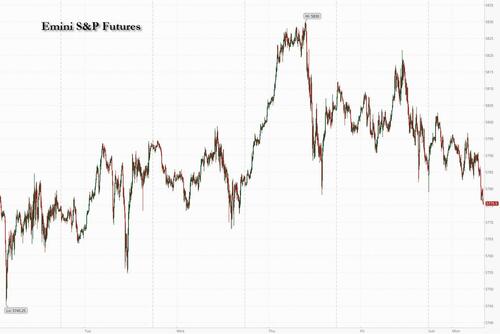

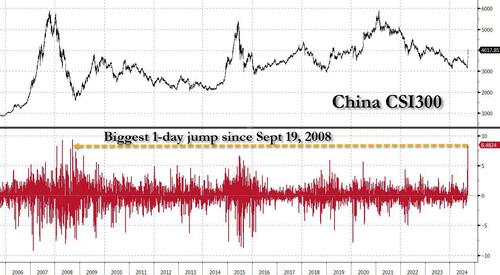

US equity futures reversed earlier gains and are now down at session lows, tracking European market weakness as we close the quarter even as Chinese stocks have their best day since Sept 19, 2008. As of 8:00am, S&P futures are down 0.2% after last week’s record highs on Wall Street, while both Nasdaq (-0.4%) and Russell (-0.6%) underperform pre-market with Mag7 names lower ex-AAPL and TSLA, and semis weaker with NVDA -1.8% as traders look forward to Friday's jobs data and its impact on Federal Reserve interest-rate cuts. Treasury yields climbed 2-4bps, led by the policy-sensitive two-year note, the USD is weaker though. Commodities are mixed with base metals the standout, moving higher on the China trade while oil tumbles as the usual (record) shorters emerge in force despite epic chaos in the Middle East. This heavy data week kicks off with regional indicators and 2x Fed speakers. As JPM notes, economic strength with a Fed tailwind pushed markets to shrug off both negative seasonality and JPY carry unwind. But given the reflationary China growth reboot, can positive US data push this trend into Oct/Nov, or do we see Election uncertainty/vol spike create another downdraft before rallying into year-end as concerns emerge about the Fed's easing cycle when overlaid on China's historic stimulus bazooka? This week’s data may help answer those questions, but the medium-term trend appears to be higher.

In premarket trading, US-listed Chinese stocks rallied - again - after the latest steps by authorities to boost the economy which included step by three of the country’s largest cities easing rules for homebuyers. The moves come after China’s policymakers unveiled aggressive home stimulus to prop up the beleaguered real estate sector. Alibaba (BABA) +4%, Nio (NIO) +13%, Bilibili +8%. Here are some other premarket movers:

Last week, US data bolstered bets for further interest-rate cuts by the Fed and investors will be tuning in for remarks by Fed Chair Jerome Powell on Monday when he takes the stage at a National Association for Business Economics conference. Further out, the US jobs print on Friday could decide whether last week’s risk—on rally can extend. A strong reading might lead to a rotation toward stocks with weaker earnings, according to Goldman strategists.

A positive report may prompt some investors to “price lower odds of substantial labor market weakening,” leading them to “rotate out of expensive ‘quality’ stocks into less-loved lower quality firms,” the team led by David Kostin wrote.

As they prepare for the US data to gauge the outlook for Fed rate cuts, investors must also ponder a cocktail of risks, including rising tensions in the Middle East. The record-setting rally in stocks will also be tested by third-quarter corporate results set to kick off in mid-October.

Political developments in Europe provide an additional layer of complexity. Austria’s traditional political powers are pledging to block the far-right Freedom Party from forming a government following Sunday’s national elections that resulted in its historic victory.

“Right now, we see an improvement in sentiment, which is driven by more stringent action that we see in China — that is good news for the European equity markets,” Marcus Poppe, co-head of European equities at DWS Investment, said in an interview with Bloomberg TV. “But I would caution against expecting that we will see in three-four weeks companies saying: ‘China is picking up.’”

