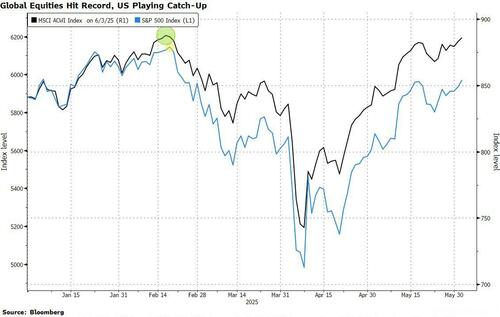

US equity futures are higher, following European and Asian markets, while the MSCI All-country world index surpassed the February record high: as if April never happened. As of 8:00am, S&P futures are up 0.2%, trading just shy of 6,000 and on the verge of a 20% bull market rebound from the April low even with some negative trade developments overnight: Trump said that China’s Xi is very tough to make a deal with, and signed an order to raise steel and aluminum tariffs to 50% from 25%. Nasdaq 100 futures are up roughly the same, with Mag 7 names mostly higher premarket led by NVDA (+0.9%) and TSLA (+0.8%). Bond yields and USD are flat; Commodities are mostly unchanged as well, although Ags are higher and gold dips. Trump says Xi is “extremely hard” to make a deal with (here); the White House said that they are expecting a Trump-Xi call this week. The 50% steel tariffs will take effect today; key macro data to watch are May ADP employment change (8:15am), S&P Global US services PMI (9:45am) and ISM services index (10am).

In premarket trading, Magnificent Seven stocks are mostly higher (Nvidia +0.7%, Tesla +0.6%, Meta +0.5%, Amazon (+0.5%, Alphabet +0.4%, Microsoft 0%, Apple -0.5%).Here are some other notable premarket movers:

Overnight, Trump’s comments on social media about Xi in which he said "he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!" cast doubt over their fragile economic truce, while China is also said to be considering placing a major order with Airbus, a blow for America’s biggest exporter, Boeing. There’s also wrangling over Trump’s massive tax bill. Elon Musk slammed the bill as a budget-busting “abomination,” while Senate Majority Leader Thune said the House SALT deal will have to change.

“It’s really getting complicated for investors to position themselves given the lack of visibility, the uncertainty and with markets fully valued,” said Roland Kaloyan, head of equity strategy at Societe Generale SA.

While some economists fear a notable weakening in US employment in the coming months under the weight of tariffs, that hasn’t shown up in the data yet. The muted impact has lifted optimism and helped offset concerns over President Donald Trump’s trade policies, which economists have warned could lead to an economic slowdown. Investors will follow services data and ADP’s report on private-sector employment later Wednesday for updated information on the strength of the US economy, ahead of Friday’s nonfarm payrolls report.

Options traders are betting the S&P 500 will post its smallest swing in months following Friday’s employment report, highlighting how the recent data has calmed investor worries over the economic impact of Trump’s tariffs. The S&P is projected to move 0.9% in either direction on Friday, according to data compiled by Piper Sandler. That figure, based on the prices of S&P 500 options straddles as of Tuesday’s close, is the smallest implied swing ahead of a jobs print since February.

“The fact is that everybody was waiting for the US economy to break, but the jobs data from yesterday demonstrates that it’s not,” said Benjamin Melman, chief investment officer at Edmond de Rothschild Asset Management. “As far as institutional investors are concerned, this is the most hated rally in a while.”

Meanwhile, with US futures little changed but on the cusp of a bull market, the MSCI All-Country World Index hit an all-time peak for the first time since February.

Global investors have dry powder to buy dips and this will help the “unloved rally” continue in the absence of strong negative news, according to strategists at Barclays. But no-one seems enthusiastic. “As far as institutional investors are concerned, this is the most hated rally in a while,” said Benjamin Melman, chief investment officer at Edmond de Rothschild Asset Management.

Still, technicals might suggest US equities are poised for a breakout. And with Nvidia reclaiming the title of the world’s largest company, the Mag 7 stock bounce has been greater than the corresponding P/E multiple expansion.

In Europe, the Stoxx 600 is up 0.7%, having extended gains after EU Trade Commissioner Sefcovic said trade talks with the US are “advancing in the right direction at pace” in a post on X. The DAX outperforms its regional peers, rising 1% after the German cabinet approved a package of tax breaks for companies worth an estimated €46 billion. Miners and technology shares lead gains, with chipmakers rallying after US peer ON Semiconductor reported a recovery in demand. Personal-care stocks and autos lag. Among individual movers, Airbus advances following a report that China is considering placing an order for hundreds of aircraft as soon as next month. Here are the biggest European movers:

“Europe is still cheap but that steep discount is no longer there,” An Do, portfolio manager at Julius Baer, told Bloomberg TV. “There is still room for US assets that are truly unique. The Magnificent 7, or large cap tech, is still growing earnings at high 30% year-on-year.”

