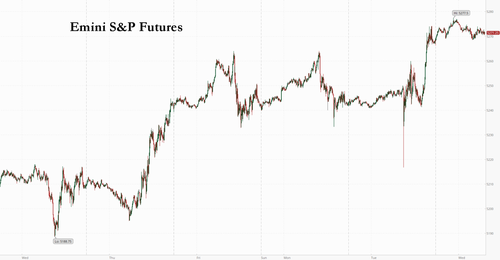

Equity futures were set to hold yesterday's gains ahead of today's CPI report, but will move violently either higher or lower after today's CPI number is released, which will either validate or reject Jerome Powell’s latest signals that interest rates will be higher for longer (our CPI preview is here). European and Asian stocks also gained, and the MSCI All Country World Index extended its longest run of gains since January. At 7:15am ET, futures contracts on the S&P 500 were little changed with small-caps catching a bid, while the MSCI All Country World Index extended its longest run of advances since January. Nasdaq 100 futures were also flat after the underlying index hit an all time high on Tuesday. Bond yields are down 1-2bps across the curve with the USD seeing some weakness. Commodities are higher, led by Energy and Precious Metals. On the macro front, both CPI and Retail Sales at 8.30am ET (previews here and here).

Activity in the premarket is muted with even the meme names up "only" low single digits and Mag7 seeing small moves ex-TSLA which is +0.8%. Here are the most prominent pre-market movers:

In other news, overnight China vowed to take “resolute measures” after the Biden administration’s move to increase US tariffs on a wide range of Chinese imports; Bloomberg also reported that China was preparing a soft nationalization of the real estate sector by buying unsold houses to prop up the property market. In other news, Boeing faces possible criminal prosecution after the Justice Department found it violated a deferred-prosecution agreement tied to two fatal crashes half a decade ago.

In the run-up to US consumer price index data, the S&P 500 advanced despite Jerome Powell’s signals that interest rates will be higher for longer and a mixed reading on producer inflation, amid speculation that today's CPI print will come in below estimates: core CPI, which excludes volatile food and energy costs, is seen slowing to 0.3% month-on-month, from 0.4%; the core CPI reading is expected to show the lowest annual increase yet this year, in which case the core PCE deflator, the Fed’s preferred inflation gauge, could also register its lowest reading in 2024. Into the data, Fed-dated OIS price in around 42bp of rate cuts for the year with the first 25bp fully priced in for the November policy meeting (see our preview here for why a lower than expected number seems likely).

“An in-line-with-consensus US core CPI read is discounted and in the price, but that may be enough to promote relief buyers and see the index push higher,” said Chris Weston, head of research at Pepperstone Group Ltd. “A core CPI read below 0.25% month-on-month and I certainly wouldn’t want to be short.”

A survey conducted by 22V Research showed 49% of investors expect the market reaction to the CPI report to be “risk-on” — while only 27% said “risk-off.”

“A downside surprise seems needed,” said Michael Leister, head of rates strategy at Commerzbank AG. “For one, break-evens have already corrected notably and thus should provide less support for the long-end from here. At the same time, the Fed will remain reluctant to give the all-clear considering the lack of disinflation progress.”

European stocks rallied, led by real estate, telecoms and utilities. The IBEX 35 outperformed while the CAC 40 was flat, lagging peers. In individual stocks, Burberry Group Plc declined after reporting a slump in sales, dragging the consumer goods sector lower. ABN Amro Bank NV dropped more than 5% after unchanged guidance, while Finnish refiner Neste Oyj slumped on a downward revision on sales margins for its renewable products. Here are all the notable European movers:

The euro-zone economy started the year on a stronger footing than anticipated, growing 0.3% in the three months through March following a shallow recession in the latter half of 2023, data Wednesday confirmed. Yet inflation is likely to backpedal more quickly than previously anticipated, with growth picking up next year, according to the European Commission. In contrast to the likely US path for interest rates, Bank of France Governor Francois Villeroy de Galhau said that the European Central Bank is very likely to start easing policy at its next policy meeting in June.

Earlier in the session, Asian stocks closed at the highest level since April 2022, as technology shares were lifted by key earnings reports and gains in US peers overnight. The MSCI Asia Pacific Index climbed as much as 0.6%, with Sony providing the biggest boost after announcing strong results and a buyback. Taiwan stocks led gains among regional equity gauges, with shares also rising in Australia. Markets were closed for holidays in Hong Kong and South Korea.

