We used to dread covering the monthly update of US government income and spending because, without fail, it would show that the USS Titanic was getting that much closer to the inevitable iceberg crash. A few months ago, there was a glimmer of hope when thanks to Elon Musk and DOGE, there was a brief push to cut government spending, while at the same time the US also found a new revenue stream in the form of tariffs which helped reduce the massive monthly US deficit by a modest amount. Alas, in the grand scheme of things, the modest trim in spending and the bounce in revenue proved to be too little... and too late.

With that in mind, here is a look at the latest Treasury Income Statement for the month of August, published earlier today.

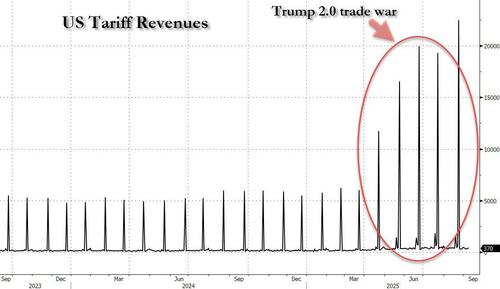

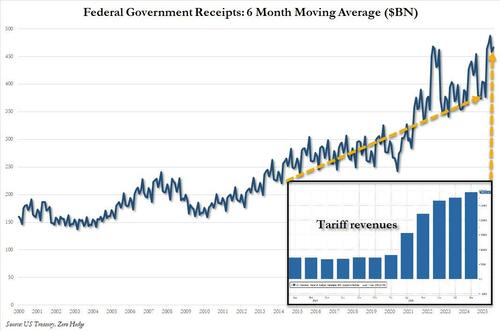

First, the good news: for the fifth month in a row, the US government benefited from outsized tariff revenues, which as shown in the chart below, continue to rise and in August hit just under $30BN - or about $360BN annualized - at the current tariff rate.

But while the tariff revenue in June was sufficient to tip the overall US Treasury budget into a (very rare) surplus, July proved to be too great an obstacle as we discussed last month. And August was just a full-blown return to the disastrous drunken-sailor spending ways of old.

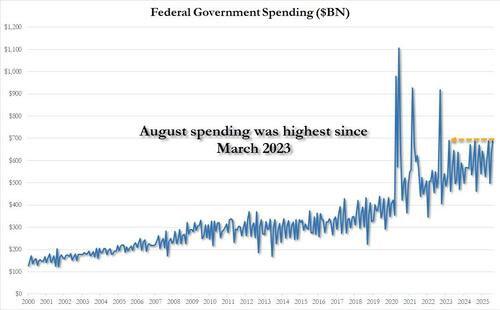

According to the latest Monthly Treasury Statement, in August the US government spent $689 billion, up 0.4% from the $686.6 billion a year ago, and the highest monthly spending total of fiscal 2025 which ends next month. So much for the cost-cutting efforts of DOGE.

And while the huge monthly spending was somewhat offset by a 12.3% increase in revenues, which increased from $306.5 billion to $344.3 billion, this included the $29.5 billion in tariff revenues noted above. Take that out and government income would have been flat YoY.

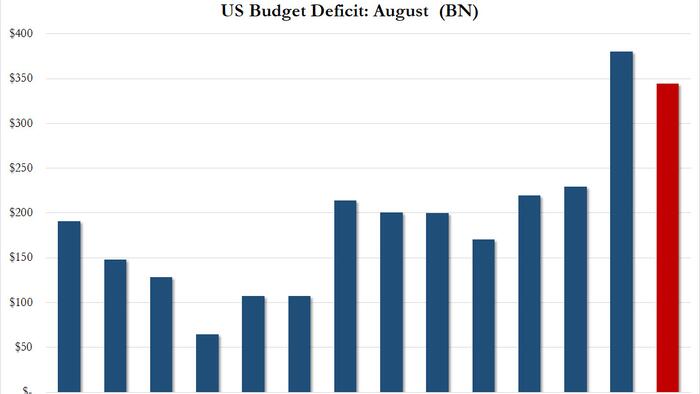

Combining the latest receipts and spending data, and we get an August deficit of $345 billion, a substantial deterioration from the $291 billion deficit in July, and the highest monthly deficit of calendar 2025. It was also the second worst August deficit in US history, with just last year's pre-election blowout of $380 billion higher, which as readers will recall, was a kitchen sink month for the Biden admin, which flooded the economy in a last-ditch effort of boosting the economy ahead of the presidential elections.