It wasn't good enough on Monday, however, and unlike the boiling euphoria in China, Europe started the week on the back foot with the Euro Stoxx 50 down 0.9% after a series of profit warnings from major automakers. VW and Porsche warned on Friday after the close, followed by Stellantis and Aston Martin on Monday; the Stoxx autos index is down 3.9%. Auto names had benefited from the rotation into cyclical over the past two weeks, but the warnings highlight the risk of blindly jumping into pockets of consumer-exposed names when trends show no signs of improvement. IBEX is flat but outperforms peers, CAC 40 lags, dropping 1.4%. Autos, construction and real estate are the worst-performing sectors. China proxies are seeing support after Hong Kong closed 2.5% higher and CSI300 was up 8.5%, the biggest one day gains since Sept 19, 2008! Iron ore is up 10% supporting mining stocks. France is still weak as the government weighs taxes on corporates earning and higher taxes on share buybacks. Meanwhile concerns of stagflation in Germany, the euro area’s largest economy, and inflation accelerating on a monthly basis in its states prompt traders to trim bets on an ECB interest-rate cut in October. Here are the biggest European movers:

UBS' European trading desk writes that it is 60/40 better to sell with hedge funds balanced and long-only accounts 60/40 sellers. They are busiest in miners and markedly better to buy after the rally in China. There are sellers of industrial and consumer discretionary on the back of the autos profit warnings. Clients are active in food and beverages ahead of a few pre-close calls. There are balanced flows in financials and slightly better buyers in consumer staples.

Europe's downbeat start was in contrast to the mood in China, where the CSI 300 Index jumped as much as 9.1%, the most since 2008, fueled by the stimulus package. The policy steps also buoyed European mining and luxury stocks.

In retrospect, our Sept 21 call that it was "time for China to turn on the printing press" was well-timed.

Taking a broader look at the region, Asian stocks fell amid a selloff in Japan as investors fretted over a surprise outcome in the ruling party’s leadership race, offsetting the optimism in Chinese markets. The MSCI Asia Pacific Index dropped as much as 1.3%, with TSMC and Toyota Motor among the biggest drags. Benchmarks in Japan slumped more than 3% in delayed reaction to the surge in the yen following the LDP election outcome last Friday, while those in Taiwan and Korea fell more than 2% after declines in US tech shares on Friday.

The losses in Japan came after Shigeru Ishiba’s victory wrongfooted investors, forcing them to pare positions that had been built on speculation that Sanae Takaichi would become the nation’s new prime minister and encourage the Bank of Japan to keep interest rates low.

As noted above, shares in China bucked the region’s trend ahead of a weeklong holiday. The CSI 300 Index soared the most since 2008 and entered a bull market, as sentiment got another boost from further government stimulus. Three of the nation’s largest cities relaxed rules for homebuyers, while the central bank also moved to lower mortgage rates. The Hang Seng China Enterprises Index rose for the 12th session.

“Regional allocations may be adjusted to favor China, particularly as Japanese equities face pressure due to rising yen strength following Ishiba’s victory in the LDP election,” said Derek Tay, head of investments at Kamet Capital Partners.

In rates, treasuries bear-flattened, with front-end yields cheaper by around 4bp on the day, following similar front-end-led selloff in bunds after September German regional CPIs. US long-end yields cheaper by only about 0.5bp, with 10-year around 3.77%, cheaper by about 1.5bp; gilts in the sector lag by 0.5bp while bunds outperform slightly. Front-end-led losses flatten 2s10s, 5s30s spreads by 2bp-3bp on the day. Focal points of US session include comments from Fed Chair Powell in the afternoon, while month-end flow has potential to support long-end of the curve. Month-end Treasury index rebalancing at 4pm New York time will extend its duration by an estimated 0.06 year

Meanwhile concerns of stagflation in Germany, the euro area’s largest economy, and inflation accelerating on a monthly basis in its states prompt traders to trim bets on an ECB interest-rate cut in October.

Yields rise across the curve, with the front-end up about 4bps each in bunds, gilts and Treasuries. The Bloomberg Dollar Spot Index is steady. CHF and JPY are the weakest performers in G-10 FX, AUD and DKK outperform. Crude erases gains, with WTI drifting lower to around $68. Spot gold falls roughly $8 to trade near $2,650/oz. Most base metals trade in the green. Bitcoin drops.

Looking at today's calendar, US economic data calendar includes September MNI Chicago PMI (9:45am, several minutes earlier to subscribers) and September Dallas Fed manufacturing activity (10:30am). Fed speakers scheduled include Governor Bowman (8:50am) as well as Powell’s address at the National Association for Business Economics conference in Nashville (1:55pm, text and Q&A expected).