In FX, the dollar extended declines; Norwegian krone and yen outperformed as all G-10 FX rose. US equity futures were steady while

In rates, major global bonds rallied, led by gilts. US 10-year yields dropped to a five-week low of around 4.42% before US CPI data as treasuries were slightly richer across the curve, following wider gains in core European rates where German yields are lower by 4bp to 7bp, outperforming peers. Gains in Treasuries extend Tuesday’s rally as traders set up for Wednesday’s April CPI and retail sales reports. US yields richer by up to 2bp across belly of the curve which outperforms slightly, steepening 5s30s spread by almost 1bp on the day; 10-year yields around 4.42% with bunds and gilts outperforming by 5bp and 3.5bp in the sector.

In commodities, oil held gains after an industry report showed shrinking US stockpiles, overshadowing a softer demand growth outlook by the International Energy Agency for the rest of the year. WTI traded within Tuesday’s range, adding 0.5% to near $78.42. Most base metals trade in the green. Copper futures in New York rallied to a record high after a short squeeze that’s prompted a scramble to divert metal in other regions to US shores. Spot gold was up roughly $15 to trade near $2,373/oz.

Looking at today's calendar, US economic data slate includes May Empire manufacturing, April CPI and retail sales (8:30am New York time), March business inventories and May NAHB housing market index (10am) and March TIC flows (4pm). Fed officials’ scheduled speeches include Barr (10am), Kashkari (12pm) and Bowman (3:20pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following the momentum from the US where the major indices ultimately gained and the Nasdaq posted a fresh record close with two-way price action seen following PPI data. ASX 200 was led by the mining, materials and healthcare sectors, while participants also digested the recent budget announcement with the government planning to boost spending next year ahead of an election. Nikkei 225 gained but was well off today's best levels with newsflow dominated by earnings releases including from Sony and Sharp, while the Japanese megabanks are also scheduled to announce their results today. Shanghai Comp was pressured after the recent US tariff announcement and with Stock Connect trade shut owing to the holiday closure in Hong Kong, although the real estate industry found solace from news that China is mulling purchases of unsold homes to ease the glut.

Top Asian News

European bourses, Stoxx600 (+0.2%) are mostly firmer, continuing the positive sentiment seen in APAC trade overnight. European sectors hold a strong positive tilt; Real Estate is the clear outperformer, lifted by post-earning gains in Leg Immobilien (+2.9%). Basic Resources is lifted by broader strength in underlying metals prices. Consumer Products & Services is weighed on by losses in the Luxury sector, namely Burberry (-3.1%). US Equity Futures (ES U/C, NQ U/C, RTY +0.3%) are modestly firmer, attempting to build on the prior session’s advances, though still mindful of the upcoming US CPI & Retail Sales.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets had been on course to continue their quiet holding pattern ahead of today's CPI but a late positive burst powered the S&P 500 (+0.48%) to within a whisker of its all-time high and the NASDAQ (+0.75%) to a new peak, while the 10yr treasury yield (-4.7bps) fell to its lowest level since the last CPI print on April 10. There weren’t obvious drivers, but perhaps the absence of bad news was enough to inject some relief into markets. Y esterday’s PPI data didn't really move the needle much with a notable beat balanced by some notable down revisions and some of the details being neutral for core PCE. So the focus will now shift to April's CPI after 3 upside surprises in a row for core CPI. Don't forget US retail sales as well, released at the same time.

For now at least, the Fed continue to stick to their recent message with Chair Powell yesterday saying that “we’ll need to be patient and let restrictive policy do its work”. So there was little acknowledgement that rate cuts were happening anytime soon, but Powell also didn’t dial up the hawkishness either. That narrative was supported by the PPI print for April, which was a distinctly mixed bag. On the negative side, headline PPI came in at a monthly +0.5% (vs. +0.3% expected), and the measure excluding food, energy and trade was also up +0.4% (vs. +0.2% expected). But in more positive news, the previous month’s headline PPI was revised down three-tenths to show a -0.1% decline. And on top of that, the components that feed into the Fed’s target measure of PCE were more neutral. For instance, portfolio management services were up +3.9%, but domestic airfares came down -4.7%.

