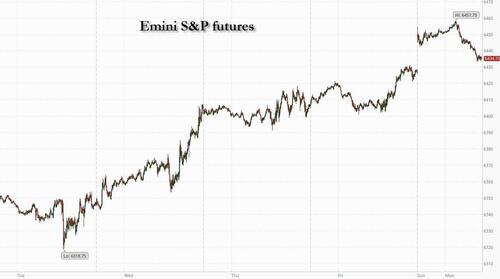

Another day, another all time high.

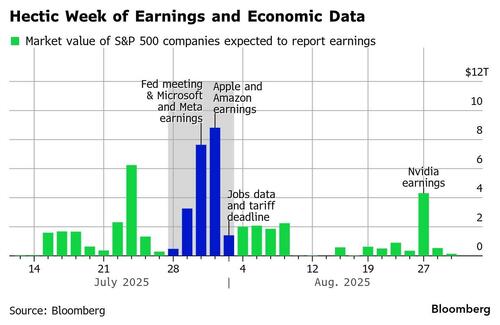

US equity futures and global markets are at a fresh all time high (but the gains are fading) on a trade-induced, global risk-on rally, sparked by Sunday's US/EU deal for 15% tariffs on European exports to the US, while we also learned that US/China will extend the trade truce by 90-days as they resume negotiations today. As of 8:00am ET, S&P futures are up 0.2%, well off session highs, while Nasdaq futures gain 0.3%. Pre-market, all Mag7 names are higher with semis outperforming. Cyclicals are poised to outperform, led by Fins/Industrials. Bond yields are up 1bp, reversing an earlier drop, as the USD appreciates on the back of a slide in the euro and yen. Commodities are mixed with crude higher, natgas lower, precious metals flat, base metals down, and Ags mixed. Today’s macro data is light with on Dallas Fed Mfg Activity but it's a crazy busy week with the Fed decision on deck, 38% of all companies reporting, the jobs report on Friday and much more (full preview coming).

In premarket trading, Mag 7 names are all higher (Tesla +1.6%, Nvidia +0.7%, Amazon +0.6%, Meta +0.4%, Alphabet +0.4%, Microsoft +0.3%, Apple +0.2%).

In the biggest news over the weekend, Trump and European Commission President Ursula von der Leyen announced the EU deal on Sunday at his golf club in Turnberry, Scotland, although they didn’t disclose the full details of the pact or release any written materials. And even as fears of a damaging trade war ease, optimism is tempered by the risks posed from the US jobs report, Fed and BOJ meetings and earnings from megacap companies this week. Early gains in European automakers faded and the euro slid to its lowest in a week against the dollar as investors digested more negative aspects of the accord.

US energy stocks moved higher after Trump said the EU agreed to buy $750 billion in American energy products and invest $600 billion in the US on top of existing expenditures.

“This deal removes any uncertainty which has been reflected in the positive market movements this morning,” Michael Browne, global investment strategist at Franklin Templeton Institute, wrote in a note. “We will now have to see what the tariffs mean for businesses and how they will be absorbed, but it will vary by sectors.”

Elsewhere, Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng are scheduled to meet in Stockholm on Monday amid a report their two countries are expected to extend their tariff truce by another three months. “Markets like certainty and we should expect a deal very soon,” according to Franklin Templeton Institute’s Browne.

Meanwhile, Mag 7 members Apple, Amazon.com, Microsoft and Meta are all due to report numbers. Robust corporate earnings have bolstered investor confidence in US stocks, as companies head for their highest share of beats since the second quarter of 2021.

Progress in trade deals, positive economic data and corporate resilience have offset worries that stocks are overheating. More than 80% of S&P 500 companies have exceeded profit estimates, according to data compiled by Bloomberg Intelligence.

Later in the week, the Bank of Japan is set to keep interest rates unchanged with traders on alert for any signs of future guidance by the central bank.

In geopolitical news, leaders of Thailand and Cambodia are set for talks Monday to halt the deadliest clashes between the neighbors in more than a decade.