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed heading into month-end amid the backdrop of recent geopolitical escalation and as participants digested a slew of data releases, as well as China's latest support efforts and Japan's leadership transition. ASX 200 was led by outperformance in the commodity-related sectors as oil and metal prices benefitted from geopolitics and China's policy announcements. Nikkei 225 suffered heavy losses amid a firmer JPY following Ishiba's victory against Abe protege Takaichi in the LDP leadership race, while the data releases from Japan were mixed with a steeper-than-expected drop in Industrial Production but Retail Sales topped forecasts. Hang Seng and Shanghai Comp rallied ahead of National Day Golden Week holiday closures despite mixed PMI data from China with advances led by strength in property developers after the PBoC instructed banks to lower interest rates on existing mortgages and lower downpayments, while some Chinese cities also eased home purchase restrictions. Furthermore, the mainland index is on course for its largest gain since 2015 and is set for a bull market after China's latest policy announcements and the PBoC's Monetary Policy Committee quarterly meeting where it pledged several supportive efforts

Top Asian News

European bourses, Stoxx 600 (-0.7%) are modestly lower across the board and to varying degrees, with sentiment in the region failing to piggy-back off China's performance but instead focusing on escalating geopolitics, profit warnings, and upcoming risk events such as Friday's NFP. European sectors are mostly negative; Basic Resources remain aflaot, given the strength in metals prices. Autos is by far the clear laggard after a myriad of guidance cuts today; Stellantis (-12.9%), Aston Martin (-27.5%) and Volkswagen (-2.7%) all slip. As a reminder, Mercedes-Benz (-1.7%) and BMW (-1.9%) both lowered forecasts already earlier in the month. US Equity Futures (ES U/C, NQ -0.1%, RTY -0.3%) are flat/subdued on month end, with traders keeping an eye on this week's risk events including Fed Chair Powell today, US ISMs throughout the week, and US NFPs on Friday. Bytedance, the owner of TikTok, reportedly plans a new AI model built with Huawei's Ascend 910B chips, according to sources; Bytedance is NVIDIA's (NVDA) largest customer for H20 AI chips tailored for the Chinese market.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

Economic Data

Central Banks

Government:

DB's Jim Reid concludes the overnight wrap

Welcome to the last day of the month and it’s a busy week ahead bookended with a Powell speech today and payrolls on Friday. Also key will be the flash CPIs from Germany and Italy (today), and the Eurozone (tomorrow), especially after weak numbers from France and Spain on Friday. This could tip the balance for an October ECB cut. Elsewhere the global reaction to the China stimulus blitz last week will stay ever present even if their golden week holiday starts tomorrow and we won't see domestic markets open over the period. As you'll see below investors are again scrambling to put on China risk this morning ahead of the holiday.

Let's now go into detail on the main events ahead before summarising the rest of the week's highlights. For payrolls, DB expect headline (150k forecast vs. 142k previously) and private (125k vs. 118k) payrolls to be slightly ahead of their 3-month averages of 116k and 96k, respectively. This is broadly in-line with consensus. DB expect the unemployment rate to round up to 4.3% on the back of a slight pick-up in participation (to 62.72%), but the risk is that it could remain at last month's 4.2% reading which is in-line with consensus. There are plenty of other employment signals this week with the ISM surveys, ADP, claims and JOLTS tomorrow. The JOLTS report has historically had one of the most reliable longer-term correlations to the prevailing employment trends but is always lagging by a month. Last month the private sector hiring rate continued near 2014 lows (outside the pandemic) but lay-offs were also lower than any period prior to the pandemic. The private sector quits rate (2.3%), which my colleague Francis Yared places great significance on, is also back close to 2018 levels and he believes more consistent with an unemployment rate of 4.5% using historical correlations as your guide. In short the US labour market can be characterised by currently having relatively low hirings and very low firings. So this is why there is no current drama but why it's wise to be on high alert. One small shock could move things very quickly. Equally a recovery in hiring could increase the gap between the two quite sharply. Interestingly the following month's payrolls figures could be influenced by the Boeing strike in mid-September that we don't think will influence Friday's figures, and a potential dockworkers' one from tomorrow.

The risk of lay-offs increasing and tipping the balance in the current labour market is why the FOMC recently opened up their account with a 50bps cut. Powell's speech today will likely stick to his FOMC script but it's fair to say that Fedspeak since the meeting has been more amenable to additional 50bps cuts than we'd thought they would be. We have another round of Fedspeak this week as you'll see in the day-by-day calendar at the end so plenty of opportunity for that debate to move along even if the payrolls at the end of the week could have a bigger impact.

In Europe, today's German and Italian CPI will take on added significance given how weak Friday's French (1.5% YoY vs. 1.9% expected) and Spanish (1.7% YoY vs. 1.9% expected) numbers were. The Eurozone numbers come tomorrow. If these misses are repeated it probably forces the ECB to either lean towards 25bps next month or 50bps in December instead of 25bps. So important releases.

In terms of the rest of the week across the globe, the main highlights outside those already discussed are the Chicago PMI and Lagarde speech today, various global manufacturing PMIs and US ISM alongside the US Vice President debate and the Japanese tankan survey tomorrow, US ADP and Eurozone unemployment on Wednesday, and various global services PMIs and ISM and Eurozone PPI on Thursday. Outside of data a policy speech by French PM Barnier tomorrow will give clues to how the budget will materialise.

