US equity futures flipped between gains and losses on Wednesday while European stocks hit an all time high as May’s rally in equities continued amid a clutch of solid earnings reports. As of 7:45am, S&P 500 futures traded down 0.2%, and was near session lows reversing an earlier modest gain after the underlying gauge advanced the previous four sessions. The benchmark Treasury yield rose two basis points to 4.48%. Oil fell to the lowest level since mid-March, after a mildly bearish US stockpile report. The renewed plunge in the yen took the USDJPY as high as 155.5 amid a renewed bout of impotent jawboning by Japanese officials who however have now lost all credibility. Later today the focus will be on comments from Fed officials, including Lisa Cook, and earnings from Uber, Arm and Airbnb.

Among notable premarket movers, Lyft shares rose after the ride-hailing firm’s results and outlook beat estimates. Reddit rises 13% after the social-media company reported first-quarter results that beat expectations and gave an outlook that surpassed estimates even though there is no way in hell the company can ever achieve that forecast but at least it will enjoy a higher stock price for a few months. Here are some other notable premarket movers:

Investors saying goodbye to Q1 earnings season and enjoying a 3% S&P 500 rally in May are now uncertain what comes next, as US policymakers signal bets on a pivot to easier policy may be premature. Minneapolis Fed president Neel Kashkari said it’s likely the central bank will keep rates where they are “for an extended period of time" although Neel is best known for always being wrong about everything so taking the other side my seem prudent.

“We are now crawling through the tail end of earnings season and the market is lapsing into complacency,” said Hugh Grieves, fund manager of the Premier Miton US Opportunities fund. “The economy is ‘okay,’ rate cuts remain on the table and the oil price is declining. Unfortunately that’s not a stable equilibrium.”

The Fed’s stubborn hawkish stance as a result of even more stubborn inflation has put it out of sync with central banks in Europe that have already embarked on easing. Earlier Wednesday, Sweden’s Riksbank kicked off its rate cutting cycle, easing policy for the first time in eight years. That followed the Swiss National Bank’s decision to leapfrog peers with an interest rate cut in March. Meanwhile, Fed Governor Lisa Cook is due to speak later Wednesday.

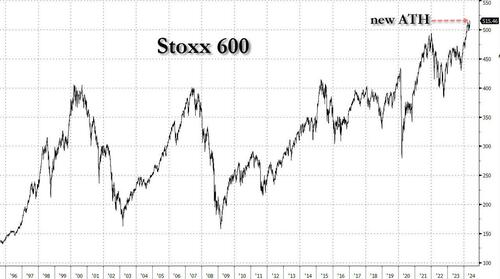

Europe's Stoxx 600 rose 0.4%, sending European stocks rise to a record high after another batch of strong corporate earnings including sold results from Siemens Energy (for once).

Elsewhere, strong earnings from AB InBev lift food and beverages, which leads gains among sectors, while auto stocks and miners lag, with BP notching a second day of losses. Here are the most notable European movers:

“Right now we’re seeing the broadening of performance, especially from the earnings perspective,” Nataliia Lipikhina, head of EMEA equity strategy at JPMorgan Private Bank, said in an interview on Bloomberg TV. “The market wanted to see that earnings in different sectors, not just tech, are delivering.”

Earlier in the session, stocks in Asia were set to halt a four-day winning streak as focus shifted to earnings to validate a recent rally. The MSCI Asia Pacific Index slipped as much as 0.9% after closing at a two-year high in the previous session. Japanese tech firms Sony and Nintendo were among the biggest drags to the gauge, with the latter dropping more than 5% on weak outlook. The country’s benchmarks fell more than 1% in the region’s worst performance. Chinese onshore benchmarks posted their first decline this week amid a warning from Morgan Stanley strategists that the recent rally is likely to abate. Hong Kong stocks also fell. Index heavyweights Tencent and Alibaba are among key tech firms to release earnings next week, and the results will be crucial for the rally to resume.

In FX, the Swedish krona is among the worst performing G-10 currencies, falling 0.4% versus the greenback after the Riksbank cut its benchmark interest rate for the first time in eight years and said it could be reduced twice more in the second half of 2024. The yen weakens 0.5% against the dollar, with USD/JPY around 155.50.

In rates, treasuries were slightly cheaper across the curve with losses led by intermediate- to long-end sectors, steepening curve spreads. US long-end yields are cheaper by 2bps, steepening 2s10s spread by 1.5bp, 5s30s by 0.5bp; the 10-year is around 4.48% with bunds lagging by 1.5bp in the sector amid new record high for Europe’s Stoxx 600 Index after another batch of strong corporate earnings. Supply concession is also a factor for Treasuries with 10-year note sale later Wednesday and 30-year bond auction Thursday. Indeed, the week's refunding auction cycle continues at 1pm New York time with $42b 10-year new issue one day after Tuesday’s 3-year note sale drew good demand, stopping through by 0.3bp. WI 10-year yield at around 4.48% is 8bp richer than April’s, which tailed by 3.1bp in a poor result.

In commodities, oil prices decline, with WTI falling 1.6% to trade near $77.20. Spot gold drops 0.1%.

Looking at today's calendar, the US economic data slate includes March wholesale inventories (10am). Fed members’ scheduled speeches include Jefferson (11am), Collins (11:45am) and Cook (1:30pm) From central banks, the Riksbank was the latest western bank to commence an easing cycle cutting rates to 3.75%. Finally in the US, a 10yr Treasury auction is taking place.

Market Snapshot

Top Overnight News

Earnings

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower after the choppy US performance and in the absence of fresh catalysts. ASX 200 lacked firm direction with gains in industrials and energy offset by weakness in miners and financials. Nikkei 225 underperformed as participants digested earnings including disappointing guidance by Nintendo. Hang Seng & Shanghai Comp were ultimately lower amid trade and tech-related frictions after the US revoked export licences that allowed Intel (INTC) and Qualcomm (QCOM) to supply Huawei with semiconductors.

