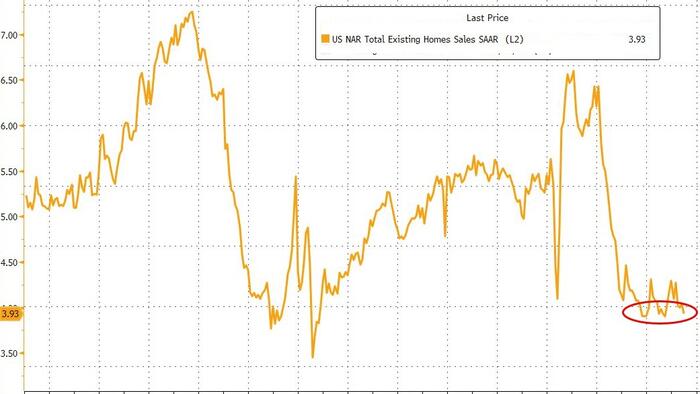

After a small bounce in May (off 15 year lows), expectations are for existing home sales to fall once again in June as mortgage rates ticked up.

The analysts were right as sales dropped 2.7% MoM (vs -0.7% MoM expected), leaving existing home sales unchanged year-over-year...

Source: Bloomberg

Source: Bloomberg

The median sales price increased 2% in June from a year ago to a record high of $435,300...

Home prices continue to rise even after a recent pickup in inventory.

“Multiple years of undersupply are driving the record high home price. Home construction continues to lag population growth,” Lawrence Yun, NAR chief economist, said in a statement.

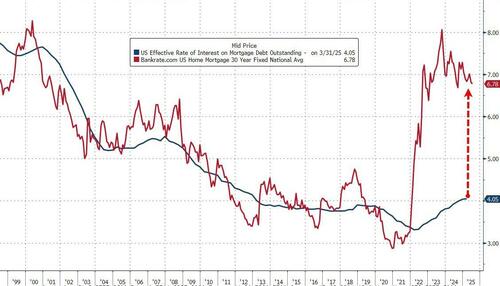

“High mortgage rates are causing home sales to remain stuck at cyclical lows.”

Yun said on a call with reporters that it’s typical to see high home prices this time of year because families want to move before the school year begins.

Economists at Goldman Sachs said in a recent note that 87% of mortgage holders have rates below current rates, and two-thirds have borrowing costs 2 percentage points below current rates, “strongly disincentivizing them from moving.”

Source: Bloomberg

Yun said an NAR analysis showed that a 6% mortgage rate would lead to about a half million more homes sold and an additional 160,000 renters becoming first-time homeowners.

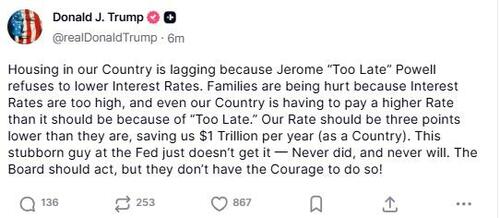

“Housing in our Country is lagging because Jerome ‘Too Late’ Powell refuses to lower Interest Rates,” Trump said in a social media post Wednesday, referring to the Fed chair.

“Families are being hurt because Interest Rates are too high.”

In a sign that buyers are balking at high asking prices, 21% of the homes sold were above list price, down from 28% in May.