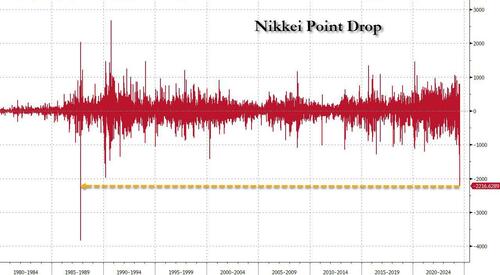

It is a global selling carnage this morning, as risk-off extends across worldwide equity markets but nowhere more so than Japan where the point (if not percentage point) drop in the Nikkei has surpassed Black Monday 1987.

As of 7:45am, S&P futures are down 1.2% as traders worried that the Federal Reserve has been too slow to cut interest rates, and technology earnings disappointed, pushing Nasdaq futures 1.7% lower as Amazon’s Q3 earnings forecast disappointed and Apple reported a surprise plunge in Chinese revenues. While Europe is a sea of red, it is nothing compared to what took place in Asia, where the Topix index crashed 6.1%, the biggest one-day selloff since 2016, as a result of the continued meltup in the yen after the BOJ's idiotic rate hike - which took place just as Japan's economy slumped back into contraction and inflation peaked - and given poor risk sentiment in the US. US rates are continuing their downside momentum with the OIS market now pricing in 88bp of rate cuts in 2024. A rally in Treasuries extended into a seventh straight day, with the two-year yield slumping to its lowest in 14 months. The dollar weakened. In FX, low yielding currencies are leading the rally against USD with CNH and JPY up 0.7% and 0.3%, respectively, while higher beta currencies like MXN and NOK are both down 0.6%. Today we get the jobs report (exp. 175K) and the final Factory/Durable Orders report out of the US.

In premarket trading, Exxon Mobil jumped after it exceeded profit expectations after the $63 billion acquisition of Pioneer Natural Resources Co. pushed oil and natural gas output to a record. Chevron shares slid in premarket trading after reporting earnings per share that missed the average analyst estimate. The company also said its headquarters would move to Texas from California. Amazon plunged 8% on concern costs are rising quickly to meet demand for AI services. Intel cratered more than 20% after giving a grim growth forecast and laying out plans to slash 15,000 jobs. Snap dropped 17% as revenue undershot estimates. Here are some other notable movers:

The next big data point for the market is Friday’s monthly jobs report, which is expected to show that US employers added workers at a slower pace last month (see our preview here). Forecasters anticipate the monthly US jobs numbers will show moderating job and wage growth in July, underscoring a further softening in the labor market. Payrolls probably rose by 175,000 last month following June’s 206,000 increase, according to the median estimate in a Bloomberg survey.

While Fed Chair Jerome Powell has signaled that rates are likely to be lowered in September, some investors have argued they should move faster to prevent a deeper economic slowdown. Indeed, amid the rout, jumpy markets now see the Fed delivering three consecutive quarter-point cuts in September, November and December — and are pricing a roughly 50% chance that one of those reductions will be 50 basis points. The policy-sensitive two-year yield slumped to its lowest in 14 months, while rates on the benchmark 10-year security held below 4% after falling to that level on Thursday for the first time since February.

“The data is really starting to show signs of concern and that is what’s coming back to bite the Fed,” said Daniela Hathorn, a senior market analyst at Capital.com. “They kept signaling they’d wait for the data, and that was fine until Wednesday, but yesterday’s data has investors fearing whether it waited for too long.”

Risk assets have taken a beating in recent sessions for other reasons too. Lackluster earnings from Microsoft Corp. to Amazon.com Inc. have hurt sentiment that is also being weighed down by concern about the sluggish Chinese economy and a weakening of the earlier euphoria over artificial intelligence. Middle East tensions have also multiplied after the assassination of Hamas’ political chief in Tehran.

It’s all added up to a volatile week for markets, with the VIX Index on track for the highest closing level in nine months. The Nasdaq 100 recorded swings of at least 1.4% over the past three days. A gauge for the Magnificent Seven big tech companies was up 0.3% for the week through Thursday.

The sharp recalibration in expectations for US rates came after the Fed held rates again this week. While Chair Jerome Powell signaled that central bank officials are on course to pare rates at their next meeting, economic reports on Thursday showed rising jobless claims and weaker manufacturing, spooking investors. Ahead of the Fed meeting, former New York Fed President William Dudley and Mohamed El-Erian warned that the Fed risks making a mistake by holding rates too high for too long and are once again behind the curve. That narrative has started to take hold in the past 24 hours. But bond market exuberance means that if Friday’s employment report shows signs of unexpected strength, there’s a risk some traders will dump bullish wagers en masse. According to Bloomberg, a $12 million wager has emerged in options linked to the Secured Overnight Financing Rate, which closely tracks Fed policy expectations, targeting some 225 basis points of easing by the middle of 2025. Even with the recent explosion of bets, the market is pricing in about 160 basis points by then.

“In coming days there may be even a discussion about whether the Fed will have to cut by 50 basis points at the next meeting in order to catch up with the loss of momentum in the economy,” Gary Dugan, chief executive officer of the Global CIO Office, said in an interview on Bloomberg Television. “From the peak a 10%-to-15% correction wouldn’t be strange in this huge change in shift in sentiment in the markets as central banks look well behind the curve.”

