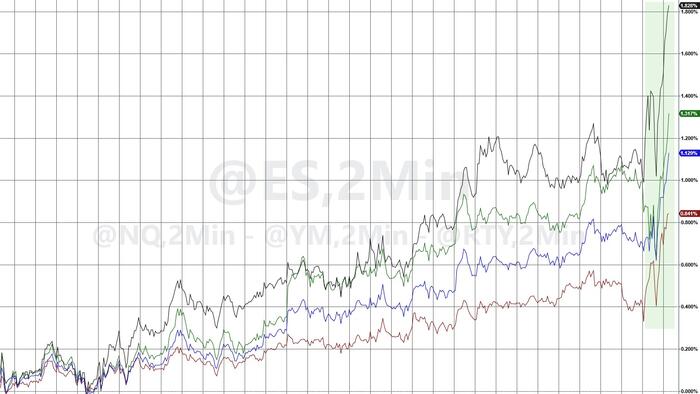

US equity markets are surging again this morning following comments by Treasury Secretary Bessent (and USTR Greer) that appeared to suggest the possibility of a tariff truce with China.

U.S. Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent condemned China's decision last week to step up curbs on its exports of rare-earth metals, calling the actions part of a broader plan by Beijing to control the world's supply chains.

"China's announcement is nothing more than a global supply chain power grab," Greer said.

"This move is not proportional retaliation. It is an exercise in economic coercion on every country in the world."

So that was Bad Cop.

And then Bessent played Good Cop...

But while Bessent said China's "highly provocative move" comes after the U.S. has made significant efforts to de-escalate tensions, he said that the U.S. would rather not take action against Beijing.

"I believe China is open to discussion, and I am optimistic that this can be de-escalated ultimately.

We are confident in the strong relationship between President Trump and President Xi.

We've had substantial communication with the Chinese over the past few days, and we believe that there will be more forthcoming this week," Bessent said.

It is possible that “we could go to a longer roll in return for a delay” on rare earths export controls, Bessent said when asked if US would delay implementation of additional 100% tariffs on China.

“All that’s going to be negotiated in the coming weeks” before Chinese and US leaders meet in South Korea, he says.

None of that sounded particularly new or different to us, but no matter the confusion, the market ran with it...

But US-listed rare earth stocks tumbled on the possible delay: Critical Metals -20.5%, USA Rare Earth -13.6%, MP Materials -7.3%, Ramaco Resources -9.5%

Will the market's strength prompt a response from Trump, using that hubris to take another shot at Beijing?