Earlier in the session, Asian stocks gained, led by South Korea as investors cheered the presidential election victory of Lee Jae-myung, which is seen potentially driving another leg up for the market. The MSCI Asia Pacific Index rose as much as 0.9%, with TSMC and SK Hynix among the biggest boosts to the benchmark. Korea’s Kospi jumped 2.7% to enter a technical bull market. The outcome of Korea’s election ended a months-long political leadership vacuum, and is fueling bets on further progress in the nation’s corporate reform drive. Hong Kong shares trimmed gains after President Donald Trump called Xi Jinping very tough to make a deal with, underscoring mounting uncertainty over the progress of US-China trade talks. Investors are also digesting the impact of higher US tariffs on steel and aluminum, after Trump officially signed a directive doubling the levy to 50%.

In FX, The Bloomberg Dollar Spot Index falls 0.1%. The Norwegian krone is leading gains versus the greenback, rising 0.5%. The euro adds 0.2% after euro-area composite PMI was revised higher to show a modest expansion rather than a contraction in May.

In rates, treasury long-end yields are about 1bp richer on the day while front-end is about 1bp cheaper, flattening the yield curve slightly. US 10-year yields are 1bp higher at 4.46% with bunds and gilts in the sector trading slightly cheaper; long end’s slight outperformance flattens 5s30s curve by about 2bp. Price action in European core rates is similarly muted, and US stock and oil futures trade near Tuesday’s highs. Gilts lead a selloff in European government bonds with UK 10-year yields rising 3 bps to 4.67%. Focal points of US session include ADP employment and ISM services gauge and Bank of Canada rate decision. Dollar swap spreads remain near Tuesday’s highs, following a late jolt higher after report that Wells Fargo & Co. has been released from a Federal Reserve asset cap that restricted its size for more than seven years

In commodities, oil prices edge lower after a two-day gain as rains slowed the growth of some blazes that had disrupted Canadian crude production. WTI falls 0.3% to $63.20. Spot gold climbs $10 to around $3,363/oz.

Looking at today;s US economic data includes May ADP employment change (8:15am), S&P Global US services PMI (9:45am) and ISM services index (10am). Fed releases latest Beige book at 2pm. Bank of Canada rate decision expected at 9:45am. Fed speaker slate includes Bostic and Cook at 8:30am

Market snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following the gains on Wall St where sentiment was lifted by better-than-expected JOLTS data and with some slight optimism with US President Trump and Chinese President Xi reportedly set to speak this Friday. ASX 200 was led higher by outperformance in the energy sector and with participants unfazed by recent data releases including the miss on Q1 GDP. Nikkei 225 advanced at the open following recent currency weakness but with further upside capped by a lack of drivers. KOSPI outperformed and is on course for a bull market following the Presidential Election which was won by the DP's Lee Jae-Myung who was later sworn in. Hang Seng and Shanghai Comp conformed to the positive mood but with gains capped as China remained quiet regarding a potential Trump-Xi call.

Top Asian News

European bourses (STOXX 600 +0.6%) opened modestly firmer across the board and have traded with an upward bias throughout the morning – currently at session highs. Aided by PMIs and potentially the readout from Sefcovic on his call with Greer. European sectors hold a strong positive bias and aside from the top performer, the breadth of the market is fairly narrow. The European auto sector has been in focus today, with European auto supplier association, Clepa, suggesting production lines and plants have already been shut and the impact will likely grow in the next 3-4 weeks. This sparked some modest pressure in the sector.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US event Calendar

DB's Jim Reid concludes the overnight wrap

Sentiment and data haven't been great so far this week, but ever since the weak US ISM manufacturing data on Monday, markets have steadily climbed with the S&P 500 up +1.86% since the lows after it was released, including another +0.58% gain yesterday as the headline JOLTS data was broadly positive (more below). So the index is now up +19.82% since the closing low after Liberation Day, leaving it just shy of the 20% threshold that would technically mark the start of a bull market. We have the ISM services today so we'll see if that provides the same market response.

The mood was boosted yesterday by tech and semiconductors stocks, as Meta’s deal to enter a 20yr agreement with the largest US nuclear operator seemed to energise the sector. The deal was said to be cheaper than a similar one powered by Microsoft last year as it used existing facilities. It shows just how much energy demand there will be going forward from AI and the lengths these firms will go to maintain their green credentials as fossil fuels would be cheaper. I ran a "Deep Research" search last week where I uploaded a number of my previous reports and asked it to do a summary of the new World Outlook document in my style. Unfortunately it took 18 hours of processing. When I asked for updates it kept on saying "just give me 45 more minutes, I'm nearly there". In the end I gave up but I hate to think how much splitting of how many atoms was needed for it to take that long. Maybe my writing style is so chaotic it blew up their servers. I should say Deep Research is incredible but it’s trial and error as to what it does well and what it does less well.

