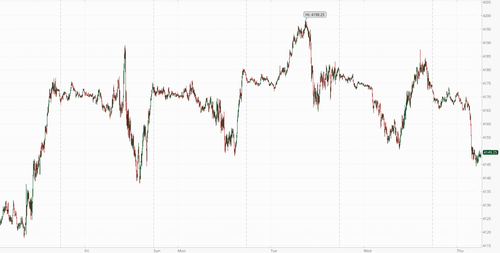

US equity futures suffered their biggest overnight drop this week as a premarket slide in Tesla shares added to uncertainties surrounding the future of US monetary policy as well as the overall quality of the first-quarter earnings season. Contracts on the S&P 500 fell 0.7% as of 7:00 a.m. in New York while Nasdaq 100 futures took a 1% hit. Elsewhere, bond yields were lower, the USD was lower, and commodities were weaker on global demand fears.

In premarket trading, Tesla slid as much as 8.5% and were down -6% at last check, after the EV maker’s first-quarter results were hit by a slew of price cuts, denting profit margins and prompting at least six analysts - including Morgan Stanley's Adam Jonas - to cut their price targets. MegaCap techs are also dragging indices lower with most names down 1%, or more. Bed Bath & Beyond shares tumbled 19% in premarket trading after Dow Jones reported that the retailer is preparing a bankruptcy filing for as early as this weekend. The stock had soared almost 100% in the three days prior. Here are some other premarket movers:

With better Bank earnings and a lackluster start from Tech earnings, the market seemingly remains stuck in near-term range of 3800 – 4200, with the SPX failing at 4150 level. Next week’s tech earnings will be the litmus test for bears and bulls.

Meanwhile, hawkish Fedspeak continues with some estimating 25bps – 50bps, or more, hikes remaining. Investors are seeking comfort whether policymakers will address growing recession worries, such as those flagged by the Federal Reserve’s monthly Beige Book survey which clearly noted that a credit crunch has arrived, or keep on fighting inflation as suggested by Fed Bank of New York President John Williams, who said price gains remained too high.

“We’re in a paradoxical situation,” said Alexandre Hezez, chief investment officer at Group Richelieu, a Paris-based asset manager. “If the Fed keeps on raising rates it’s not positive as it would mean we’re not done with inflation yet, but if it cuts, that would mean there are recessionary forces around.” The best path forward would be “a status quo” for the coming months, after a 25 basis-point hike in May, Hezez said, noting strong divergences on the matter among the Federal Open Market Committee.

European stocks are on course for their largest fall in almost four weeks amid tepid earnings and the prospect of additional monetary tightening. The Stoxx 600 is down 0.3% with autos, miners and tech the worst performing sectors while Renault and Nokia have fallen sharply after their respective quarterly updates. Here are the most notable European movers:

Earlier in the session, Asian stocks edged lower as volatility across global markets remained subdued, with investors awaiting new catalysts and digesting recent corporate earnings. The MSCI Asia Pacific Index dropped as much as 0.4% before paring its loss. Most major benchmarks were up or down by less than 0.5%, with South Korea and mainland China leading the declines.

In key results Thursday, TSMC forecast worse-than-anticipated revenue for the current quarter, reflecting a persistent slump in global chip demand. Chinese EV battery maker CATL is expected to report strong revenue growth later in the day. China tech earnings so far have been in line, “could have been better but we stay more optimistic,” given positive initiatives from companies such as Alibaba, Xiaolin Chen, head of international at Kraneshares, told Bloomberg TV. “Overall you see very encouraging and constructive policies get introduced by policymakers or corporates themselves to become more market oriented.” The Kospi slipped after coming close to a bull market. The gauge is Asia’s best performer among major markets this year, climbing 19% from a September low amid frenzied gains in EV-battery related stocks and heavyweight Samsung Electronics.