Top Asian News

European bourses, Stoxx600 (+0.3%) are almost entirely in the green, with indices initially opening tentatively around the unchanged mark before picking up gradually to session highs throughout the morning. European sectors are mixed, with Food Beverage and Tobacco at the top of the pile, lifted by post-earning strength in AB InBev (+4.4%). Basic Resources is the clear underperformer, given the weakness in underlying metals prices; Autos are also hampered by poor BMW (-4.5%) results. US Equity Futures (ES U/C, NQ U/C, RTY -0.3%) are mixed and trading with little direction, continuing the tentative price action seen in the prior session. Apple (+0.6% pre-market) gains amid reports that its China iPhone shipments rose 12% in March.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Fed speakers

DB's Jim Reid concludes the overnight wrap

As summer finally threatens to arrive here in London, even if I'm looking out on fog this morning as I type, markets continued their advance yesterday, with the risk rally continuing post what was deemed to be a very dovish payroll print last Friday. As recently as April 25th, 10yr yields peaked at 4.735% intra-day but a -28bps rally to 4.46% has come alongside a more optimistic view on rate cuts this year again. Obviously Fed Chair Powell helped this by playing down the prospect of further rate hikes at last week’s FOMC. 10yr yields have rallied around 24bps since their peak on FOMC day and yields have now fallen for a 5th consecutive session. That’s the longest run of declines since August.

Those moves on the rates side supported risk assets too, with the STOXX 600 (+1.14%) and the FTSE 100 (+1.22%) both hitting a new record yesterday as UK equities resumed trading after the holiday. The advance was more moderate in the US, but the S&P 500 (+0.13%) still posted a 4th consecutive advance despite underperformance from tech stocks. It now means the S&P has posted its strongest 4-day rally since November, having risen by +3.37% since the close last Wednesday after Powell’s press conference. Moreover, it’s worth noting that the equal-weighted S&P 500 managed to post a stronger +0.28% gain, since the Magnificent 7 (-0.50%) dragged down the rest of the index amidst larger declines from Tesla (-3.76%) and Nvidia (-1.72%). Otherwise, Disney (-9.51%) was a standout after their earnings release, and was the second-worst performer in the S&P 500 yesterday.

Asian markets are running out of a bit of steam this morning though with the Nikkei (-1.43%) the biggest underperformer across the region, slipping from multi-week highs while the CSI (-0.66%), the Shanghai Composite (-0.41%), the Hang Seng (-0.16%) and the KOSPI (-0.12%) are all lower. US stock futures are pretty much flat though with Treasury yields back up 0.5bps-1.5bps across the curve.

In FX, the J apanese yen continues to struggle trading -0.29% lower at 155.16 versus the dollar despite the B OJ Governor Kazuo Ueda stating that the central bank may take appropriate monetary action if yen moves significantly impact Japan’s inflation. Nothing particularly new in those comments but the government's popularity is also under pressure over the weak currency and cost of travelling to, and importing from, abroad. Trade figures for April are out tomorrow.

Back to markets and one asset that continues to struggle is oil. Brent Crude was down another -0.35% to $83.04/bbl yesterday and is trading down at $82.74 this morning. We peaked above $92 in the second week of April after Middle East tensions ramped up. This reversal has been supportive for the broader market, since its helped to ease fears about more persistent inflation. For instance, US 5yr inflation swaps were down another -0.8bps yesterday to 2.49%. This is the first time since March that they’ve closed beneath 2.5%, having fallen for 7 of the past 8 sessions.

We’ll have to wait another week for the next US CPI release and the latest on inflation, but in the meantime, and as discussed at the top, sovereign bonds posted a fresh rally on both sides of the Atlantic yesterday. In the US, that saw yields on 10yr Treasuries (-3.0bps) decline to 4.46%, whilst 2yr yields were -0.2bps to 4.83%. 2yr yields had been as low as 4.80% intra-day, with a modest rise later on in part following some hawkish comments from Minneapolis Fed President Kashkari (a non-voter this year). He said in a blog post that “ with inflation in the most recent quarter moving sideways, it raises questions about how restrictive policy really is.” But Kashkari was already one of the most hawkish-sounding members on the FOMC, so the comments have to be taken in context. Year-end Fed pricing was unchanged on the day, with 44bps of cuts priced in.

Over in Europe, the focus continued to be on the ECB, with anticipation mounting that they’ll cut rates at their next meeting in 4 weeks’ time. That contributed to a fresh rally for sovereign bonds, with the 10yr bund yield (-4.9bps) falling for a 4th consecutive day to 2.42%. That was echoed across the continent, with yields on 10yr OATs (-5.2bps) and BTPs (-2.9bps) also moving lower, whilst those on 10yr gilts (-9.9bps) saw a larger decline as they caught up with the previous day’s moves.

There wasn’t much other data yesterday, although we did get the UK construction PMI for April, which hit a 14-month high of 53.0 (vs. 50.4 expected). By contrast, in Germany the construction PMI fell to 37.5, whilst the factory orders data for March contracted by -0.4% (vs. +0.4% expected). So some negative news after what have been more encouraging recent growth data for Europe’s largest economy of late. Finally, Euro Area retail sales were up +0.8% in March (vs. +0.7% expected).

To the day ahead, and data releases include German industrial production and Italian retail sales for March. From central banks, the Riksbank will be making its latest decision, and we’ll hear from Fed Vice Chair Jefferson, the Fed’s Collins and Cook, and the ECB’s Wunsch and De Cos. Finally in the US, a 10yr Treasury auction is taking place.