's modest dip never happened: S&P futures are trading are higher, surpassing Monday's highs, with both Tech and small-caps outperforming, as investors keep a close eye on any potential market impact from the collapse of a major commuter bridge in Baltimore after it was rammed by a container ship. As of 8:00am ET, S&P futures were 0.4% higher, erasing Monday's 0.3% drop, while Nasdaq futures gained 0.5%. Europe's Estoxx 50 is similar, trading at multiyear high with utilities and financials outperforming. According to a JPM morning note, it is unclear if yesterday’s moves were tied to month-end/quarter-end rebalancing but generally those flows occur before the last day of the period. USD weakness continues as the yen just refused to drop no matter what; commodity performance is mixed with gold approaching ATHs and oil trading at a 5 month high. Today’s macro data calendar is busy with focus on Durable/Cap Goods, Home price indices, Consumer Confidence, and regional activity indicators (Dallas, Philly, and Richmond); we also get a $67BN 5Y bond auction; let’s see if it goes as smoothly as yesterday’s 2Y auction.

In premarket trading, both Mag 7 and Semis are higher (as usual) with TSLA +3.2%. USD weakness continues but commodity performance is mixed with gold approaching ATHs. Shares of Donald Trump’s social media startup surged around 20% in premarket trading after it completed a merger with Digital World Acquisition Corp. Tesla climbed 3%, set to extend gains for a second consecutive session. Italian newspaper Il Sole 24 Ore reports that officials at the country’s Industry Ministry contacted the company about potential production of electric trucks. Here are some other notable premarket movers:

As Bloomberg notes, concern about a disconnect between earnings expectations and share prices has grown this week. US durable goods and consumer confidence data are due today ahead of the government’s closely followed personal consumption expenditures price index on Friday when many markets will be closed for Easter holidays. Federal Reserve Chair Jerome Powell is also due to speak the same day.

For Vincent Juvyns, global market strategist at JPMorgan Asset Management, better visibility on the economy means that that focus is turning back to earnings going into the second quarter. “Markets are expensive, not too expensive, but it would be dangerous to bet on further upside without earnings driving it,” he said.

As has been the case for the past 18 months, bearish Morgan Stanley and JPMorgan strategists - Michael Wilson and Marko Kolanovic - were the latest to warn that lofty valuations will be hard to justify if they’re not accompanied by an acceleration in company profits. Or, as we said in Jan 2023, the rally won't end until they finally throw in the towel and turn bullish. Meanwhile, the S&P 500 is up almost 10% this year on a combination of healthy US economic data, Fed rate-cut wagers and optimism about artificial intelligence.

Meanwhile, the Financial Times cited Chief Investment Officer Andrew Balls as saying Pimco is holding a smaller-than-usual position in US Treasuries and prefers the bonds of countries such as the UK and Canada. Pimco believes inflationary pressures may lead the Federal Reserve to cut interest rates more slowly than other major central banks, according to the report.

European stocks also rose, with Stoxx 600 gaining 0.4%, even as miners slumped after iron ore futures tumbled over deepening anxiety regarding Chinese demand. Consumer products and services also underperformed, while the travel and leisure and banking sectors lead the regional index. Among individual stock moves in Europe, A.P. Moller-Maersk A/S fell after the shipping giant said that it chartered a container vessel that hit the Francis Scott Key Bridge in Baltimore on Tuesday. Ocado Group Plc rose after sales at its online grocery business got a boost from price cuts, while BNP Paribas SA gained after Goldman Sachs Group Inc. upgraded the French bank to a buy rating thanks to a better operating backdrop. Here are the most notable European movers:

Earlier in the session, Asian stocks were mixed, as Korean stocks rallied and Hong Kong equities erased earlier gains, with the regional benchmark poised for a second quarterly advance. The MSCI Asia Pacific Index was little changed, erasing a gain of as much as 0.5%. South Korea’s Kospi headed for its highest close in almost two years as foreign investors bought local chip stocks following US memory maker Micron’s surge.

Stocks in Hong Kong and mainland China erased earlier gains. Elsewhere, Japanese equities fluctuated as the weak yen supported exporters but prompted warnings from officials. Australian and New Zealand stocks declined. Australia's ASX 200 declined as tech losses clouded over the outperformance in the energy sector, while weaker Consumer Confidence added to the glum mood.