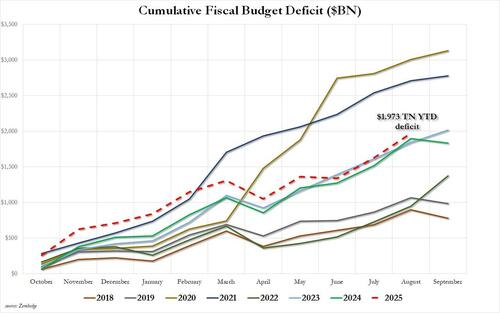

Looking at the deficit on a cumulative basis, we find that after June's improvement, the deficit took another lunge in the past two months, and in August - just one months before the fiscal year end - it hit $1.974 trillion, up 4% from the $1.897 trillion a year ago. That means that with just one month to go, 2025 is shaping up as the third worst year in US history for the budget deficit, with just the covid years 2020 and 2021, worse.

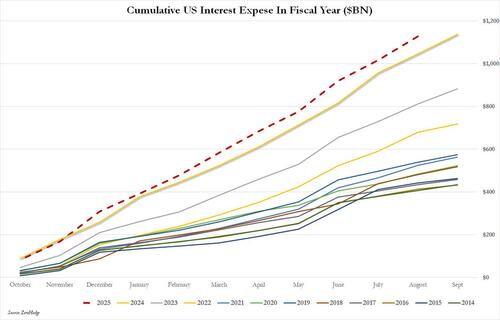

Last but not least, the epic disaster that is US gross interest spending continues to rise, and in August the US spent $111.5 billion on interest, pushing the total for the eleven months of the fiscal year to a record $1,124 trillion, and on pace to surpass $1.2 trillion for the full year.

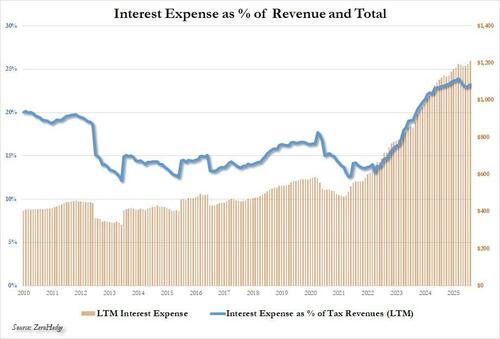

With total debt rising by about $1 trillion every 100 days, it means that interest will keep growing too, and unless revenue grows in line, we will reach a point where every taxed dollar goes to pay down US debt. As of today, interest expense eats up just over 23% of all government tax revenues, just shy of the non-wartime record high.

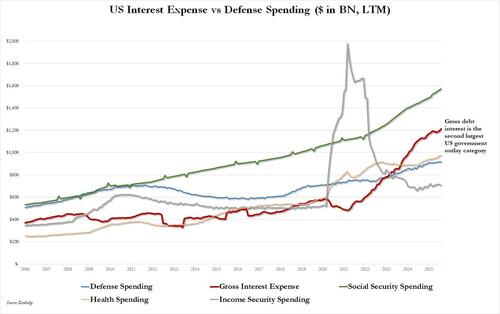

It also means that, as we first showed over a year ago, gross interest remains the second highest spending category for the US, well above defense, income security and health spending, and only Social Security remains a larger outlay category (although it is unclear for how much longer).

Bottom line: after a brief period of irrational hope in early 2025 when Musk's obsession with DOGE and cutting spending, we are again at square zero one and back on the fast-track to the debt-death of the United States. No wonder why in his most recent public commentary, Musk fully agrees with us: the government is unfixable.