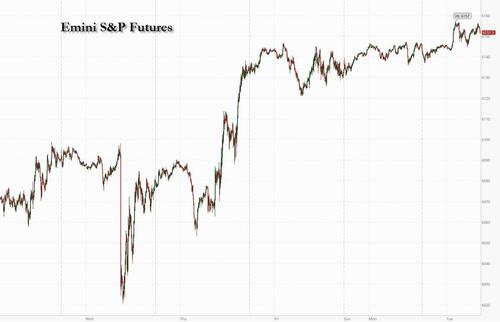

US equity futures and global markets are higher as Russian and US officials met to negotiate an end to the three-year war in Ukraine. As of 8:00am ET, both S&P and Nasdaq futures are 0.4% higher, with Mag7 names all higher ex META (GOOGL +0.5%, AMZN +0.4%, AAPL +0.1%, MSFT +0.3%, META -0.2%, NVDA +1.2% and TSLA +0.8%) and Semis bid up, led by Intel. In Europe, the Stoxx 600 index held near record highs, with defense stocks such as Rheinmetall and Dassault Aviation rallying further on expectations that governments will have to ratchet up military spending. A gauge of emerging-market equities hit a three-month high, while stocks in Asia were mixed, but still closed in the green for a fifth day after President Xi Jinping met with prominent entrepreneurs Monday. Tariff headlines were quiet over the weekend as the market focused on a RU/UKR solution. Bond yields are higher by 1-3 bps and USD looks to break a 5-day losing streak. Commodities are stronger with all 3 complexes bid up and WTI finding support above $70/bbl. Today’s macro releases lack market-moving data as part of a relatively quiet macro week; we have two Fed speakers on deck.

In premarket trading, Nvidia is leading gains among the Magnificent Seven stocks (GOOGL +0.5%, AMZN +0.4%, AAPL +0.1%, MSFT +0.3%, META -0.2%, NVDA +1.2% and TSLA +0.8%). Intel shares extended their recent surge after the Wall Street Journal reported that Taiwan Semiconductor and Broadcom are mulling deals that would break up the US chip giant. Delta Air Lines fell after one of its jets flipped out of control upon landing in Toronto. In Europe, InterContinental Hotels Group Plc dropped after results. Here are some other notable premarket movers:

As discussed last night, the "romantic phase" of the European defense stock surge is coming to an end, as attention turns to who gets to pay for all those trillions in required defense expenditures. The spending concerns weighed on European bonds, with German 10-year bund yields — the benchmark borrowing rate for the euro area — touching the highest in more than two weeks. As US Treasuries trading resumed, 10-year yields rose about three basis points. The moves came as Saudi Arabia hosted talks between Russia and the US, which could pave the way for President Donald Trump and Russia’s Vladimir Putin to meet. Meanwhile, European governments are mulling new defense funding measures ahead of a March 20-21 summit.

“The prospect of the war in Ukraine coming to an end is very positive,” said Tim Graf, head of EMEA macro strategy at State Street Bank and Trust Co. “Underneath it all is defense spending, which will be good for US defense contractors, but also European industrials and defense contractors.”

Indeed, the mood on equities remains bullish overall, with a Bank of America survey showing global stocks are the most popular asset class with investors. Fund managers’ cash levels have dropped to the lowest since 2010, indicating greater willingness to take on risk.

Attention is now set to refocus on the Federal Reserve’s interest-rate path, with Governor Christopher Waller saying recent economic data supports keeping rates on hold until more progress is seen on inflation. His comments helped the dollar advance against Group-of-10 peers. Fed officials Mary Daly and Michael Barr are due to speak Tuesday, while minutes from the central bank’s latest policy meeting will be released on Wednesday.

European stocks were little changed after reaching a fresh record high on Monday, as investors assessed the outlook for defense spending and the likelihood of ceasefire in Ukraine. Investors will turn their focus to Saudi Arabia, where Russian and US representatives are meeting to negotiate an end to the war in Ukraine. Stoxx 600 was little changed at 555.49 with 366 members down, 209 up, and 25 unchanged. Here are some of the biggest movers on Tuesday:

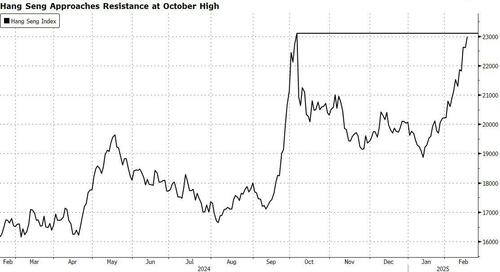

Earlier in the session, Asian stocks were mixed, but are still headed for a fifth day of gains after President Xi Jinping met with prominent entrepreneurs Monday. The MSCI Asia Pacific Index advanced 0.1%, with Hong-Kong listed technology stocks Alibaba, Tencent and Xiaomi among the biggest boosts. Australian shares fell amid the central bank’s decision to cut interest rates by a quarter point, and those in mainland China declined. The meeting with Xi, attended by the likes of Alibaba’s Jack Ma, inspired hopes that the world’s second-largest economy may do more to support its private sector. The Hang Seng Index advanced 1.3%.