Japanese stocks were mixed in thin trading as investors eye upcoming earnings from major domestic and overseas companies. The Topix closed little changed at 2,039.73, while the Nikkei advanced 0.2% to 28,657.57. Volume on both gauges was more than 20% below the 30-day averages. Out of 2,158 stocks in the Topix, 1,203 rose and 811 fell, while 144 were unchanged. “There is a lack of news, and investors are still waiting for corporate earnings results to come out and then further on, monetary policy,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management

In Australia, the S&P/ASX 200 index was little changed to close at 7,362.20, as gains in banks were offset by broad declines in mining shares. Asian shares were broadly lower as investors parsed mixed corporate earnings and the latest assessment on the US economy. Australia’s central bank should set up an expert policy board, hold fewer meetings and give press conferences explaining its decisions, according to recommendations from an independent review that would align it with many global peers. Read: RBA Review Calls for Expert Policy Panel, Fewer Meetings (3) In New Zealand, the S&P/NZX 50 index fell 0.3% to 11,879.68.

In FX, the Bloomberg Dollar Spot Index is flat. New Zealand dollar dropped to a month-low after data showed the nation’s inflation slowed down more than expected, spurring expectations for the central bank to ease policy tightening.

In rates, US two-year yields are lower after a five day rally, falling 3bps to 4.22% while 10-year yieldS fell as much as 5bps to 3.54%, the lowest since Monday; traders bet on 23bps of Fed tightening in May and 30bps by June, while pricing 50bps of cuts by year-end. German and UK two-year borrowing costs both fall by 1bps.

In commodities, crude futures extended their recent decline with WTI falling 1.8% to trade near $77.70. Will OPEC have to get involved again and cut production some more? Spot gold is little changed around $1,994.

Bitcoin continues to slip and has drifted more than 1% %to a fresh USD 28.56k WTD trough vs Monday's USD 30.5k best, action which has come alongside the broader dip in sentiment with specific fundamentals somewhat limited.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, existing home sales for March and the Conference Board’s leading index for March. From central banks, we’ll get the ECB’s account of their March meeting, and hear from ECB President Lagarde, the ECB’s Visco, Holzmann and Schnabel, the Fed’s Waller, Mester, Bowman and Bostic, the BoE’s Tenreyro and BoC Governor Macklem. Finally, earnings releases include AT&T, Union Pacific and American Express.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded rangebound with the region indecisive following the flat handover from the US where earnings were under the spotlight and early headwinds were seen after firmer-than-expected UK CPI data. ASX 200 was indecisive as participants digested output updates and with the mining sector subdued despite the fresh record Q1 iron ore shipments by Rio Tinto, while Australian Treasurer Chalmers announced recommendations from the independent RBA review which included establishing separate boards for governance and monetary policy with fewer meetings and press conferences to be conducted after policy decisions. Nikkei 225 gradually pared opening losses following mixed trade data including better-than-expected exports growth and after a recent report that the BoJ is said to be wary of tweaking yield control this month. Hang Seng and Shanghai Comp were mixed following the lack of surprises by the PBoC which maintained its benchmark lending rates for the 8th consecutive month and as frictions lingered after the US Commerce Department imposed a USD 300mln civil penalty on Seagate for supplying hard disk drives to Huawei in violation of export controls.