In FX, a gauge of the dollar fell for the second straight session and front-end Treasuries rose ahead of a string of US economic data. The Bloomberg Dollar Spot Index dropped 0.1%, while front-end Treasuries rose; two-year yields dropped 4bps to 4.59%

In rates, treasuries were richer by up to 2bp across long-end of the curve, led by bigger gains in gilts as traders look past comments from BOE’s Mann who said markets are pricing in too many interest-rate cuts this year. 10-year TSY yields are richer by around 1.8bp on the day at 4.23% with gilts outperforming by 3bp in the sector; long-end outperforms slightly over the session, with 5s30s near lows of the day and flatter by 1bp vs Monday’s close. The US session has packed data slate headed by durable goods orders and consumer confidence. Auction cycle continues with $67 billion 5-year note sale. The holiday-accelerated auction cycle resumes with $67b 5-year note sale at 1pm, follows 0.5bp tail for 2-year sale on Monday. This week’s sales conclude with $43b 7-year Wednesday

In commodities, oil was little changed after the biggest gain in a week, with OPEC+ set to affirm its policy of production cuts amid tensions in the Middle East and Russia. Gold hovered near a record high.

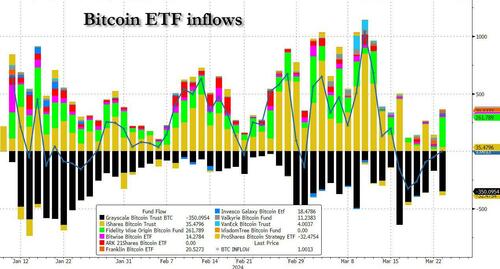

Bitcoin holds above $71k, with Ethereum now back above $3.5k. On Monday, spot bitcoin ETFs registered inflows totalling USD 15.4mln on Monday, ending a five-day run of outflows.

Looking at today's calendar, the US economic schedule includes March Philadelphia Fed non-manufacturing activity and February durable goods orders (8:30am), January FHFA house price index, S&P CoreLogic home prices (9am), March consumer confidence and Richmond Fed manufacturing index (10am) and March Dallas Fed services activity (10:30am); no Fed speakers scheduled.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were choppy after a similarly subdued handover from Wall St owing to early tech headwinds and ahead of month-end. ASX 200 declined as tech losses clouded over the outperformance in the energy sector, while weaker Consumer Confidence added to the glum mood. Nikkei 225 swung between gains and losses amid an indecisive currency and inconclusive Services PPI data. Hang Seng and Shanghai Comp. saw two-way price action with earnings releases in focus, while the mainland failed to sustain early optimism from the PBoC's more forceful liquidity operation.

Top Asian News

European equities, Stoxx600 (+0.1%), began the session without direction, though caught a bid alongside strength in US equity futures; however, the FTSE 100 (-0.1%) lags, given the underperformance in the Basic Resources sector. European sectors hold a negative tilt; Banks is found at the top of the pile, propped up by BNP Paribas (+1.9%), which benefits from a broker upgrade. Basic Resources is hampered by broader weakness in base metals. US equity futures (ES +0.3%, NQ +0.4%, RTY +0.4%) are entirely in the green, attempting to pare back some of the weakness seen in the prior session.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I'll be off skiing on Friday, although with the forecast and recent lack of snow it may as well be water skiing. It felt like the market had left for their hols early yesterday as we started what is an Easter shortened week. The most interesting theme of the day was a steady but notable global rates sell-off that, for example, wiped out nearly half of last week's -10.8bps fall in 10yr UST yields. There was no obvious catalyst so maybe thin trading played a part? As we'll see below, there was a little hawkishness in the Fed speak but the moves were steady through the day rather than directly related to any headlines.

10yr US yields closed +4.7bps higher at 4.25% with 2yrs +3.6bps at 4.63%. Markets also trimmed the amount of Fed rate cuts they are expecting this year by -4.7bps to 80bps. We also saw the expected probability of a June cut fall to 79%, down from nearly 86% at the peak last week. It was real yields that drove the sell-off, with the 10yr real yield up +5.9bps after falling for the previous four sessions. The yield increases levelled off following a decent 2yr auction. Bonds totaling $66bn were issued 0.5bps above the pre-sale yield, but with the indirect bidder share reaching its highest level since June. We still have $110bn in Treasury supply to come this week, with a record $67bn 5yr auction later today, so something to keep an eye on.

