US equity futures are higher led by tech names after blowout earnings reported by Nvidia - which as Goldman reminds us "is now #5 weight in the S&P and the poster child for “AI” Euphoria + momentum" - whose stock is up almost 30% premarket and rapidly approaching $1 trillion in market cap. S&P futures were up 0.6% to 4,151 with Nasdaq 100 futures up a whopping 2% led higher by NVDA and semi stocks. Bond yields are slightly higher, while USD is stronger. Commodities are mostly lower as WTI fell 1.5% reversing all of yesterday's gains after Russia played down the likelihood of OPEC+ cutting production further.

In premarket trading, Tech stocks are surging boosted by NVDA which reported after the bell yesterday with forecast beat; stocks is up almost 30% after close. For some context, NVDA added > $200bn in market cap overnight post earnings and as Goldman notes, "this might be the best TMT earnings print we've seen since that June qtr 2020 print from Zoom (ZM), when they beat revs by ~62%." In any case, it’s another sign that investors are willing to pile into promising tech stocks, despite the growing worries about China’s economy and a potentially catastrophic US debt default.

“If you look at tech it continues to reinvent itself over and over,” Larry Adam, chief investment officer at Raymond James, said in an interview on Bloomberg Television. “I continue to like the big tech names.”

Here are some other notable premarket movers:

In other overnight news, Fitch put US’s AAA rating on negative watch amid debt ceiling concerns, and this morning DBRS echoed the move when it "Placed United States Ratings Under Review With Negative Implications." McCarthy signaled some progress being made on the negotiation, but representatives are not required to stay in DC over the holiday weekend. Meanwhile, JPM sees the odds of passing x-date without an increase in the ceiling index is now around 25% and rising.

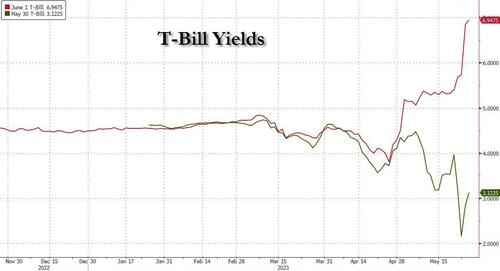

Elsewhere, Treasury-bill yields slated to mature early next month surged above 7% on Wednesday, with the rate on the June 1 and June 6 maturities increasing by more than a percentage point. Those securities are seen as most at risk of non-payment if the government exhausts its borrowing capacity. On Thursday morning, Bills maturing on June 1 traded just around 7%.

“Nvidia was last night’s good surprise,” said Gilles Guibout, head of European equity strategies at Axa Investment Managers. “But more broadly, there are few reasons for the market to keep rising: interest rates are not going down, global economic growth isn’t rebounding, full-year earnings are seen flat and stock valuations are already at a decent level.”

European markets were propped up by chipmakers after sales guidance from Nvidia smashed expectations - shares in the US semiconductor maker are up ~28% in the premarket. The Stoxx 600 is up 0.1% after touching a seven-week low on Wednesday. Here are some of the most notable European movers:

Earlier in the session, Asian stocks were mostly lower with the region cautious after the losses on Wall Street due to debt ceiling fears. The MSCI Asia-Pacific index closed 0.8% lower for the day as sentiment around Chinese markets continued to worsen. The Hang Seng Index shed 1.9% on the day and the yuan broke through the closely-watched 7-per-dollar level. The key worry for investors is that China’s economy is losing momentum and there are persistent financial troubles in the real estate industry. Recent data suggest gross domestic product growth this year will be closer to the government’s target of about 5%, contrary to expectations of a large overshoot formed earlier in the year. The Hang Seng was pressured with underperformance in Hong Kong after the benchmark index slipped beneath the 19,000 level.

In FX, the Bloomberg dollar index climbed for a fourth day, boosted by rising US yields and more-averse trading conditions after Fitch Ratings on Wednesday said it may downgrade the US’s AAA credit rating; the kiwi is the weakest of the G-10 currencies. The USD/JPY was little changed at 139.49, holding near 139.70 hit in earlier trade, its highest since late November.