European stocks and US futures both advance after the European Union secured a trade deal with President Donald Trump over the weekend, further easing fears of a damaging trade war ahead of the Aug. 1 deadline. The Stoxx 600 climbs 0.6% with technology, real estate and health care names leading gains. Automotive stocks jumped in early trading but later slipped as investors focused on more negative aspects of the deal. European chipmakers rise after Samsung won a contract to build AI chips for Tesla. Here are the biggest movers Monday:

Earlier in the session, Asian equities declined as investors assessed a US trade deal with the European Union and considered the potential for negotiations with other nations, including China. The MSCI Asia Pacific Index dropped 0.3%, with Advantest weighing on the gauge after a UBS downgrade. Japanese and Indian shares were among the biggest decliners in the region. Samsung rose after it signed a $16.5 billion pact to make chips for Tesla. Shares in Hong Kong, China, Indonesia and Taiwan advanced. The MSCI Asian benchmark climbed last week to the highest since March 2021, as US deals with Japan and other nations buoyed optimism ahead of President Donal Trump’s Aug. 1 tariff deadline.

“The rally since ‘Liberation Day’ is due to a change in sentiment and expectations, rather than a change in fundamentals,” Chi Lo, senior market strategist, APAC at BNP Paribas Asset Management, said in a Bloomberg TV interview. “If we get a shock, such as China-US trade talks not going as expected, that could be a trigger for a pullback,” he added.

In FX, the dollar strengthens for a third straight session with the Bloomberg Dollar Spot Index up 0.4%. The antipodean currencies are leading losses against the greenback among the G-10 currencies, falling around 0.7% each. The euro is not far behind with a 0.6% drop having erased an earlier gain. The pound has been the most resilient, albeit still losing 0.2%.

In rates, treasuries are little changed in early US trading, off day’s best levels reached during London morning following weekend announcement of a US-EU trade accord. Yields are back within 1bp of Friday’s closing levels after declining by 2bp-3bp; dominant themes last week included progress toward trade agreements averting steeper US tariffs on imports, and US administration pressure on Fed Chair Jerome Powell to step down before his term ends next year. 10Y Treasurys are trading at 4.40%, up 1bp from Friday's close, erasing an earlier drop. An accelerated and compressed coupon auction cycle begins with $69b 2-year note sale at 11:30am and $70b 5-year at 1pm; it concludes Tuesday with $44 billion 7-year, the last coupon auction of the May-July financing quarter. Quarterly refunding announcement for August-to-October is ahead Wednesday.

In commodities, spot gold is steady near $3,338/oz. WTI rises 0.6% to near $65.60 a barrel. Bitcoin is hovering just below $119,000.

Looking at today's US economic data calendar, we only have July's Dallas Fed manufacturing activity (10:30am); key employment indicators are ahead this week including JOLTS job openings, ADP employment change and employment report. Fed officials are in external communications blackout ahead of their July 30 rate decision; swap contracts linked to future Fed rate decisions continue to fully price in one quarter-point rate cut this year in October, and most of a second one by year-end.

Market Snapshot

Top Overnight News

Trade/Tariffs: US-EU Deal

Trade/Tariffs: US-China

A more detailed look at global markets courtesy of Newsquawk

European bourses (STOXX 600 +0.7%) opened entirely in the green, benefiting from the EU-US trade agreement. As the morning progressed, indices waned off best levels, but still remain in the green. Nothing behind the slight pressure, but likely some profit-taking ahead of this week's key risk events, which include US PCE, NFP and a slew of earnings. European sectors hold a strong positive bias. Healthcare has been buoyed by the EU-US trade deal, where the EU secured a 15% rate for a vast majority of EU exports including cars, semiconductors and pharmaceuticals. Autos were initially strengthened by the announcement, but now trade mixed as traders digest the financial implications of the tariff - Germany's VDMA said that the "trade deal will cost German auto firms billions every year". Media is found at the foot of the pile, joined by Basic Resources.