The Philadelphia Semiconductor Index (+2.48%) took the news well, with Nvidia (+2.95%) seeing its market cap narrowly overtake Microsoft to reclaim the position of the world’s most valuable company for the first time since January. That also helped the NASDAQ outperform (+0.85%), though the Mag-7 saw only a modest gain (+0.23%) as Alphabet slid by -1.69% and Meta itself fell by -0.60%. So signs of an ongoing debate over which tech companies will gain from AI. The gains in the US also occurred in Europe, where the STOXX 600 (+0.09%), the FTSE 100 (+0.38%), DAX (+0.67%) and CAC 40 (+0.34%) all rose. On the tech theme, my colleague Marion Laboure published her tech performance review for May, which is highly relevant given the sector’s surprising uplift in recent days.

One of the most important catalysts for the recovery was that JOLTS report, which showed the US labour market in a more robust position than previously thought. Specifically, job openings unexpectedly rose to 7.391m in April (vs. 7.1m expected), so that push back against fears that companies would dial back hiring after Liberation Day. The quits rate of those voluntarily leaving their jobs did edge down a tenth to 2.0%, but that was also within its range over the last 12 months, so not a cause for alarm. The report coincided with the start of the risk-on move, with bond yields also moving higher after the release. By the close, that meant the 10yr yield (+1.4bps) was up to 4.46%, and the 30yr yield (+1.6bps) rose to 4.98%, edging closer to 5% again. The moves also got momentum from the latest rise in oil prices, with Brent crude (+1.55%) up to $65.63, its highest level in nearly three weeks.

We also had some fresh trade headlines yesterday, as Reuters reported that the Trump administration wanted countries to provide their best offer by today on the trade negotiations. As a reminder, there’s just over a month until the 90-day extension for the reciprocal tariffs runs out on July 9, so the US are trying to negotiate lots of deals before that, and Press Secretary Karoline Leavitt said that “I can confirm the merits in the content of the letter”. Leavitt also suggested that there would be a call between Trump and China’s President Xi “very soon”. Otherwise, Trump also signed the executive order yesterday that imposed the higher 50% tariffs on steel and aluminium announced on Friday, and these took effect overnight. The UK is exempt from the increase until July 9 to allow the two countries to work out new levies or quotas under the framework deal they agreed last month.

Earlier in the day, the initial market plunge seemed to coincide with the collapse of the Dutch government after the far-right Freedom Party (PVV), the largest in the Netherlands’ parliament, withdrew from the ruling coalition. The move came as other parties in the four-party coalition refused to back the PVV’s proposed migration curbs. This marks the second time in two years that a Dutch government has collapsed due to differences over migration policy. Incumbent Prime Minister Dick Schoof will continue in a caretaker role until snap elections are held. There wasn’t too much of an impact on markets however, as even though the country’s main equity index, the AEX, slid -0.75%, it had recovered by the afternoon to close up +0.21%. European bond yields also saw little movement, with 10yr bunds (unch), OATs (+0.2bps) and BTPs (-0.5bps) fairly steady, although gilts (-2.9bps) outperformed.

Elsewhere in Europe, the Euro Area flash CPI print fell to just +1.9% in May (vs. +2.0% expected), marking the first sub-2% headline print in four years (excluding the 1.7% surprise in September 2024). Moreover, core CPI was down to just +2.3%, the lowest since January 2022. The print cemented market expectations that the ECB would deliver another rate cut tomorrow, and showed that the April spike in services inflation was mostly noise associated to strong Easter effects. Underlying services inflation momentum has eased significantly and our European economists believe there’s still scope for further services disinflation.

Overnight in Asia, markets have put in a very strong performance that built on the overnight gains from Wall Street. In particular, South Korea’s KOSPI (+2.45%) has surged after the election of Lee Jae-myung as President, with the index trading at a 10-month high this morning. So if it closes at that level, it would be up more than +20% from its closing low after Liberation Day, marking the technical definition of a bull market. In addition, the country’s headline CPI print also fell to +1.9% in May (vs. +2.1% expected). But there’ve been gains across the board, with the Nikkei (+0.88%), the Hang Seng (+0.72%), the CSI 300 (+0.52%) and the Shanghai Comp (+0.43%) all advancing. Australia’s S&P/ASX 200 (+0.79%) has also risen this morning, despite underwhelming Q1 GDP figures that showed the economy only grew by +0.2% (vs. +0.4% expected). Looking forward however, US equity futures are pointing a bit lower this morning, with those on the S&P 500 down -0.04%.

To the day ahead now, data releases include the US ADP report for May and ISM services, the final services and composite PMIs from the US and Europe, and Canada’s Q1 labor productivity. Central bank speakers include the Fed’s Bostic and Cook, and we’ll also get the BoC’s decision.