In rates, treasuries are lower with the US 10-year yield rising 1bps to 3.76% ahead of GDP and claims data. The yield on two-year Treasuries rose 4 basis points to 4.42%, its highest since March; traders are pricing in a nearly 50% chance that the Fed will raise rates by 25 basis points next month; 10-year yields sit around 3.76%, with gilts trading cheaper by 10bp in the sector as rate-hike premium increases further in sterling swaps. A late Wednesday announcement that Fitch placed US credit on “rating watch negative” elicited limited market reaction. The US auction cycle concludes with $35b 7-year note sale at 1pm, following strong demand for 2- and 5-year sales. WI yield around 3.790% is ~25bp cheaper than last month’s, which tailed by 1.3bp.

Meanwhile, UK government bonds led losses in Europe. Traders added to bets the Bank of England will keep raising interest rates after an unexpectedly strong reading of UK inflation Wednesday. Money markets are now pricing more than 100 basis points of additional tightening by December.

In commodities, WTI declined 1.3% to trade near $73.40 on Thursday after the dollar strengthened and Russia played down the likelihood of OPEC+ cutting production further. Billionaire mining investor Robert Friedland says the copper market weakness is temporary. Southwestern Energy is among the most active resources stocks in premarket trading, falling 4.6%.

Bitcoin is lower but holding above the $26k mark despite briefly dropping below in early trade, with the USD capping upside and broader marks still focused on the debt ceiling as we near the US long weekend.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, the second estimate of Q1 GDP, pending home sales for April, and the Kansas City Fed’s manufacturing index for May. Central bank speakers include the Fed’s Barkin and Collins, ECB Vice President de Guindos and the ECB’s Nagel, Villeroy, Centeno and De Cos, along with the BoE’s Haskel.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly lower with the region cautious after the losses on Wall St owing to debt ceiling fears and after the FOMC Minutes showed officials were split on support for more hikes, while Fitch placed the US AAA sovereign rating on Rating Watch Negative despite several optimistic comments from House Speaker McCarthy. ASX 200 weakened as the commodity-related sectors led the broad declines across nearly all industries and with sentiment also dampened as households are set to pay hundreds of dollars more each year after the energy regulator approved an increase of up to 25% in electricity bills. Nikkei 225 was kept afloat but with the upside capped in the absence of any major positive drivers. KOSPI was subdued after the BoK rate decision in which the central bank kept rates unchanged as expected, although 6 out of the 7 board members saw the need to keep the door open for one more rate hike. Hang Seng and Shanghai Comp. were pressured with underperformance in Hong Kong after the benchmark index slipped beneath the 19,000 level, while the mainland was lacklustre amid recent US-China frictions.

Top Asian News

European bourses are mixed after initial pressure on a negative German GDP revision, DAX 40 -0.2%; though, tech is the standout outperformer post-NVDA, with Euro Stoxx 50 +0.3% as such. Stateside, the NQ +1.9% and ES +0.7% are firmer, given Nvidia, while the RTY and YM reside in negative territory amid broader market concern over the debt ceiling and after Fitch's update. Nvidia (NVDA) Q1 23 (USD): Adj. EPS 1.09 (exp. 0.92), revenue 7.19bln (exp. 6.52bln). Q2 23 revenue view 11bln (+/- 2%) (exp. 7.18bln). CFO said that the data centre revenue rise in the quarter is led by growing demand for generative AI and large language models using GPUs. +24% in pre-market trade. Swiss government to commence consultation on liquidity backstop of all systemically important banks, according to the Finance Ministry; SNB's Maechler says Credit Suisse (CSGN SW) crisis was one of confidence.

