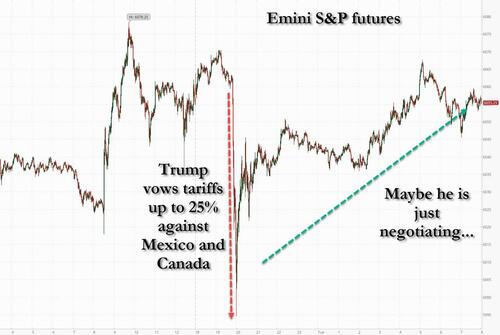

US equity futures are higher even as president Trump pledged to impose tariffs up to 25% on Canadian and Mexican imports as soon as Feb. 1, but held off imposing an immediate China tariff, which according to JPMorgan points "to a more cautious view from Trump on tariff implementation", helping push the USD/CNY lower by -0.7%. The possibility of tariffs on Canada and Mexico on Feb. 1 weighed on futures yesterday evening, if not so much Tuesday morning when S&P futures are near session highs, up 0.4% to 6,060 with Nasdaq futures rising by a similar amount as a more serene mood settled over markets after a rollercoaster session on Donald Trump’s first day in office, with investors looking past the threat of tariffs to the potential boost from fiscal stimulus and tax cuts. Trump also threatened Europe with tariffs unless it buys more American oil, and gave TikTok a 75 day reprieve to sell itself. Other moves included declaring national emergencies on migration and energy, withdrawing from the Paris agreement and WHO, rolling back EV policies, and boosting oil and gas drilling. Elsewhere in markets, the is FTSE flat/DAX -10bps/CAC +5bps/Shanghai -5bps/Hang Seng +91bps/Nikkei +32bps. 10Y yields dropped from their Friday close to trade at 4.58%, down 4bps, as the dollar gained. This week, key macro focus will be Q4 earnings (9% of SPX mkt cap reports) and headlines from Washington. Crude oil dropped after Houthi rebels said they would no longer target tankers transiting the Red Sea. Bitcoin slumped on Monday after Trump failed to mention it even once in his various speeches and addresses. Today, we will hear from KEY, DHI, PLD, SCHW, MMM, FITB pre-open while NFLX, STX, UAL, COF, IBKR, HWC report after the bell.

In premarket trading, US-listed Chinese stocks rise, following gains in Hong Kong peers, as President Donald Trump refrained from announcing any tariffs on Chinese goods on his first day in office. 3M rose 4% as management expects profit to grow this year. Apple falls 2% as sales of iPhones dived 18.2% in China during the December quarter, according to independent research; Jefferies, Loop downgrade on Weak iPhone Demand. D.R. Horton gained 3% after affirming its forecasts for full-year revenue and deliveries. General Motors rose 1% after Deutsche Bank upgraded the automaker to buy on expectations that the automaker will report to the high-end of its guidance range in the fourth quarter.

US stock futures, Treasuries and the dollar all gained as traders chose to focus on the prospects for economic growth and corporate profits under Trump’s second four-year term. Still, the lack of an overall narrative on trade restrictions so far underscores the risk of higher volatility across financial markets.

Trump threatened tariffs of as much as 25% on Canadian and Mexican imports as soon as Feb. 1, triggering sharp declines in the Mexican peso and Canadian dollar. The currencies were among the worst-performing of 30 major currencies on Tuesday, with the peso trading 1.2% lower and the loonie down 0.9%. Their declines stood out as the worst market fallout from a raft of executive orders signed by Trump, including one that declares a national emergency at the US-Mexico border. However, the yuan jumped almost 1% after Trump refrained from announcing immediate tariffs against China.

Investors had been on edge over the first executive orders to be announced by the White House after Trump vowed to quickly implement his “America First” agenda. In the runup to inauguration day, traders had driven up yields and stoked the dollar to a 13-month high, expecting that sweeping trade tariffs will crimp global growth, lift US inflation and potentially cause the Federal Reserve to refrain from interest-rate cuts this year.

"The fears are sometimes greater than reality,” said Robert Dishner, senior portfolio manager at Neuberger Berman. "The market is going to settle to a cadence of the domestic agenda. For now there is an evaluation.”

