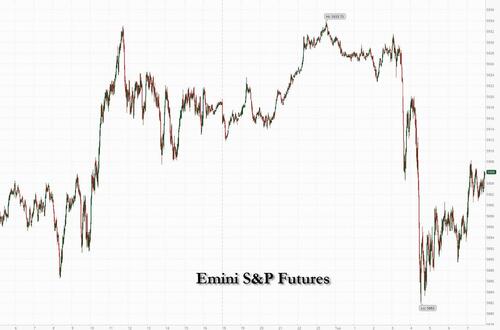

Stocks fell, with European equities shedding almost 1%, and global bonds and the dollar climbing on worries over the latest escalation in the Ukraine. Sentiment was spooked after Vladimir Putin signed a decree lowering Russia's threshold for a nuclear strike in the event of a massive conventional attack on its soil. The warning came just minutes before Ukrainian forces carried out their first strike within Russian territory with a Western-supplied ATACMS missile, although the tepid Russian response indicated that Putin is in no rush to retaliate to this provocation by the deep state. As of 8:00am S&P 500 futures dipped 0.3%, but were well off their session lows; Nasdaq futures dropped 0.2% with TSLA down 1.5% and NVDA up +0.8% pre-market. The yield on 10-year Treasuries fell three basis points to 4.38% after earlier dropping to 4.33%. The moves were steeper in Europe, with German bond yields dropping to the lowest since October. The euro retreated 0.3%. Poland’s main stock index sank more than 3%. However, bunds then pared gains and their outperformance over Treasuries as traders unwind haven buying after Russia reports limited damage following Ukraine’s missile attack using US weapons, a move seen as Putin's unwillingness to push the world into WW3. Commodities are mixed: oil is flat, base metals are mixed with copper and iron ore higher, and Precious Metals are higher. Today, the key focus will be LOW and WMT earnings pre-market. On macro data, we will receive Housing Starts and Building Permits.

In premarket trading, Walmart rose 4% after the company boosted its outlook for the year on strong demand from US consumers searching for value. Alphabet dropped 0.5% on reports that top Justice Department antitrust officials decided to ask a judge to force Google to sell off its Chrome browser to break its monopoly search. Bakkt jumped another 18% after the Financial Times reported that Trump Media and Technology Group is in advanced talks to buy the crypto trading firm, citing people familiar with the matter. Here are some other notable premarket movers:

Markets were rattled by reports that Ukrainian forces reportedly carried out their first strike on a border region in Russia using Western-supplied missiles. Earlier, President Vladimir Putin had approved an updated nuclear doctrine that expanded the conditions for Russia to use atomic weapons, including in response to a massive conventional attack on its soil. Putin had pledged in September to revise the doctrine.

“The market reaction is logical, one could feel already yesterday that the tension was rising,” said Andrea Tueni, head of sales trading at Saxo Banque France. “For the moment the market reaction is contained, some are still in a wait-and see-mode.”

Traditional haven assets including the Japanese yen, Swiss franc and gold gained. Ukraine’s sovereign dollar bonds - which had risen sharply in recent days on hopes for a Trump-led ceasefire, fell the most among emerging-market peers, with a note due February 2029 losing 1.6 cent on the dollar.

Also on Tuesday, traders were discussing how Trump’s nomination of Treasury secretary could shape policy. The transition team is considering pairing Kevin Warsh, a former Fed official, in the Treasury secretary role, with hedge fund manager Scott Bessent as director of the White House’s National Economic Council, according to people familiar with the matter. “Kevin Warsh was in the FOMC, so the likelihood of political interference into the Fed policy making is certainly diminishing if he were to become the Treasury secretary,” said Gero Jung, chief economist of Mirabaud Asset Management in Geneva.

Europe's Stoxx 600 fell as much as 1% on concerns Russia’s war in Ukraine is escalating. The turbulence boosted the region’s defense stocks, several of which are among the top gainers alongside Aeroports de Paris and Imperial Brands. At the other end of the index, Siemens and Husqvarna fall on respective broker downgrades. Here are the biggest movers Tuesday:

Earlier in the session, Asian stocks rose, extending a rebound from recent losses, led by Taiwan and Australia after gains in US peers overnight. The MSCI Asia Pacific Index climbed 1.1%, with TSMC and Commonwealth Bank of Australia among the biggest boosts. Tech and financials were among the largest drivers amid broad advances across sectors. US and European stock futures rose as a decline in Treasury yields bolstered the appeal of holding equities. The rally follows a decline of 3.9% in the Asian benchmark last week, its worst in seven months. Investors remain focused on US President-elect Donald Trumps’ plans including the heavy tariffs he has vowed on China, as well as the response planned by the latter as it continues to try and revive its economy.