Top European News

APAC stocks were ultimately mixed despite early tailwinds following the announcement of the US-EU trade deal, while gains were capped ahead of a slew of risk events this week and with Japan pressured amid political uncertainty. ASX 200 traded higher but with upside limited amid light catalysts and ongoing global trade uncertainty, while participants digested quarterly activity updates. Nikkei 225 wiped out its opening gains and dipped into negative territory amid political headwinds with Japan's ruling LDP said to have collected enough signatures on Friday to call a general meeting that will hold PM Ishiba accountable for the party's recent crushing election loss, while participants also brace for the BoJ policy meeting this week where analysts reportedly see the BoJ providing a less gloomy view and signalling the potential for resuming rate hikes later in the year. Hang Seng and Shanghai Comp were mixed ahead of US-China trade talks in Sweden and with the trade truce expected to be extended for 90 days.

Top Asian News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Russia-Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

This week’s key August 1st trade deadline is rapidly becoming a non-event. The last of the significant agreements was concluded yesterday, with the US and EU reaching a deal that mirrors the structure of the recent US-Japan accord. European stock futures are up around a percent in Asia as a result. The agreement includes a 15% tariff on autos, excludes pharmaceuticals, and maintains the existing 50% tariffs on steel and aluminium. In a significant gesture, the EU has pledged to import $750 billion worth of energy, invest $600 billion into the US economy, and purchase “vast quantities” of military equipment. Additionally, the EU has committed to opening its markets to US goods at zero tariffs. On pharma there was some confusion as to whether the EU will be exempt from the upcoming Section 232 investigation on the sector. For now, there is mixed commentary on this from both sides.

Meanwhile, US-China negotiations are underway in Stockholm today and tomorrow. Although their bespoke August 12th deadline looms, early reports — so far only from Chinese press headlines — suggest a 90-day extension has been granted. This development, if confirmed, would further reduce the urgency surrounding this week’s trade calendar. So expect the White House stationery cupboard to take a hit this week, with a flurry of letters flying out— but in the context of most of the big trade understandings having already been agreed.

Adding a curveball to the week though, Thursday (July 31st) will see the Federal Appeals Court hear the International Trade Court’s ruling that President Trump’s use of an emergency declaration to impose tariffs was unlawful. Frankly, it’s hard to gauge the outcome or the potential impact if the policy is indeed struck down—so this is one to watch. It feels like the agreements made with other countries would likely stand even if the court ruling continues to go against Mr Trump. For others he will pivot to different methods of imposing tariffs. So perhaps no major impact now, but we will see.

Turning to central banks, the Federal Reserve meets on Wednesday. The key question is whether enough uncertainty has lifted for the Fed to signal a clearer policy direction for September. Our US economists preview the meeting here and expect the Fed to hold rates steady for a fifth consecutive meeting, maintaining its current guidance without offering new clues about September. Notably, they anticipate two governors will dissent—something that hasn’t happened since 1993—at a time when political pressure on Chair Powell is intensifying. Also meeting this week are the Bank of Canada (Wednesday) and the Bank of Japan (Thursday), both expected to keep rates unchanged.

The Fed isn’t the only focus in the US this week. It’s a packed schedule for data and earnings, culminating in Friday’s payrolls report. Deutsche Bank forecasts a headline gain of just +75k (vs consensus +109k and last month’s +147k), and +100k for private payrolls (matching consensus and up from +74k last month). The difference reflects a reversal in strong state and local hiring seen in the previous month. Both DB and consensus expect the unemployment rate to tick up to 4.2%. Importantly, our economists believe that with lower immigration, even payrolls in the 50–100k range could still tighten the labour market. Other labour indicators this week include the JOLTS report tomorrow and ADP data on Wednesday.

Also on Wednesday, Q2 US GDP is expected to show a +2.1% print, rebounding from -0.5% in Q1. Thursday brings the crucial June core PCE data, alongside personal income and consumption figures. Rounding out the US data highlights, we’ll see the Conference Board’s consumer confidence index for July tomorrow (DB forecast 96.1 vs 93.0 in June), the Q2 employment cost index, and the ISM manufacturing gauge for July on Friday (DB forecast 49.5 vs 49.0 in June).