Top Asian News

European bourses are lower across the board, Euro Stoxx 50 -0.3%, as pressure emerged without a clear catalyst after a relatively contained open. Sectors are largely in the red, with Autos underperforming amid downside in Renault post-earnings and with attention on Tesla; elsewhere, Nokia slumps and L'Oreal trims upside after their latest updates. Stateside, futures are pressured to a larger extent than their European peers with downside occurring in tandem with the above move and exacerbated by marked pressure in Tesla, NQ -1.1%. TSMC (2330 TT/TSM) Q1 (TWD): Net Profit 206.9bln (exp. 192.8bln), Sales 508.6bln (exp. 517.9bln), Gross Profit 286.5bln (prev. 273.2bln). EPS 7.98 (exp. 7.41), Gross Margin 56.3% (exp. 54.5%). Q2 Guidance (USD): Revenue 15.2-16.0bn (exp. 17.3bln), Gross Margin 52-54% (exp. 52.5%), Operating Margin 39.5-41.5% (exp. 40%). TSM +0.4% in pre-market trade. Tesla (TSLA) - Q1 2023 (USD): Adj. EPS 0.85 (exp. 0.85), Revenue 23.33bln (exp. 23.29bln). Still sees FY production 1.80mln vehicles (exp. 1.84mln). Tesla did not release its automotive margins, but continues to believe that its operating margin will remain among the highest in the industry. CEO Musk has taken a view that pushing for higher volumes and a larger fleet is the right choice here vs lower volume and higher margins. -7.5% in pre-market trade.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets have struggled a bit over the last 24 hours, with bonds and equities selling off thanks to strong inflation data and a mixed batch of earnings releases. However by the close of business both Euro and US equities had broadly clawed their way back to flat (S&P -0.01%) but with yields on 10yr Treasuries (+1.5bps) ending just a shade under their one-month highs at of 3.59% and Bund yields at their highest close since March 9th.

The initial catalyst for the bond and equity weakness yesterday came from the UK inflation release shortly after we went to press yesterday. It showed CPI inflation had only fallen to +10.1% in March (vs. +9.8% expected), and core inflation was above expectations as well at +6.2% (vs. +6.0% expected), which disappointed hopes that we’d be in the midst of a broader trend lower by this point. At the same time, the print was also on the upside of the BoE’s own staff forecasts in February, which had looked for a +9.2% number yesterday. So with the previous day’s wage data surprising on the upside too, the picture is one of stronger inflationary pressures than previously thought.

With another inflation report surprising on the upside, that spurred a broader selloff among sovereign bonds, and investors continued to dial back the chances of rate cuts from central banks this year. UK gilts were at the forefront of that, with the 10yr yield up by +10.9bps, and investors moved to fully price in a 25bp rate hike from the BoE in May for the first time since late February. Our own UK economist at DB has also adjusted his expectations for the BoE (link here), and now sees them taking Bank Rate up by 25bps in both May and June. If realised, that would leave the terminal rate at 4.75%, and he argues the risks are now skewed to the upside of that as well.

Those moves in the UK were echoed in other countries, and investors priced in a growing chance that the ECB would deliver another 50bp hike in two weeks’ time. That led to a rise in yields across the continent, with those on 10yr bunds (+3.8bps), OATs (+3.7bps) and BTPs (+6.2bps) all moving higher on the day. Likewise in the US, the 10yr yield rose +1.5bps to 3.591%, which came as investors further downplayed the chance of rate cuts this year. What’s interesting is that investors are now increasingly considering whether the Fed will pursue further rate hikes after the next decision in May, and the odds of a 25bp hike in June hit a post-SVB high of 29.4% yesterday. That’s partly because of the inflation data of late, but they’ve also been propelled by the persistent easing of financial conditions over recent days, with Bloomberg’s index now at its most accommodative level since the SVB collapse. Whilst that might be welcome news after the recent turmoil, one consequence of easier financial conditions is it puts more of the onus on the Fed to tighten policy to get inflation back to target, rather than relying on tighter financial conditions.

On that topic, yesterday was the first Fed Beige Book since the SVB episode. The Beige Book is released two weeks prior to FOMC meetings and publishes anecdotal data/comments from the various districts. On credit conditions, five districts mentioned tighter conditions with a respondent from New York mentioning that “Credit standards tightened noticeably for all loan types, and loan spreads continued to narrow. Deposit rates moved higher.” A respondent from California, the epicentre for stress last month, said that “following recent volatility in deposit levels at regional and community banks, outflows have reportedly stabilized since late March." Not all regions saw large disruptions with a respondent in Chicago saying there was “some movement in deposits but little change in credit availability following the collapse of Silicon Valley Bank". Attention will turn to the senior loan officer survey early next month. It’s always been a huge favourite lead indicator of ours but the whole financial world will be watching this time around.