This morning, Asian equity markets have seen some big early moves. The Nikkei has dropped by -4.64% following Friday's surprise selection of Shigeru Ishiba as the next prime minister, who has previously criticised the Bank of Japan’s loose policies. In contrast, stocks in mainland China are notching up a ninth day of gains ahead of a week long holiday tomorrow. The CSI is up by +5.84%, initially surging as much as +6.5%, the largest jump since 2015. The Shanghai Composite is also up by +5.28% with the Hang Seng +2.91% in early trading. Elsewhere the KOSPI is down by 0.88% and US futures are pretty flat.

Coming back to China, official factory activity slightly improved in September but stayed below 50 for a fifth consecutive month in September. This will be seen as backward looking now but for completeness, the manufacturing PMI came in at 49.8 in September (v/s 49.4 expected), up from 49.1 in August with the services PMI at 50.0 (v/s 50.4 expected), down from a level of 50.3 in the previous month. However, China’s Caixin PMI was 49.3 in September (v/s 50.5 expected), experiencing its sharpest contraction in 14 months. It followed a reading of 50.4 in August. The services Caixin PMI at 50.3 in September, was down from 51.6 in August.

Elsewhere, Japan's industrial output in August fell -3.3% m/m, as significant miss compared to market expectations of a -0.5% decline and against an increase of +3.1% in July. On a brighter note, retail sales increased by +2.8% y/y in August, surpassing market forecasts of +2.6% y/y following an upwardly revised gain of +2.7% in July.

Turning to politics, Austria’s far-right Freedom Party achieved a landmark victory in the parliamentary election on Sunday, strengthening pro-Russian and anti-establishment movements in Central Europe. This marks the first far-right national parliamentary election victory in Austria since World War II. Preliminary official results showed that the Freedom party secured first place with 29.2% of the vote, while Chancellor Karl Nehammer’s Austrian People’s Party came in second with 26.5%. The center-left Social Democrats finished third with 21%. The outgoing government, a coalition between Nehammer’s party and the environmentalist Greens, lost its majority in the lower house of parliament. Despite the Freedom Party’s success, it seems unlikely that their leader, Herbert Kickl, will become the new leader, as he would need a coalition partner to achieve a parliamentary majority. Rivals have stated they will not collaborate with Kickl in government.

Looking back at last week now, risk assets surged as China’s stimulus announcements and positive US data led to renewed optimism about the global outlook. In fact, it was the strongest week for the Hang Seng since 1998, with a +13.00% advance over the week (+3.55% Friday). And for the CSI 300, it was its best week since 2008, with a +15.70% advance (+4.47% Friday). China-exposed stocks in the US and Europe did very well in response too.

In terms of those broader gains, the stimulus announcement meant the CAC 40 had its best weekly performance since March 2023 with a +3.89% gain (+0.64% Friday), aided by the luxury goods companies in the index. Copper was another beneficiary, posting its biggest weekly gain since May with a +7.43% advance (+0.40% Friday). And the major indices more broadly had a very strong week, as the STOXX 600 hit another all-time high thanks to a +2.69% gain last week (+0.47% Friday). The gains were more modest in the US, with the S&P 500 advancing by +0.62% (-0.13% Friday).

Sovereign bonds had a decent end to the week thanks to softer-than-expected inflation data on both sides of the Atlantic. As already discussed, the preliminary reading for French CPI fell to +1.5% in September on the EU-harmonised measure (vs. +1.9% expected), and the Spanish reading was down to +1.7% (vs. +1.9% expected). So that led to growing expectations that the ECB might deliver another cut at their October meeting, particularly after the weak flash PMIs at the start of the week. Over the course of the week, that saw investors dial up the chance of an October cut from 26% to 82%, so a significant move. And in turn, that led 10yr bund yields to fall -7.4bps last week (-4.9bps Friday). However, there were still several concerns about the fiscal situation in France, and the Franco-German 10yr spread widened +2.9bps last week to 79bps.

Over in the US, on Friday we got the August numbers for PCE inflation, which is the measure that the Fed officially targets. This came in slightly below expectations, with headline PCE inflation down to +2.2% year-on-year (vs. +2.3% expected), which is only just above the Fed’s 2% target, and the lowest reading since February 2021. Annual core PCE was in line with expectations at +2.7%, but with the monthly reading a touch lower at +0.1% (+0.13% unrounded vs. +0.2% expected). That helped the 10yr Treasury yield to fall back on Friday, although over the week as a whole it was still up +1.0bps (-4.5bps Friday). The other report of note on Friday was the University of Michigan’s final consumer sentiment index for September, which came in at a 5-month high of 70.1.