The rates and yield sell-off was seen across the board with the amount of ECB cuts priced by December coming down -6.1bps to 88bps, with 2yr and 10yr German bund yields climbing +5.6bps and +4.9bps, respectively. The sell-off was marginally larger for 10yr OATs (+5.0bps) and Gilts (+6.0bps).

There was some Fed speak of note with a little caution expressed regarding expectations of Fed cuts. Atlanta Fed President Bostic repeated weekend remarks that he now expected only one rate cut this year (versus two before), suggesting the Fed could be patient if the economy was holding up. Meanwhile, Chicago Fed President Goolsbee said he continued to see three rate cuts in 2024 but highlighted the need to see housing inflation moderate more. And Fed Governor Cook noted that “fully restoring price stability may take a cautious approach to easing monetary policy”. While being mostly consistent with Powell’s narrative last week, these comments underlined the upward narrowing of end-2024 rate expectations we saw in the FOMC dot plot last week (even as the median dot was unchanged at three cuts).

We also heard from a number of ECB officials over in Europe, including the ECB’s Panetta, a known dove, who remarked “ EU inflation [was] quickly falling towards the 2% target”, with the inflation decline allowing “for possible cut in rates.” We also heard from the ECB’s Chief Economist Lane, who reiterated that “we’re seeing good progress on inflation” and was “confident wage normalisation process is on track.” Although relatively dovish, these comments did nothing to suggest that an ECB rate cut could come any earlier than June, which appears to be the baseline based on other recent ECB commentary.

Equity markets had a quiet session with the S&P 500 starting the week on the back foot (-0.31%), and with similar moves in the Dow Jones (-0.41%) and the Nasdaq (-0.27%). The last two sessions have seen the narrowest trading ranges for the S&P 500 since early February, with only one of its 24 industry groups seeing a move of more than 1% yesterday (-1.06% for software & services).

The Magnificent Seven (-0.22%) outperformed marginally even as it was reported that Apple (-0.83%), Alphabet (-0.46%) and Meta (-1.29%) could be at risk of significant fines in the EU amid a new investigation into the firms’ compliance with the Digital Markets Act. The Act looks to restrict the dominance of the biggest online platforms and came into effect earlier this month. Nvidia (+0.76%) managed to secure its sixth day of consecutive gains but the Philadelphia Semiconductor Index fell -0.34% amid a Financial Times report that China had adopted new guidance to limit the use of US-made semiconductors, including those produced by Intel (-1.74%) and AMD (-0.57%), in government computers. Over in Europe, the STOXX 600 (+0.04%) moved sideways, while the German Dax (+0.30%) hit a fresh all-time high.

Credit markets saw a mixed day, with high-yield spreads narrowing in Europe but US IG (+2bps) and high-yield (+4bps) spreads widening modestly after reaching two-year lows last Thursday. On this topic, my credit strategy team have revised their spread targets for US and Europe tighter. You can read more here.

Asian equity markets are fairly quiet this morning with the KOSPI (+0.83%) leading gains powered by chipmaking stocks. TheHang Seng (+0.30%) has bounced after the lunch break but the Shanghai Comp (-0.58%) is struggling after a second day of a stronger Yuan fix. 10yr US yields are a basis point lower with S&P (+0.16%) and Nasdaq (+0.19%) futures both higher.

The limited US data releases yesterday were slightly on the softer side. The Dallas Fed manufacturing index for March came in at -14.4 (vs -10.0 expected), down from -11.3 in February. New home sales were unexpectedly down in February, falling from 664k to 662k (vs 677k expected). On the other hand, the Chicago Fed national activity index improved to 0.05 (vs -0.34 expected), continuing to oscillate around trend levels.

Now to the day ahead. In terms of data, we have the US March Conference Board consumer confidence, the Richmond Fed manufacturing index and business conditions, the Philadelphia Fed non-manufacturing activity, the Dallas Fed services activity, the February durable goods orders and the January FHFA house price index. Outside the US, we have Germany GfK consumer confidence. Lastly, we have a record $67bn US 5yr notes auction.