Top European News

FX

Fixed Income

Commodities

Debt Ceiling Headlines

Geopolitics

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Given it’s our AI week, it’s appropriate that one of the world’s largest chipmakers Nvidia reported earnings last night, which included an outlook far above expectations thanks to demand for AI processers. They said that revenue in the three months ending July was expected to be $11bn, which was well above analysts’ estimates for $7.18bn, and their shares were up by around 25% in after-hours trading. That’s given a massive boost to other chipmakers too, and futures for the NASDAQ 100 are up by +1.39% this morning. For instance in Tokyo, shares in the equipment supplier Advantest are up +15.58% this morning, whilst the memory-chip maker SK Hynix is up +4.50% in Seoul.

Although AI could prove to be a turning point, elsewhere actually saw markets slump again yesterday as fears ramped up on several fronts. The biggest issue right now is the US debt ceiling, where there’s still no sign of a resolution, even though we might be as little as a week away from the Treasury being unable to pay its bills. On top of that, there was a very strong UK inflation print, which brought back fears that more persistent inflation was still on the cards and central banks would need to keep hiking rates to deal with that. And the other data from the last 24 hours was also pretty weak, such as the Ifo’s business climate indicator from Germany that saw its biggest monthly decline since September. All this led to another combined bond-equity selloff, with the S&P 500 down -0.73%, whilst yields on 10yr Treasuries were up +5.0bps to 3.74%.

For now at least, the focus is still very much on the debt ceiling, where there are several signs of growing market stress around the X-date. In terms of the latest news, there wasn’t anything particularly promising, with Speaker McCarthy saying to reporters that “there are a number of places where we are still far apart”. He noted later on that he thinks “we have time to get an agreement”, and said it could happen over the weekend, but thus far there haven’t been any tangible signs of progress. After the US close, we then heard from the credit rating agency Fitch that they’d placed the US’ AAA rating on “Rating Watch Negative”. Whilst their base case was that a deal would be reached, they said that the move was down to “increased political partisanship” and reflected growing risks that “the government could begin to miss payments on some of its obligations.”

The lack of any agreement (or even signs of one) has meant that market stress around the X-date has only continued to rise, with front-end T-bills around the debt ceiling now yielding well above 6%. For instance, the bill that matures on June 1 saw its yield surge by +111bps yesterday to 6.84%, and the bill maturing on June 6 is now at 6.68% (+65bps yesterday). The effects of that are increasingly being felt further out the curve as well, with the 3-month yield (+10.1bps) closing at a post-2001 high yesterday of 5.33%.

Those bond losses driven by the debt ceiling were also interacting with a very strong upside surprise in UK inflation earlier in the day, which showed headline CPI at +8.7% in April (vs. +8.2% expected). That was above every economist’s expectation on Bloomberg, as well as the +8.4% projection from the BoE a couple of weeks ago. Furthermore, core CPI rose to its highest level since 1992, at +6.8% (vs. +6.2% expected). The reading added to fears that inflation was becoming entrenched, which led investors to rapidly dial up their expectations for rate hikes from the BoE. For instance, further 25bp hikes are now fully priced in for the next two meetings in June and August, whilst terminal rate pricing has also surged, with the peak rate seen by the December meeting standing 92bps above current levels.

Whilst it was just the UK that had a strong inflation print yesterday, investors responded by dialling up the chances of rate hikes more broadly. And those moves then got further momentum thanks to a speech from Fed Governor Waller, who signalled a clear openness to another hike in June, saying that “I do not support stopping rate hikes unless we get clear evidence that inflation is moving down towards our 2 percent objective.” He framed the options around hiking, skipping, or pausing, suggesting that there was thought being given to the idea of skipping a hike in June ahead of another hike in July. Atlanta Fed President Bostic later reiterated his preference for both a near term pause and for no rate cuts until “well into 2024.” In response, investors dialled up the chances of a hike by July, with futures now putting the chance at 66% this morning, which shows how this is now being seriously considered by market participants. Looking further out, the rate expected by the December meeting also hit a post-SVB high of 4.83% by the close yesterday, and this morning that’s risen further to 4.86%, which just shows how investors are increasingly pricing out the chances of rate cuts this year.