Here is a recap of all the main events on Monday:

Meanwhile, fourth-quarter earnings season resumes, with 3M Co., Netflix Inc. and United Airlines Holdings Inc. among US companies set to report on Tuesday. Traders will also also keep an eye on comments from the World Economic Forum meeting in Davos.

Europe's Stoxx 600 shook off early weakness to rise 0.2% as Trump repeated his call on the European Union to buy more American oil and gas if the bloc wants to avoid tariffs. Tariff and policy concerns still weighed on the region’s mining, automotive and renewable stocks. Here are the biggest movers Tuesday:

Earlier in the session, Asian stocks whipsawed early on Tuesday as traders parsed comments from newly sworn-in US President Donald Trump to gauge impact on markets in the region. The MSCI Asia Pacific Index was up 0.2% after swinging between gains and losses earlier. While Trump said he planned to enact previously threatened tariffs of as much as 25% on Mexico and Canada by Feb. 1, he avoided committing to a plan for additional levies on China and said he would be having “meetings and calls” with President Xi Jinping. Chinese stocks rose more than 1% in Hong Kong as Trump avoided committing to a plan for tariffs on goods from China. But Trump also indicated that he could impose taxes on Chinese goods if Beijing blocked the sale of the social media app TikTok to a US entity.

“There is a lot to digest. But one thing to flag here is that I think at the moment, the equity market is not too concerned about US-China tensions,” Kinger Lau, chief China equity strategists at Goldman Sachs, said in a Bloomberg TV interview. China should be able to digest 20% tariffs, “so from markets standpoint we are still forecasting 20% rise in Chinese equities over next 12 months.”

Elsewhere, Indian stocks dropped amid slowing corporte earnings. The stock market correction may have room to run as weak earnings and high valuations will likely weigh on sentiment in the near-term.

In fx, the Bloomberg Dollar Spot Index climbs 0.6% while the Mexican peso fell and along with the Canadian dollar, was among the worst-performing major currencies after US President Trump threatened both countries with tariffs on his first day in office. US 10-year yields fall 6 bps to 4.57%. Cable is down 0.6% against the greenback following weak job numbers, matching a fall in the euro.

In rates, treasuries rally as fears that Trump’s policies will fuel inflation eased. The 10-year TSY around 4.58% is more than 4bp richer on the day after falling to 4.528% during Asia session; long-end-led gains flatten 2s10s, 5s30s spreads by 2.5bp and 1bp vs Friday’s close. Gilts are steady after mixed UK jobs data did little to shift bets on interest-rate cuts by the Bank of England. Bunds outperform Gilts with German 10-year yields falling 1 bps.

In commodities, oil prices decline, with WTI falling more than 2% to $76.40. Spot gold climbs $14 to $2,722/oz. Bitcoin trades near $103,000.

Looking at today's calendar, US economic data calendar includes January Philadelphia Fed non-manufacturing activity (8:30am). Fed officials are in communications blackout ahead of Jan. 29 policy announcement; swaps market prices in around 6bp of combined easing over the January and March meetings and 37bp over the course of this year.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed as the initial broad-based risk-on sentiment after US President Trump refrained from imposing tariffs on the first day of his return to the White House, was ultimately soured after he later flagged potential 25% tariffs on Canada and Mexico which could be imposed from the start of February. ASX 200 was led higher as outperformance in the top-weighted financials sector and gold miners helped pick up the slack from the weakness in energy and defensive stocks. Nikkei 225 briefly wiped out its opening gains with price action largely influenced by tariff rhetoric and a firmer currency. Hang Seng and Shanghai Comp were mixed after the recent tariff-related fluctuations in asset classes, while President Trump also floated the idea of universal tariffs on anyone doing business with the US but added that they are not there yet.

Top Asian News

European bourses (Stoxx 600 +0.1%) opened with a strong negative bias, with only a couple of indices remaining afloat. As the morning progressed, sentiment in the complex gradually improved, to currently display a mixed picture in Europe. European sectors are mixed vs initially opening mostly in the red. Trump's inauguration has sparked some considerable moves across sectors in Europe; Autos, Basic Resources and Utilities have all been hampered thus far. The latter is in focus after Trump said he will end leasing to some wind farms.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Russia-Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

It was Blue Monday here in the UK yesterday as it is deemed to be the most depressing day of the year (always third Monday in January). My kids have just been taught about it and were asked to add some colour to their school uniform for the day to battle the blues. One of my twins wore one of my red work ties and I now know exactly what he had for lunch as a result!