For today, our US economists are expecting headline CPI to come in at +0.37%, and core CPI to be at +0.29%. The last three core CPI prints each came in at +0.4%, so this would be a deceleration. But even if those forecasts are realised, the 3m annualised rate for core CPI would still be running at +4.1%, so not the sort of territory where the Fed would ordinarily be cutting rates. For the year-on-year numbers, those forecasts would push the headline CPI rate down to 3.4%, and the core CPI rate to 3.6%. Click here for our US economists’ full preview, along with how to sign up for their webinar immediately afterwards.

Ahead of that, markets turned more upbeat yesterday, with the S&P 500 (+0.48%) closing within two tenths of a percent of its all-time high on March 28. Tech stocks outperformed, with the Magnificent 7 (+1.01%) reaching a new all-time high, led by Tesla (+3.29%) and Nvidia (+1.06%). But the equity rally was broad-based, with the small-cap Russell 2000 up +1.14%. The advance of the S&P 500 was earlier held back by several defensive sectors, with energy stocks (-0.13%) one of the weaker performers as Brent crude oil prices (-1.18%) closed at a 2-month low of $82.38/bbl. Meanwhile in Europe, the STOXX 600 (+0.15%) just about made it up to an all-time high, as the index posted an 8th consecutive advance for the first time since 2021.

The other notable story in the equity space came from several meme stocks, with GameStop up +60.1% on the day, building on its +74.4% advance on Monday. It's now up to $48.75 having traded as low as $10 in late April. Similarly, AMC Entertainment was up +31.98%, whilst Blackberry gained +11.94%.

For sovereign bonds, there was a divergent performance yesterday, with Treasuries rallying whilst most of Europe sold off. Yields on 10yr Treasuries fell by -4.7bps to 4.44%. By contrast, yields on 10yr bunds (+3.8bps), OATs (+3.9bps) and BTPs (+2.6bps) all moved a bit higher on the day. Those moves came in spite of comments from the ECB’s Knot that “June will be a good opportunity to make a first move in removing restriction”, which helped to cement the view that the ECB are moving towards a rate cut at their next meeting. In the UK, gilts saw a relative outperformance, with the 10yr yield down -0.1bps, which came as the unemployment rate ticked up a tenth to 4.3% over the three months to March. Moreover, BoE chief economist Pill sounded open to a rate cut, saying that it was “not unreasonable to believe that through the summer we will begin to see enough confidence in the decline in persistence that bank rate will come under consideration”.

In other news yesterday, we had confirmation that the US were imposing fresh tariffs on $18bn of Chinese imports, including steel and aluminium, semiconductors, and EVs. In fact, the t ariff on EVs will go up from 25% to 100%. Some of the new tariffs will take effect this year, but others won’t happen until 2026. The move comes ahead of November’s presidential election, but both parties have taken a much tougher stance on China over recent years, and Biden has kept most of Trump’s previous tariffs in place. Indeed, Trump himself said at a rally on Saturday that “I will put a 200% tax on every car that comes in from those plants”. So the direction has been towards a more protectionist stance on trade from both parties. Our China economist has written about the potential impact on the domestic macro landscape here.

Asian equity markets are mixed this morning with the Nikkei (+0.18%) and the S&P/ASX 200 (+0.47%) trading higher while Chinese markets are lagging with the CSI (-0.27%) and the Shanghai Composite (-0.17%) both trading slightly lower after the new US tariffs announced yesterday on an array of Chinese imports. Elsewhere, stock markets in South Korea and Hong Kong are shut for a public holiday. US equity futures are slightly higher with Treasuries fairly flat.

In monetary policy action, the PBOC kept the one-year medium-term lending facility (MLF) unchanged at 2.50%. This came despite weaker money supply numbers than expected overnight although Bloomberg are running a story suggesting China are working on a plan to buy up unsold homes to shore up the property sector. Moving ahead, markets will move their focus to China’s industrial production and retail sales data due on Friday.

Looking at yesterday’s other data, the German ZEW survey improved in May, with the expectations component up to 47.1 (vs. 46.4 expected), whilst the current situation reading moved up to -72.3 (vs. -75.9 expected). For the current situation that’s a 9-month high, and for the expectations component, that’s a 2-year high, which was last surpassed in February 2022.

To the day ahead now, and data releases include the US CPI report for April, along with retail sales for April and the NAHB’s housing market index for May. From central banks, we’ll hear from the ECB’s Rehn, Muller, Villeroy and Makhloufi, along with the Fed’s Kashkari and Bowman.