Not surprisingly to many, US durable good orders tumbled (-6.3% MoM) in preliminary April data (better than the 7.8% MoM decline expected), following March's 7.6% MoM tariff-front-running surge (revised down from the initial 9.2% MoM jump). Headline orders remain 2.7% higher on a YoY basis...

Source: Bloomberg

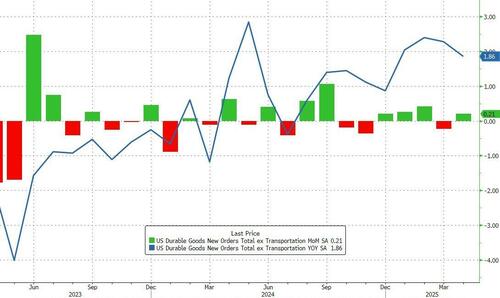

Ex-Transports, orders rose 0.2% MoM (better than the unchanged print expected) and up from the downwardly revised 0.2% decline in March...

Source: Bloomberg

The value of core capital goods orders, a less-volatile proxy for investment in equipment that excludes aircraft and military hardware, decreased 1.3% last month after an upwardly revised 0.3% gain in March.

Such shipments fell 0.1%.

Because orders can be canceled, the government uses data on shipments as an input to gross domestic product, which reflect when a payment has been made.

Capital goods shipments rose 3.2%, including defense and commercial aircraft, after a 1% decline in March.

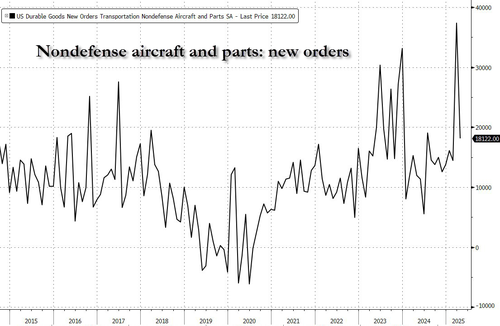

The report showed bookings for commercial aircraft, which are volatile from month to month, slumped 51.5% after rising in April.

Boeing Co. said it received only eight orders in April, the fewest since May 2024. That was down from 192 March orders that were the most since 2023.