With another upside surprise on inflation and hawkish rhetoric from officials, sovereign bonds sold off on both sides of the Atlantic. UK gilts were at the epicentre of this, with the 2yr gilt yield ending the session up by a massive +23.7bps, taking it up to its highest level since September 27, just after the mini-budget that triggered market turmoil. Likewise, the 10yr yield was up +5.6bps to its highest level since October. In the US, yields on 10yr Treasuries were up +5.0bps to 3.74%, which is their highest level since the SVB collapse, and in Europe yields on 10yr bunds (+0.3bps), OATs (+0.9bps) and BTPs (+1.7bps) all moved higher as well. Overnight, 10yr Treasury yields have seen a further +0.8bps increase to 3.75%.

The deteriorating global backdrop also led to a bad day for equities, with the S&P 500 (-0.73%) losing ground for a second day running amidst broad-based declines. Over in Europe the losses were even more severe, with the STOXX 600 (-1.81%) seeing its worst daily performance since March 15 at the height of the market turmoil over Credit Suisse, which took the index back to a 7-week low. On a sectoral basis, the biggest outperformer was energy thanks to a further rise in oil prices, with Brent crude (+1.98%) closing at a 3-week high of $78.36/bbl.

Another event yesterday were the latest Fed minutes from the meeting on May 2-3, but they weren’t a particularly market-moving event. They showed that the committee members were becoming more open to a pause in rate hikes, and it said that “Many participants focused on the need to retain optionality” moving forward. Some participants noted that since the “progress in returning inflation to 2% could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings.” But the counter was that if there were a medium-term economic slowdown there wouldn’t be the need for further tightening. There was also a note that “that data through March indicated that declines in inflation, particularly for measures of core inflation, had been slower than they had expected”, which correlates to Fed speakers becoming more hawkish in recent weeks.

Overnight in Asia, the selloff has mostly continued, with losses for the Hang Seng (-2.07%), the Shanghai Comp (-0.66%), the CSI 300 (-0.49%), and the KOSPI (-0.52%). The main exception is the Nikkei, which has posted a +0.50% advance. And looking forward, there are signs that markets are now beginning to stabilise, with futures on the S&P 500 up +0.38% this morning, having been helped by the strong Nvidia earnings last night.

On the data side, the main release yesterday aside from the UK CPI print was the Ifo’s business climate indicator from Germany. That came in at 91.7 in May (vs. 93.0 expected), and marked an end to 6 consecutive monthly gains in that indicator. The expectations reading fell to 88.6 (vs. 91.6 expected), ending a run of 7 consecutive gains, and the current assessment reading fell to 94.8 (vs. 94.7 expected). Whilst the release is only one indicator, it adds to the pattern across Europe in recent months whereby we’re no longer seeing the big upside surprises from Q1, and if anything the releases have been more on the downside of late.

Finally in the political sphere, there was another announcement in the 2024 presidential race yesterday as Florida Governor Ron DeSantis formally confirmed he would be a candidate. According to FiveThirtyEight’s polling average for the Republican nomination, DeSantis is currently in second place behind former President Trump. However, Trump’s lead has widened significantly over the last couple of months, and Trump currently stands at 54.3%, with DeSantis some way behind on 20.6%, and then former Vice President Pence (who hasn’t yet declared) on 5.3%. The first primaries won’t actually be until 2024, but based on past cycles we can expect the field to come increasingly into view over the summer as the various candidates seek to coalesce public support, raise funds and win key endorsements beforehand.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, the second estimate of Q1 GDP, pending home sales for April, and the Kansas City Fed’s manufacturing index for May. Central bank speakers include the Fed’s Barkin and Collins, ECB Vice President de Guindos and the ECB’s Nagel, Villeroy, Centeno and De Cos, along with the BoE’s Haskel.