“I think it’s more symbolic rather than a structural shift for China tech,” said Billy Leung, an investment strategist at Global X ETFs. The key question is whether this translates into real support measures at the Two Sessions event in March, he added, stating that investors “will need to see follow-through.” Shares traded higher in Korea, Japan and Taiwan.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.3%, arresting a three-day slide that had been gradually losing pace. Waller characterized the economy as solid, with a labor market that is in a “sweet spot.” The Aussie dollar outperforms after the RBA cut interest rates but stressed it won’t ease as aggressively as markets anticipate; the British pound was down 0.2%.

In rates, treasury yields rose across the curve on return from a long holiday weekend. Yields on 10-year Treasuries rose 3bps to 4.51%. Markets are pricing the possibility that the Fed will deliver one 25bps cut by year-end, with a roughly 50-50 chance or another easing. Treasuries also track selling in European government bonds, which take a hit on the growing view that Europe will need to raise defense spending to help Ukraine, likely requiring more bond issuance. German 10-year yields rise 1 bps to 2.50%. Gilts underperform after UK pay growth picked up to its highest level in eight months and employment unexpectedly rose. UK 10-year yields rise 2 bps to 4.55%.

In commodities, oil prices advance, with WTI rising 1.5% to $71.80 a barrel. European natural gas prices fall for a sixth consecutive session to near €47 a megawatt-hour. Spot gold climbs $14 to $2,910/oz after Goldman Sachs Group Inc. analysts raised their year-end gold target to $3,100. Prices for the precious metal are up almost 11% so far this year.

Looking to the day ahead, and US data releases include the Empire State manufacturing survey for February, and the NAHB’s housing market index for February. Eslewhere, there’s UK unemployment for December, the German ZEW survey for February, and Canada’s CPI for January. From central banks, we’ll hear from BoE Governor Bailey, the ECB’s Holzmann and Cipollone, and the Fed’s Daly and Barr. US and Russian delegates meet in Saudi Arabia for talks aimed at ending the war in Ukraine.

Market Snapshot

Top Overnight news

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed in the absence of a lead from Wall St owing to the Presidents' Day holiday, while participants in the region braced for central bank updates beginning with the RBA rate decision. ASX 200 traded negative amid underperformance in energy and the top-weighted financials sector, while sentiment failed to benefit from the RBA's widely expected 25bps rate cut as it also signalled caution on further cuts. Nikkei 225 gained but with upside capped after swinging between gains and losses amid firmer yields and a quiet calendar. Hang Seng and Shanghai Comp were varied as the Hong Kong benchmark resumed its recent outperformance with the help of strength in tech and auto names, while the mainland was lacklustre as US-China frictions lingered and after reports noted that the PBoC may further limit its MLF rollover to prevent idle funds.

Top Asian News

European bourses (STOXX 600 U/C) began the session with a modest upward bias, but price action has been choppy since; indices currently display a mixed picture. European sectors are mixed after initially opening with a slight positive bias; the breadth of the market is fairly narrow. Banks take the top spot, mainly driven by UK banks after the region’s latest jobs data saw a slight paring of BoE rate cut bets; Dec'25 -58bps (prev. -62.8bps). US equity futures are modestly firmer, with slight outperformance in the NQ (+0.4%), as the region returns from holiday on account of Presidents’ Day. BofA Fund Manager Survey highlights that investors are bullish and are long stocks, and short "everything else"; cash levels have hit their lowest in 15 years. 89% of respondents said US stocks are overvalued. On positioning: Euro-area longs rose to an eight-month high, UK shorts to a 11-month high. Interestingly, the survey suggests that the trade war is seen as no more than a "tail risk". EU antitrust chief said she is ready to issue decisions on Apple (AAPL) and Meta (META) next month; says EU will not engage in transactions with the US over democracy and Europe's values.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I have a certain “circle of life” feeling this morning as for the first time I went to bed before my 9-year daughter Maisie last night. It’s half term and she had friends over for a sleepover. By the time I headed up to bed at 9:30pm they were still awake. Let’s hope it’s a few more years before she comes home from a nightclub around 430am just as I’m getting up to write the EMR.