In other US news, the Treasury refunding announcement is due Wednesday, following today’s borrowing estimate. Remember that a couple of summers ago this announcement shocked markets with unexpectedly large long-term debt auctions. However, since then, the Treasury has managed the process to avoid such surprises.

In Europe, July CPI and preliminary Q2 GDP figures will be released across major economies. Spain’s inflation report comes Wednesday, followed by France, Italy and Germany on Thursday, and the Eurozone on Friday. GDP prints begin with Spain on Tuesday, then Germany, France, Italy and the Eurozone on Wednesday. Labour market data will also be released throughout the week. Tomorrow, the ECB will publish its consumer expectations survey for June.

In Asia, key releases include July PMIs in China on Thursday and Friday, and Japan’s June industrial production, retail sales and July consumer confidence on Thursday. Bloomberg’s median estimates suggest China’s manufacturing PMI will remain unchanged at 49.7, while the non-manufacturing index is expected to dip slightly to 50.3 from 50.5 in June.

Corporate earnings will be intense, with 159 S&P 500 and 113 Stoxx 600 companies reporting. The spotlight will be on Microsoft and Meta (Wednesday), followed by Apple and Amazon (Thursday)—together representing 20% of the S&P 500. Expect plenty of focus on AI capex and monetisation prospects. See the full week ahead in their day-by-day calendar at the end as usual.

In Asia this morning markets are relatively subdued outside of DM futures with the Nikkei (-0.99%) the main decliner. Mainland Chinese stocks are largely flat but with the Hang Seng +0.4% higher and the KOSPI up +0.25%. USTs are flat but 10yr JGBs are -4.3bps lower. S&P (+0.42%) and Nasdaq (+0.57%) futures are higher.

Looking back at last week now, the US reached significant tariff agreements with the Philippines (19%), Indonesia (19%) and Japan (15%). Mr Trump’s deal with Japan was notably lower than expected (15% vs 25%), including a reduced tariff on Japanese automobiles. This helped the Nikkei gain +4.11% over the week, with its best daily performance (+3.51%) since the 90-day extension announced in April. Globally, markets responded positively, buoyed by optimism that more deals would be finalised before August 1. Mr Trump stated on Friday that most deals were done and that “some letters will say 10%, 15% tariff rate.” The S&P 500 rose +0.49% on Friday to a new record high (+1.88% on the week), despite Mr Trump’s comments about limited negotiations with Canada and potential unilateral tariffs.

In Europe, markets started the week lower amid concerns over stalled US-EU negotiations, but sentiment improved as reports suggested a deal centred around a 15% tariff rate was close. The STOXX 600 and FTSE 100 both ended the week up +0.57%, though Germany’s DAX slipped -0.32%.

Elsewhere, ECB President Christine Lagarde struck a surprisingly hawkish tone on Thursday as the ECB held rates steady for the first time this year. This led investors to reassess the likelihood of further cuts, with only 16bps of easing now priced by year-end (-8.1bps on the week). Two-year bund yields rose +7.8bps. On Friday, ECB’s François Villeroy de Galhau said the bank should “remain completely open on future decisions,” and highlighted the euro’s rise, noting its “significant disinflationary effects.” The euro gained +0.82% against sterling, reaching its highest level since late 2023.

Meanwhile, in the US, the Treasury curve flattened sharply amid easing trade concerns, strong data and reduced fears that Mr. Trump might dismiss Fed Chair Powell. Data highlights included the lowest weekly jobless claims since April (217k vs 226 expected) and the strongest composite PMI since December (54.6 vs 52.8). The two-year yield rose +5.4bps on the week, while the ten-year yield fell -2.8bps—marking the steepest flattening of the 2s10s curve since February. On Friday, the ten-year yield dipped -0.8bps as Mr Trump reassured markets he wouldn’t fire Powell, quoting Powell as saying “the country is doing well,” which Mr Trump interpreted as a signal for lower rates. Still, Fed futures continue to price in less than 1bp of easing for this week’s FOMC meeting.