In FX, the Bloomberg Dollar index rose 0.1%, while USDJPY dropped as much as 0.9% to 153.29, before paring losses; one-week volatility spiked by 60 basis points to 10.34% after the Russia headlines hit the wires; the Swiss franc also inches higher.

In rates, treasuries held flight-to-quality gains garnered during London morning following report Ukraine had carried out its first strike on Russian territory with Western-supplied missiles. Yields, off session lows, remain 4bp-5bp richer across the curve. Scant US economic data and Fed speeches are slated. Treasury 10-year yields are around 4.37% vs session low 4.343%; gilts in the sector lag by around 1bp while bunds trade broadly in line; curve spreads are within 1pm of Monday’s closing levels

In commodities, natural-gas futures gained as much as 1.1%, trading near their highest levels in a year. Oil traders, meanwhile, appeared unfazed by the latest developments, with WTI falling 0.8% to $68.60 a barrel after Europe’s largest oil field gradually restarted following a power outage. Spot gold climbed 0.9% or $23 to around $2,634/oz.

Bitcoin is back in the vicinity of an all-time high, climbing above $92,000. The digital asset has been supported by a series of developments highlighting the deepening embrace of the digital-asset industry by Trump.

Today's economic data calendar includes October building starts and housing permits at 8:30am. Fed speaker slate includes Kansas City’s Schmid at 1:10pm

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly in the green following the similar performance stateside although gains were capped amid relatively quiet newsflow with no major fresh macro catalysts to drive price action. ASX 200 outperformed and notched a fresh record high with all sectors in the green and the advances led by a tech resurgence and strength in gold miners, while there were recent amiable Xi-Albanese comments and Morgan Stanley raised its ASX 200 target. Nikkei 225 traded higher and shrugged off a firmer currency as Japan aims for cabinet approval of an economic package soon. Hang Seng and Shanghai Comp swung between gains and losses despite better-than-expected earnings from Xiaomi which failed to lift shares in the smartphone/EV maker, while support pledges by regulators did little to boost sentiment and the EU is also reportedly to demand tech transfers from Chinese companies in return for EU subsidies which would apply to batteries but could be expanded to other green sectors.

Top Asian News

European bourses opened on a mixed/modestly firmer footing. Thereafter, Russia’s Kremlin said "Russia reserves the right to use nuclear weapons in an event of aggression". This sparked a safe-haven bid, with equities selling-off to session lows, whilst the JPY and bonds soared to highs. This move has since stabilised, with equities currently residing at lows. European sectors opened entirely in the green, but sentiment has since slipped and now shows a mostly negative picture in Europe. A clear defensive bias is seen in Europe; Utilities top, whilst Autos and Consumer Products lags. US equity futures are entirely in the red, with sentiment hit following comments via Russian Kremlin that noted it could respond to aggression in a nuclear manner. Goldman Sachs lowers its 12 month Stoxx 600 target to 530 from 540 (currently 502). Cuts FTSE 100 target to 8500 from 8800 (currently 8138)

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

One thing we pointed out in our LT Study was how this era has some uncanny parallels to the end of the last quarter-century 25 years ago. For instance, equities have surged over the last couple of years, with a narrow rally that’s been driven by tech stocks, just like in the dot com bubble. Moreover, the Fed are easing policy in that environment, just like they did in 1998, whilst valuation metrics like the CAPE are currently sitting at historic highs. In light of that, Henry took a look at how the current situation resembles three other periods when valuations were historically high: the dot com bubble, the pre-GFC era, and 2021. You can see the report here.

Risk assets began to stabilise yesterday, with the S&P 500 (+0.39%) picking up again after its decline of more than -2% last week. There wasn’t really a major catalyst behind the moves and it was a fairly quiet day on the whole. But the Magnificent 7 (+1.22%) saw a sizeable outperformance thanks to a +5.62% surge in Tesla’s share price, so that helped to drag up equities more broadly. Those moves for Tesla followed a Bloomberg report that the Trump transition team had said to advisers they’d make a federal framework for self-driving cars a priority for the Transportation Department, so that was very good news from their perspective. The equity gains were reasonably broad beyond tech, with nearly two thirds of the S&P 500 higher on the day, although the Dow Jones (-0.13%) lost ground amid underperformance for industrials. Over in Europe the story was one of small declines, with the STOXX 600 down -0.06%.

Government yields had a topsy-turvy day in the US. At the close 10yr Treasury yields (-2.5bps) and 30yr yields (-0.7bps) were lower and 6-8bps down from their intra-day highs, which saw 30yr yields touch their highest levels since May. The reversal was driven by a decline in real yields, with breakevens higher on the day and the US 2yr inflation swap up +3.1bps to a 7-month high of 2.66%. Overnight, yields on 10yr USTs have slipped -0.8bps lower trading at 4.406%.

This dialing up of investors’ inflation expectations came amid a strong day for oil prices with Brent crude up +3.18% to $73.30/bbl, which in large part reflected an increased focus on geopolitical tensions after the weekend’s news that President Biden authorised Ukraine to use US long-range missiles for strikes inside Russia. Gold (+1.84%) posted its best day in three months, with a stronger day for commodities also facilitated by a decline for the dollar index (-0.39%) for the first time in seven sessions.

Over in Europe, markets closed before the US bond rally took hold, with yields on 10yr bunds (+1.6bps), OATs (+1.1bps) and BTPs (+1.5bps) all inching higher. That came against the backdrop of several ECB speakers yesterday, but there wasn’t much deviation from expectations. For instance, Greece’s Stournaras said that for the December meeting, he thought “25 basis points is an optimal reduction.” And Ireland’s Makhlouf said that he believed “in a prudent and cautious approach”. So that seemed to steer away from speculation about a larger 50bps cut from the ECB in December, and investors moved to dial back the chance of a 50bp cut to just 17% yesterday, down from 23% on Friday.

Elsewhere, the question of appointments to the Trump administration remains a key focus, and we’re still waiting to see who’ll be nominated as the new Treasury Secretary. Interestingly, there was growing speculation about Kevin Warsh yesterday after an initial push over the weekend. He is a former Fed governor during the financial crisis from 2006-11, who previously served in the George W. Bush administration. The other names in the frame recently have been Scott Bessent and Howard Lutnick. A Bloomberg report yesterday evening said that Trump’s transition team is considering pairing Warsh as Treasury Secretary with Bessent as the director of the National Economic Council. Warsh is seen as more hawkish on monetary policy and less protectionist than the other candidates so on the former point the surge on Polymarket.com for the likelihood of him getting the Treasury job (45% as I type) may have been a big factor in the intra-day Treasury rally yeaterday.

Asian equity markets are higher outside of China this this morning with the S&P/ASX 200 (+0.89%) leading the gains with the Nikkei (+0.64%), the KOSPI (+0.14%), the Hang Seng (+0.12%) also higher. On the other hand, mainland Chinese stocks are lagging with the Shanghai Composite (-0.54%) edging lower ahead of the PBOC’s decision on its benchmark loan prime rate later this week. Outside of Asia, US stock futures are indicating a positive start with those on the S&P 500 (+0.13%) and NASDAQ 100 (+0.15%) trading slightly higher.

In central bank news, the minutes from the RBA’s recent policy meeting indicated that the board remains vigilant to upside inflation risks and believes policy needs to remain restrictive as it sees no “immediate need” to change the cash rate.

In FX, the Japanese yen (+0.14%) is has been edging higher (154.42) amid concern of possible government intervention given the current levels. Looking forward, the focus this week is on CPI data for October, due on Friday.

There was very little data to speak of yesterday, although we did get the NAHB’s housing market index from the US. That ticked up to 46 (vs. 42 expected), marking its third consecutive monthly increase, which took the index up to a 7-month high.

To the day ahead now, and data releases include US housing starts and building permits for October. Central bank speakers include BoE Governor Bailey, the BoE’s Lombardelli, Mann and Taylor, the ECB’s Elderson, Muller and Panetta, and the Fed’s Schmid. Finally, earnings releases include Walmart and Lowe’s.