By the time that inevitable day arrives, the defence architecture of Europe could look a lot different. As I said in my chart of the day yesterday, to paraphrase Lenin (not something I do often), there are days when decades happen. While that might be a slight exaggeration, the potential implications are huge after the events of the last five days where first the US froze out Europe in announcing the start of talks with Russia, and second with the broadside against Europe from US Vice President JD Vance. That all this is occurring within a week of the German general election (this Sunday) means that Europe might start to move down a very different path within weeks to the pre-existing one.

The initial reaction yesterday was to price in more European defence spending with bonds selling off and equities rising, especially in the defense sector. This lifted the STOXX 600 (+0.54%) and the DAX (+1.26%) to fresh all-time highs. Indeed, for the DAX, that now leaves it up +14.5% YTD, marking its strongest start to a year since 2012. At the sectoral level, cyclicals generally did better, whilst the strength among defence companies meant Rheinmetall (+14.03%) was the strongest performer in the DAX, and the second-best performer in the STOXX 600. US markets were closed for the holiday, but by the European close, futures pointed to gains that would’ve been enough to take the S&P 500 to a fresh all-time high. They remain around the same levels in Asia with S&P 500 (+0.21%) and NASDAQ 100 (+0.30%) contracts up.

This discussion of more spending and new issuance helped to drive a fresh bond selloff across Europe. For instance, yields on 10yr bunds (+5.7bps) rose to 2.49%, their highest in over two weeks, whilst yields on 10yr OATs (+3.8bps), BTPs (+2.6bps) and gilts (+2.7bps) all moved higher as well. US markets were closed yesterday, but 10yr treasury futures also lost ground during the European session, with cash bonds reopening +3.2bps this morning so the pattern has been clear across the world. That said, the broader risk-on tone did lead to a fresh tightening in sovereign bond spreads, and the Italian 10yr spread over bunds hit a 3-year low of 106bps.

Earlier in the day, there had been divisions among European countries at the emergency summit in Paris over whether to send troops to Ukraine. For instance, UK PM Keir Starmer said that the UK was "ready and willing to contribute to security guarantees to Ukraine by putting our own troops on the ground if necessary". But Spain’s foreign minister separately said that “Nobody is currently considering sending troops to Ukraine”. In the meantime, Bloomberg reported that the US had asked European countries about what security guarantees they’d be willing to provide to Ukraine, and there’s been extensive talk of something much more substantial. For instance, France’s minister for European affairs said that joint Eurobonds were something that should be considered, whilst Germany’s foreign minister has said on defence that “We will launch a large package that has never been seen in this dimension before”. Peace talks are set to start in Saudi Arabia today between US and Russian representatives. So we'll see if any headlines emerge from that.

All this is coming during a pivotal week for Europe, as the German election is taking place this Sunday. Depending on the results, that could pave the way for some reform of the debt brake that permits for more borrowing. As a reminder, our Germany team’s base case is now that a coalition agreement will include a meaningful increase in defence spending from the 2026 budget onwards, potentially with some glide path toward at least 2.5% by the end of the term. They now expect a new defence fund would be set up with greater urgency and spent more rapidly, implying a positive fiscal impulse.

Asian equity markets are mostly trading higher this morning amid a rally in Chinese technology stocks. Across the region, the Hang Seng (+1.28%) is leading gains and resuming its tech-led rally but with the Shanghai Composite (-0.19%) dipping after a stronger open. Today has seen a meeting between President Xi Jinping and China’s top business leaders in what is seen as a possible end to the years-long crackdown on the private sector with the government working to revive an economy disrupted by a pandemic, regulatory crackdowns, and a real estate crisis.

Elsewhere, the Nikkei (+0.53%) and the KOSPI (+0.57%) are higher but the S&P/ASX 200 (-0.66%) is extending its previous session losses following a hawkish RBA statement and press conference after their 25bps cut this morning.

This was the RBA's first rate cut since 2020, with the bank citing some progress towards bringing down inflation, but warning that further monetary easing still hinged on more downside in inflation. The central bank flagged that it would retain a restrictive policy due to the strength of the jobs market and an uncertain global economic outlook. Following the decision, the Aussie (-0.04%) briefly climbed before paring gains, trading fairly flat at 0.6352 against the dollar while yields on the policy sensitive three-year government bond have increased +5.5bps to trade at 3.93% as we go to print.

To the day ahead now, and US data releases include the Empire State manufacturing survey for February, and the NAHB’s housing market index for February. Otherwise, there’s UK unemployment for December, the German ZEW survey for February, and Canada’s CPI for January. From central banks, we’ll hear from BoE Governor Bailey, the ECB’s Holzmann and Cipollone, and the Fed’s Daly and Barr. US and Russian delegates meet in Saudi Arabia for talks aimed at ending the war in Ukraine.