The shift in pricing “reflects investors’ growing concern that the FOMC might need to cut rates more quickly than the 25-basis-point quarterly cadence as economic headwinds continue to mount,” said Ian Lyngen, head of US rates strategy at BMO Capital Markets. Powell repeated on Wednesday that the Fed is data dependent when deciding when to lower interest rates, and emphasized that policymakers are mindful of the risk to the the labor market of waiting too long.

“We suggest investors brace for renewed volatility, but avoid overreacting to short-term shifts in market sentiment,” said Mark Hafele, chief investment officer at UBS Global Wealth Management.

European markets are all deep in the red, with the Stoxx 600 tumbling over 1% with technology and finance shares leading the declines. Among industry groups, utilities were the only category of stocks to rise. Europe’s semiconductor sector slumps, following an extended retreat among global tech stocks. Among chip-equipment stocks: ASML -5.2%, ASMI -7.9%, BE Semiconductor -6.5%, VAT Group -7.3%. Among chipmakers, Infineon -3.8%, STMicro -3.8%, Melexis -2.1%, Nordic Semiconductor -4.5%. Here are the other biggest movers:

But if Europe was bad, Asia was a disaster: here stocks crashed as sentiment was hit by a triple whammy of a selloff in Japanese equities, a global tech rout and signs of weakness in the US economy. The MSCI Asia Pacific Index plunged as much as 3.6%, the most since February 2021, with Taiwan Semiconductor Manufacturing Co., Mitsubishi UFJ Financial Group and Samsung Electronics Co. among the biggest drags. Japan’s Topix Index entered a technical correction in its worst two-day rout since 2011, while benchmarks in the tech-heavy markets of South Korea and Taiwan fell about 4%. Traders took risk off the table amid signs the investment landscape is shifting. Japanese stocks are falling out of favor as the prospect of further interest-rate hikes by the country’s central bank supports the yen, hitting exporters’ shares. Meanwhile, disappointing earnings from US tech behemoths has cooled optimism over artificial intelligence, triggering a rout that has ensnared Asian chip giants

“The recent strengthening of the Japanese yen coupled with tech sector weakness is poised to significantly impact the Asian stock market,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore. “Given the substantial weight of tech stocks in Asian indices, disappointing results from tech giants could trigger a broader market downturn in Asian markets.”

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The euro and yen top the G-10 FX leaderboard, rising 0.3% a piece against the greenback. The offshore yuan climbs to the highest since May.

In rates, a rally in Treasuries extended into a seventh straight day ahead of the US jobs report. US 10-year yields fall 3bps to 3.95% - the lowest since early February - ahead of June employment data investors are counting on to reinforce the case for aggressive Fed rate cuts this year. European bonds follow suit. Fed-dated OIS contracts price in around 32bp of easing for the next policy meeting in September, or roughly 32% odds that the central bank’s first move will be a half-point rate cut rather than 25bp.

In commodities oil prices advance, with WTI rising 0.4% to $76.60 a barrel. Spot gold jumps $16 to around $2,462/oz.

Today's economic data slate includes July employment report (8:30am) and June factory orders (10am). Scheduled Fed speaker slate includes Goolsbee (12pm) and Barkin (8:30pm)

Market Snapshot

Top Overnight News

Earnings

A more detailed look at global markets courtesy of Newsquawk

APAC stocks suffered firm losses following the bloodbath and flight-to-quality stateside which was triggered by weak ISM Manufacturing data, while geopolitical concerns and mixed earnings added to the downbeat sentiment. ASX 200 declined amid the broad weakness and with firm losses seen across all sectors. Nikkei 225 fell beneath 37,000 for the first time since April, while the Topix index followed the benchmark into correction territory. Hang Seng and Shanghai Comp. were pressured which saw the former give up the 17,000 status and the mainland index also retreated, while there were bearish comments on trade from a Mofcom official who stressed the seriousness of difficulties and challenges in foreign trade. SK Hynix (000660 KS) was pressured by over 10% in APAC trade as chip stocks continued to sell off.

Top Asian news

European bourses are pressured across the board, Euro Stoxx 50 -1.3%, with the ISM-induced downside continuing and being exacerbated by marked pressure in Intel post-earnings. As such, sectors are all in the red; Tech underperforms with heavyweight ASML opening lower by over 6% given INTC, Banking/Finance names hit on the pronounced downside in yields. Overall, the complex has a defensive configuration in-fitting with the broader risk tone. DAX 40, -1.2%, pressured with continued downside in Auto names and also its exposure to the tech-woes through Infineon. FTSE 100, -0.3%, is one of the better performers with large-cap defensive/energy names cushioning the downside, in addition to strength in IAG and GSK on Co. specifics. Stateside, futures are lower across the board, ES -1.0% & NQ -1.7%, NQ lagging given its tech-exposure with RTY -1.5% not far behind given the labour market concerns highlighted by ISM ahead of NFP; post-earnings, INTC -21%, AMZN -8.8% & AAPL -0.4%.

Top European news

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar