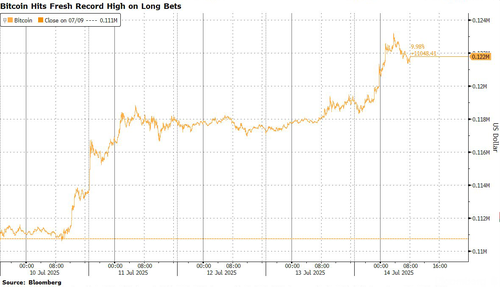

US equity futures are lower, although well off session lows, and European stocks slumped after Trump’s weekend threat to slap 30% tariffs on EU and Mexico, providing a test for markets that were recently at record highs. With global yields blowing out, as German and Japanese long-dated bonds slumped as traditional safe havens were ignored, amid the risk-off tone the only flight to safety today are cryptocurrencies and precious metals, with Bitcoin surging to a new record high of $122,000 while silver rose above $39 for the first time since 2011. As of 8:00am ET, S&P and Nasdaq futures are down 0.3% after Trump said the tariff rates will kick in on Aug. 1 if the EU and Mexico can’t negotiate better terms, and investors will need to make the call on whether he’s going to follow through this time, with Mag 7 names mostly lower premarket with NVDA/TSLA in the green. Semis are also under pressure and cyclicals and defensives are mixed, pointing to a choppy session. The Treasury yield curve is seeing a slight bear steepening while the USD is flat. Commodities are stronger across all 3 complexes with crude, nat gas and silver the standouts. A flurry of economic data is in focus this week, with CPI due on Tuesday and PPI on Wednesday plus the unofficial start to earnings season with all the big banks reporting.

In premarket trading, Mag 7 stocks are mixed (Tesla +2.7%, Nvidia +0.5%, Meta -0.2%, Alphabet -0.5%, Amazon -0.5%, Microsoft -0.5%, Apple -1%).

In corporate news, Synopsys secured China’s approval to buy out Ansys for $35 billion, while Elon Musk said Tesla plans to poll shareholders on whether to invest in xAI. Nvidia CEO Jensen Huang said the US government doesn’t need to be concerned that the Chinese military will use his company’s products to improve their capabilities. Fastenal is set to report earnings before the market opens. Improved pricing, market share gains and stabilizing short-cycle industrial markets should support accelerated top-line and earnings growth, according to Bloomberg Intelligence. Jane Street has deposited 48.4 billion rupees ($564 million) in an escrow account to comply with an order from India’s securities regulator, part of an ongoing probe into allegations of market manipulation by the US trading giant. Partners Group is selling a large asset in its buyout portfolio to a consortium led by its own infrastructure division.

The week's data will be key to rate-cut expectations and “could set the tone for the direction of the Fed and risk sentiment for the second half of the year,” according to CreditSights. Meanwhile, Trump seized upon a new way to criticize Jerome Powell’s leadership of the Fed: his handling of an expensive renovation of the central bank’s headquarters.

Elsewhere, RBC lifted its S&P 500 year-end target to 6,250 from 5,730, though remains neutral on stocks for the second half, expecting choppy conditions. As reported previously, Goldman strategists expect the S&P 500 to rise by 10% to 6,900 over the next 12 months, implying a P/E multiple on forward consensus earnings of 22 times.

Strategists are also getting worried about earnings. Wall Street is bracing for the weakest season since mid-2023, and are a key source of uncertainty for Goldman clients. Still, earnings revisions are showing a big dispersion between sectors, which creates an opportunity for stock picking, Morgan Stanley’s Michael Wilson said. Key themes include the impact of tariffs and a weaker dollar, and AI-related spending.

Trump’s weekend threat to impose 30% tariffs on the European Union and Mexico is testing market resilience, following a series of escalated trade measures against multiple partners. While traders largely view them as a bargaining tactic and expect final tariffs to be softer, the moves have injected uncertainty just as the S&P 500 was trading near record highs. Elsewhere, Bloomberg reported that the EU is preparing to step up its engagement with other countries hit by Trump’s tariffs following a slew of new threats to the bloc and other US trading partners. Thailand is weighing allowing zero-duty market access for more US goods to help persuade the Trump administration to lower a threatened 36% tariff on its exports.

“The market will generally think this is mostly a negotiation tactic,” noted Deutsche Bank AG strategist Jim Reid. “However, at some stage someone’s bluff could be called. If huge tariffs do get imposed on Aug. 1, in thin holiday markets, we could get a sizable market reaction.”

US inflation figures due on Tuesday is expected to show faster price growth as companies began passing on higher import costs. Alongside retail sales, industrial production and consumer sentiment figures later in the week, the data could test the Federal Reserve’s wait-and-see stance on interest rate cuts. Swaps are still pricing in nearly two quarter-point reductions this year, with a likelihood of around 60% for a first cut in September.

“It is important to note that investors are already pricing in rate cut expectations,” noted Linh Tran, market analyst at XS.com. “If the data points to stronger-than-expected inflationary pressures or a tight labor market, the Fed may be forced to delay rate cuts — potentially triggering a valuation shock for equity markets.”

Meanwhile, Trump again repeated his criticism of Fed Chair Jerome Powell late on Sunday, saying it would be a “good thing” if the central banker stepped down. Deutsche Bank strategist George Saravelos said the potential dismissal of Powell is a major and underpriced risk that could trigger a selloff in the US dollar and Treasuries.

In Europe, major markets are mostly lower with UK leading and Germany lagging after President Donald Trump dials up trade tensions by announcing a 30% tariff on goods from the European Union. Healthcare shares are among the biggest sector gainers, while technology and auto are the biggest laggards. In individual stocks, Hermes falls after Jefferies downgrades to hold after seeing a lack of major growth for the luxury goods maker. The UK's FTSE 100 rose 0.3%, outperforming its European peers that have struggled after Trump threatened the EU with a 30% tariff rate. The Stoxx 50 falls 0.6%. UK equities also benefited from increased bets on interest rate cuts by the Bank of England after Governor Bailey hinted at bigger reductions if the jobs market deteriorates more quickly than the central bank expects. Bailey’s remarks also boosted gilts, most notably at the short-end. UK two-year yields fall 5 bps to 3.81%. Cable dips 0.1% The EU is said to contact other US allies that are tariff targets per BBG, flagging the potential for a coordinated response to the US. Momentum is leading, Cyclicals/Vol are lagging; Growth over Value. UKX +0.4%, SX5E -0.6%, SXXP -0.3%, DAX -0.7%. CSI +0.1%, HSI +0.3%, NKY -0.3%, ASX -0.1%, KOSPI +0.8%.

Earlier in the session, Asian stocks were mixed with China/HK leading and HSTECH was higher but remains in a 2.5 month-long range.

In FX, the Bloomberg Dollar Spot Index adds 0.1% while the yen is the strongest of the G-10 currencies, rising 0.1% against the greenback. The Swedish krona is the weakest with a 0.5% fall.

In rates, treasuries edged lower, with US 10-year yields rising 1 bp to 4.42%. The big overnight bond movers were in Japan and Germany...

... The yield on Japan’s long-term bonds moved sharply higher amid signs of thin liquidity and increasing worries about higher government spending that may spread to other countries. Regarding supply in the US, Treasury coupon auctions are on hiatus until 20-year bond reopening on July 23; investment-grade corporate new issue calendar is blank thus far but expected to feature big-bank offerings later in the week after 2Q results start being reported Tuesday

In commodities, oil prices advance, with WTI rising 1% and above $69 a barrel. Spot gold climbs $10 to around $3,365/oz. Bitcoin rises to another record above $122,000 as traders await "crypto week."

Today's US economic calendar is blank and no Fed speakers for Monday; ahead this week are June CPI, PPI and retail sales.

Market Snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive but with some cautiousness seen following US President Trump's latest tariff letters in which he announced to impose 30% tariffs on the EU and Mexico from August 1st, while the region also reflected on somewhat mixed Chinese trade data. ASX 200 was rangebound as gains in mining, resources and materials offset the weakness in the consumer, industrial, financial and tech sectors, while data showed imports missed estimates for Australia's largest trading partner. Nikkei 225 initially retreated amid tariff uncertainty although the losses were gradually pared as sentiment overnight somewhat improved and Machinery Orders topped forecasts. Hang Seng and Shanghai Comp kept afloat amid the latest trade data in which exports topped forecasts and imports missed but returned to growth, while there were some encouraging comments from the meeting between US Secretary of State Rubio and Chinese Foreign Minister Wang last Friday which was described as constructive and with the odds said to be high for a future meeting between US President Trump and Chinese President Xi.

Top Asian News

European bourses (STOXX 600 -0.4%) have begun the week on the backfoot, after the US issued tariff letters to Mexico and the EU, threatening a 30% tariff rate, effective from August 1st. European sectors opened entirely in the red, though fare better now, with Healthcare and Basic Resources. The former boosted by upside in AstraZeneca (+1.4%) which benefits after its blood pressure related treatment met primary and secondary endpoints. Trade sensitive sectors such as Autos and Consumer Products sit at the foot of the pile. US equity futures (ES -0.3%, NQ -0.3%, RTY -0.4%) are moving in tandem with those in Europe. RTY is once again the underperformer, given the downbeat

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Today ranks high on my list of least favourite days of the year. It’s our annual family trip to a theme park—strategically timed after our kids finish school but before some others break up, meaning shorter queues and more rollercoaster rides. I couldn’t be more thrilled.

Technically, I’m off today, but if you email me—even with something trivial—I’ll treat it as an emergency if I happen to be stuck in a queue and need an excuse to escape.

To use the biggest cliche in the book, it continues to be a rollercoaster ride for all of us following the trade story, even if the market has increasingly overcome its queasiness and ensured it has been well stocked up on motion sickness tablets.

As trade letters from the US continue to get mailed out, April 2nd has become July 9th which has become August 1st for an ever increasing list of countries. In the early hours of Saturday Mr Trump’s stationary cupboard was opened again and a letter was sent to the EU and Mexico informing them that they would face 30% tariffs on August 1st. To be fair, a month ago Trump threaten the EU with a 50% tariff so you might argue this is an improvement! The market will generally think this is mostly a negotiating tactic and that we’re unlikely to see such rates. The EU have been measured in their response so far and have extended the suspension of trade countermeasures that were supposed to kick-in tomorrow night. This will now be aligned to the August 1st deadline. So the EU and the market are hoping and expecting diplomacy to win out.

However at some stage, someone’s bluff could be called. Trump is under less pressure to back down with US risk markets around their highs and bond markets relatively stable at the moment. If huge tariffs do get imposed on August 1st, in thin holiday markets, we could get a sizeable market reaction. So the next three weeks of negotiating will be key to restful holidays everywhere.

If you’re looking for the ultimate way our holidays could be ruined then DB’s George Saravelos put out a thought provoking piece on Friday looking at what might happen if Trump finds a legal reason to dismiss Fed Chair Powell for cause. This is based on the story around whether he misrepresented facts to Congress around renovations at the Fed HQ. See it here. Basically it is likely that this would lead to a sizeable initial sell-off that could be calmed by the other governors forcibly reiterating Fed independence. However much might depend on the inflation trajectory. If all is calm on this front then we could move on but if we start to see slippage here, then a removal of a Fed Chair could be a big problem, at least initially, for a country with huge twin deficits.

Given the above, this week is important as we see the latest US CPI numbers (tomorrow) with PPI (Wednesday) following. Before we preview these, the other key global releases are the other CPI numbers in Canada (also tomorrow), the UK (Wednesday) and Japan (Friday). In the US, there will also be retail sales (Thursday) and industrial production (Wednesday) reports for June, along with the preliminary University of Michigan survey (Friday) for July. Claims on Thursday corresponds to payroll survey week so it’ll be interesting to see whether the recent improvements continue given the payroll implications. Growth will also be in focus in China, where Q2 GDP and June activity data are out tomorrow. Also important will be the US banks kicking off the Q2 earnings season tomorrow, with semiconductor firms ASML and TSMC also reporting this week.

Lets now delve into the main upcoming US data, especially the inflation numbers. In our US economists’ preview (see “Webinar: June CPI preview & webinar registration“), they expect a +0.9% increase in seasonally adjusted gas prices and solid food inflation to boost the headline CPI (+0.34% forecast vs. +0.08% previous) slightly above that of core (+0.32% vs. +0.13%) which would increase the year-over-year growth rate by three- and two-tenths respectively (to 2.7% and 3.0%), and the three- and six-month annualised rates by 1.1 percentage points (to 2.8%) and three-tenths (to 2.9%), respectively. Our economists will be looking mostly at signs of tariff related inflation in the core good categories. Wednesday’s PPI data will also be important for the categories that feed through into core PCE, the Fed’s preferred inflation gauge.

Fed speak will be active after the CPI numbers with a host of appearances so there could be plenty of reaction to the data. See those listed in the day-by-day calendar at the end alongside all the other key events from around the world this week. This includes a G20 finance ministers and central bank governors meeting on Thursday and Friday.

On the start of Q2 earnings, JPMorgan, Wells Fargo and Citi kick off the Q2 earnings season tomorrow. Bank of America, Morgan Stanley and Goldman Sachs will follow on Wednesday. Blackrock, American Express and Charles Schwab will also be among financials reporting. Investors will also focus on messages from results of semiconductor firms ASML (Wednesday) and TSMC (Thursday), with the Philadelphia Semiconductor index now up 15.2% YTD. Other S&P 500 companies reporting this week will include Johnson & Johnson, Netflix, General Electric and PepsiCo. In Europe, notable names include Novartis, Volvo, Sandvik and Saab.

In Asia Europe's stock futures are down around -0.6% after the weekend letter with S&P and NASDAQ futures down around -0.4% so far this morning. The Euro has barely moved. 10yr UST yields are +1bp but 10 and 30yr JGBs are around +5.5bps and +6.5bps higher as fiscal fears dominate ahead of this coming Sunday's Upper House election.

Asian equity markets are actually mostly higher on balance with the KOSPI (+0.64%) continuing its strong gains from the past week, on sustained strength in technology and chipmaking stocks. Chinese stocks are also edging higher with the CSI (+0.20%), the Shanghai Composite (+0.40%) and the Hang Seng (+0.10%) all trading up on strong trade data (more below). On the other hand, the Nikkei is flat on trade worries and higher yields.

Coming back to China, exports regained some momentum in June while imports rebounded, as exporters rushed out shipments to capitalise on a fragile tariff truce between Beijing and Washington ahead of a looming August deadline. Exports rose +5.8% y/y in June (v/s +4.8% in May), beating the market forecast for +5.0% growth. Imports rebounded +1.1% y/y, following a -3.4% decline in May. Markets were expecting a +0.3% rise.

Recapping last week now and tariffs were the dominant story, as President Trump announced the rates that countries would face from August 1. Markets were initially calm, and several indices including the S&P 500 and the German DAX hit a record high. But after more aggressive measures were announced, including a 35% rate for Canada and the potential for a higher baseline tariff, there was a risk-off move into the weekend that left the S&P 500 -0.31% lower for the week (-0.33% Friday). Moreover, several assets impacted heavily by the tariffs witnessed a major underperformance. For instance, Trump announced a 50% rate for Brazil, which was well above the 10% from Liberation Day, and the country’s Ibovespa equity index suffered its worst week since December 2022, with a -3.59% loss (-0.41% Friday). In the opposite direction, the prospect of a 50% copper tariff meant US copper futures surged +9.12% (+0.25% Friday) in their biggest weekly jump since March 2022.

All this meant that US equities struggled towards the weekend. But it wasn’t all bad news, as the Magnificent 7 advanced +0.58% (+0.38% Friday) to its highest since January, with Nvidia’s market capitalisation surpassing $4tn. And in Europe, the Stoxx 600 finished the week up +1.15% (-1.01% on Friday), alongside a +1.97% gain for the DAX (-0.82% Friday). However, there was some weakness in Japan, where the Nikkei fell -0.61% (-0.19% Friday), along with emerging markets, with the MSCI EM index down -0.20% (-0.17% Friday).

Otherwise, government bonds struggled last week as concern mounted about the fiscal situation. Moreover, better-than-expected US data also contributed to the selloff, as investors dialled back the likelihood of rapid rate cuts this year. Indeed, the US weekly initial jobless claims fell for a 4th consecutive week to 227k. So that helped to ease fears about the labour market, particularly given the 4-week moving average for claims had reached a 21-month high in mid-June. In light of all that, Treasury yields posted a fresh increase, with the 10yr yield up +6.4bps (+6.0bps Friday) to 4.41%, whilst the 30yr yield was up +8.8bps (+8.0bps Friday) to 4.95%. That also came amidst mounting political pressure on the Fed, as President Trump said that “Our Fed Rate is AT LEAST 3 Points too high.”

Finally in Europe, last week saw an even larger increase in yields that pushed several up to multi-year highs. For instance, 10yr bunds were up +11.7bps to 2.72%, their highest level since late-March. In addition, the 30yr German yield ended the week at 3.22%, marking its highest closing level since the Euro crisis turmoil in 2011. That was echoed in France as well, as their 30yr yield hit a post-2011 high of 4.20%, having risen +14.7bps last week.