Meanwhile it was red Monday in Washington DC as Trump's inauguration ceremony took place. The subsequent speech didn't really contain any substantive surprises, and in fact was probably more traditional than many of his previous speeches. He did detail a list of executive orders and policy reversals that are imminent across immigration, ending green incentives, promoting the oil and gas sector and pushing back against the DEI movement. A lack of immediate moves on tariffs supported the market mood yesterday, but this has partially reversed overnight as late in the day Trump renewed an immediate threat of 25% tariffs on Canada and Mexico, which could be announced as soon as February 1st.

In my chart of the day yesterday we pointed out how Trump signed Executive Orders at the fastest rate of any President since Jimmy Carter, who left office in 1981. But if we look further back in history, it’s still well below that seen in the first half of the 20th century, peaking under Franklin Roosevelt who had to deal with the Great Depression and WWII. Given Trump's recent rhetoric we could go back to the first half of the twentieth century levels of executive orders in his second term.

US markets were closed for a public holiday yesterday as the inauguration took place, but the biggest moves of the day came after the WSJ reported that Trump wouldn’t impose new tariffs on his first day in office. The story said that Trump would issue a memorandum on trade, but not impose tariffs yet. So that raised hopes that Trump would initially try and reach a deal with US trade partners, with tariffs as a potential point of leverage, rather than something to be used immediately.

That report led to a clear rally for bond and equity futures, whilst the US dollar index weakened -1.16% on the day, marking its biggest move lower since the very bad jobs report in August. US Treasuries were closed yesterday for the holiday, but overnight the 10yr yield has come down -8.9bps.

However, the more positive take on trade risks has reversed overnight after Trump commented to reporters that he’s thinking of imposing 25% tariffs on Canada and Mexico on February 1st, again citing the flow of undocumented migrants and drugs into the US. He also commented the he is considering a universal tariff but that he’s “not ready for that yet.” The Canadian dollar and Mexican peso slumped by as much as -1.5% following the comments before partially recovering, while the broad dollar has recovered around a third of yesterday's losses. S&P 500 futures have also given up more than half of yesterday's gains (+0.36% at Europe’s close yesterday). See our economists' piece here from late November where they said a 25% increase in tariffs on Mexican and Canadian imports would increase inflation by up to 1 percentage point in 2025. So although at this stage this was an off the cuff comment to reporters last night, markets should be pretty concerned about the headlines.

Before all this, in European trading markets had been earlier buoyed by the tariff news (or lack of), with a clear advance for those sectors most exposed to trade. As an example one of the biggest sectoral advances came for Automobiles & Parts (+1.08%). That helped the German DAX (+0.42%) to outperform and hit another all-time high, with BMW (+2.80%) as the top-performer in the index. And given the weakness in the US Dollar, that meant the Euro strengthened +1.39% on the day, marking its biggest daily advance since November 2023. This move will be under threat this morning with the Euro already giving up around a quarter of its gains in Asia from yesterday. Let's see how European autos react.

The WSJ story also led to a clear rally for European sovereign bonds, with 10yr bund yields paring back their earlier increase to close -0.5bps lower. That pattern was echoed across the continent, with yields on 10yr OATs (-1.0bps) and BTPs (-2.7bps) moving lower as well. There was a bit of hawkishness from the ECB’s Holzmann in a Politico interview, who said that a January rate cut was “not a foregone conclusion for me at all”, but Holzmann is one of the most hawkish members of the Governing Council, so investors remained confident that the ECB were still on course to cut rates next week.

Asian equity markets are volatile this morning albeit within a relatively small range as the tariff yo-yo story has impacted sentiment. The Hang Seng (+0.83%) remains higher but is off the highs while Chinese and Japanese equities have dipped lower as I type.

To the day ahead now, and data releases include UK unemployment for November, the German ZEW survey for January, and Canada’s CPI for December. From central banks, we’ll hear from the ECB’s Centeno. Finally, earnings releases include Netflix.