For equities, as discussed at the top, the main news came after the close as we heard from Tesla, which dropped more than -6% in after-market trading before recovering its losses. The EV-maker missed profit estimates with EPS coming in at $0.85 ($0.86 estimated) as margins were tighter than expected. The company also expects there to be “ongoing cost reduction” of their vehicles.IBM (+1.73% in after-market trading) rose after beating earning expectations and increased sales guidance for 2023.

Also after the close we learned that the US Treasury took in $129bn across corporate and individual income taxes, which means that the Treasury General Account is now up to $252bn, up from $144bn on Monday. Today is another big day to watch as it will capture a portion of Tuesday’s deadline day tax flows, yet to be reported. The overall total was softer than some initial assumptions and leaves an x-date of midsummer as the most likely. Also on the debt ceiling, House Speaker McCarthy released a plan yesterday to raise the debt ceiling by $1.5tr, which would push the “x-date” out into March 2024. The GOP hope to vote on the bill in the coming days as an opening salvo in talks with the White House. Moderate members of both parties also pushed forward an idea that would suspend the debt ceiling until December 31 and then possibly February 2025 if certain conditions were met. The plan is likely dead-on-arrival given the slim GOP majority and the weakened position of Speaker McCarthy, who would have to put the bill up to a vote.

Prior to this, and as mentioned at the top, the S&P 500 had another quiet day, ending just -0.01% lower and remaining in the very narrow band seen over recent sessions. There was a decent amount of dispersion once again though with rate-proxies such as utilities (+0.78%) and real estate (+0.55%) rising, while cyclicals fell back led by communications (-0.72%), materials (-0.31%), and energy (-0.25%). The VIX index of volatility declined a further -0.4pts to 16.4pts, which marked its lowest closing level since November 2021. Elsewhere the NASDAQ (0.03%) was similarly unchanged with the Dow Jones (-0.23%) seeing a marginal loss. In Europe there were modest declines as well, leaving the STOXX 600 down -0.10%.

Asian equity markets are broadly trading lower this morning following a tepid performance of US equities on Wall Street. As I type, the Chinese stocks are leading losses across the region with the Shanghai Composite (-0.69%) and the CSI (-0.63%) edging lower while the Hang Seng (+0.19%) is just above flat. Elsewhere, the KOSPI (-0.28%) is trading in negative territory while the Nikkei (+0.09%) held on to its minor gains. Outside of Asia, US stock futures tied to the S&P 500 (-0.18%) and NASDAQ 100 (-0.33%) are modestly lower as risk appetite remains downbeat following the latest batch of earnings.

In early morning data, exports in Japan rose +4.3% y/y in March (v/s +2.4% expected), down from growth of +6.5% in February mainly due to a drop in China-bound shipments. Imports outpaced exports, increasing 7.3% in the year to March (v/s a +11.6% expected increase), the smallest advance in two years and coming after the prior month's 8.3% gain. Meanwhile, the nation’s trade deficit narrowed for the second consecutive month, contracting to 754.5 billion yen ($5.6 billion) from an upwardly revised deficit of 898.1 billion yen in February,

When it comes to the Bank of Japan’s decision next week, Bloomberg reported yesterday that officials were wary of adjusting their yield curve control policy this soon after last month’s market turmoil. The meeting isn’t until a week on Friday, but will be the first for new Governor Ueda, so will likely get more attention than usual anyway.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, existing home sales for March and the Conference Board’s leading index for March. From central banks, we’ll get the ECB’s account of their March meeting, and hear from ECB President Lagarde, the ECB’s Visco, Holzmann and Schnabel, the Fed’s Waller, Mester, Bowman and Bostic, the BoE’s Tenreyro and BoC Governor Macklem. Finally, earnings releases include AT&T, Union Pacific and American Express.