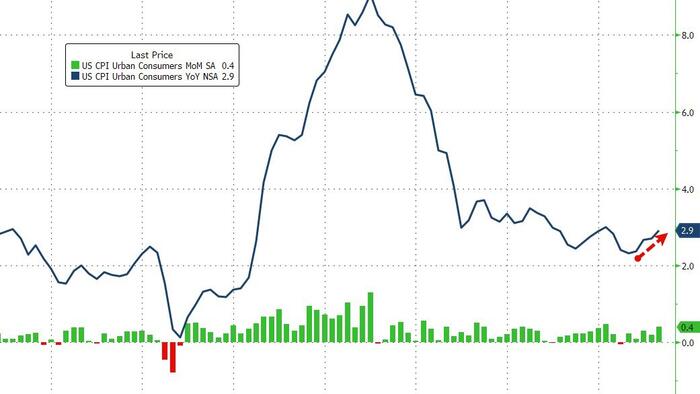

Following yesterday's cooler-than-expected PPI (MoM deflation), expectations for this morning's Consumer Price Inflation were for the further acceleration.

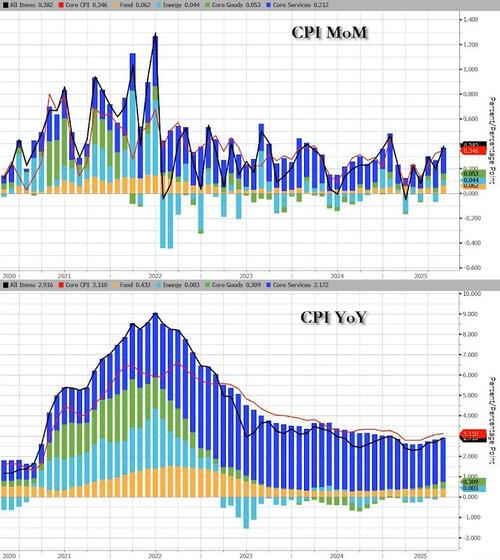

Headline CPI rose 0.4% MoM (hotter than the 0.3% expected, lifting prices up 2.9% YoY - the highest since January...

Source: Bloomberg

CPI rose 0.4% in August, after rising 0.2% in July; over the last 12 months, the all items index increased 2.9% before seasonal adjustment.

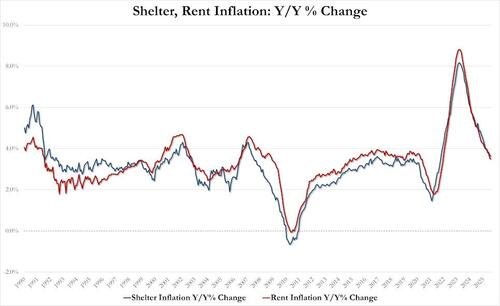

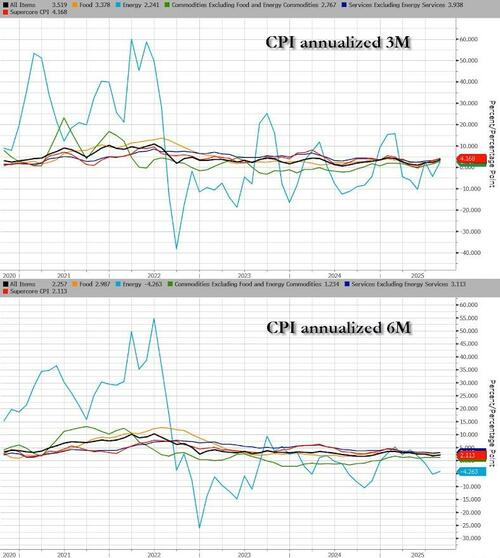

Core Services were the big driver of the increase, not driven by tariff pressures...

Source: Bloomberg

Core CPI rose 0.3% MoM as expected, lifting prices more than 3% YoY for the first time since February...

Source: Bloomberg

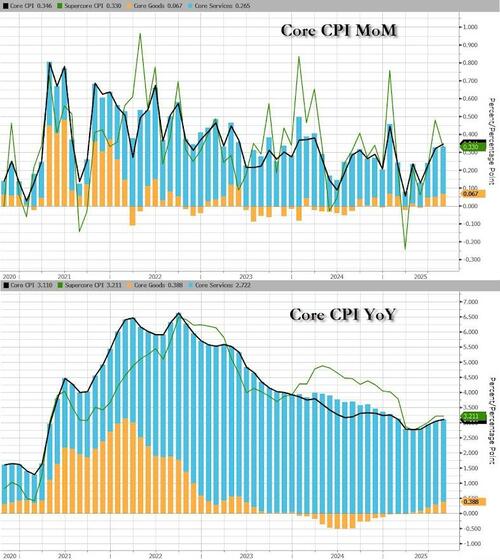

Core Services also dominated the rise in core CPI...

Source: Bloomberg

More details on the core CPI print which rose 0.3% in August, same as July:

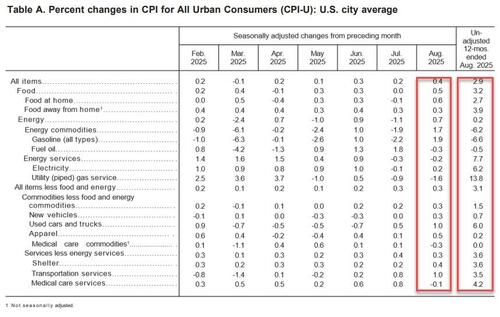

It looks like auto costs are starting to tick up again. New vehicles rose by 0.3% while used cars and trucks rose by 1.0%. But the real sting was in motor vehicle maintenance and repairs, which jumped by 2.4%.

When we look at some import-exposed categories:

At least looking at these categories, there’s no overall broad story of acceleration in inflation pressures.

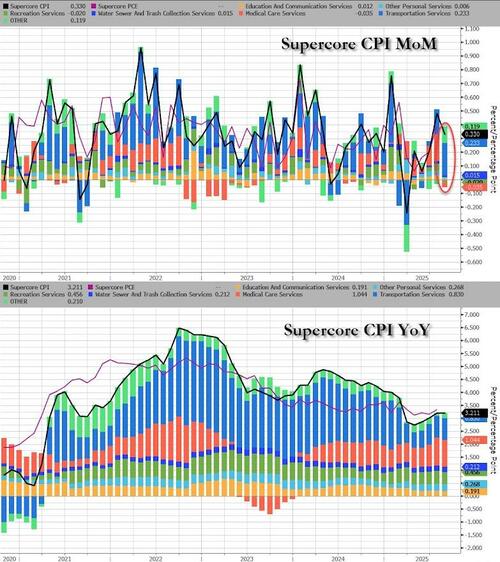

Interesting, SuperCore CPI slowed in August to 3.52% YoY...

Source: Bloomberg

Transportation Services were the biggest driver of the rise in SuperCore CPI...

Source: Bloomberg

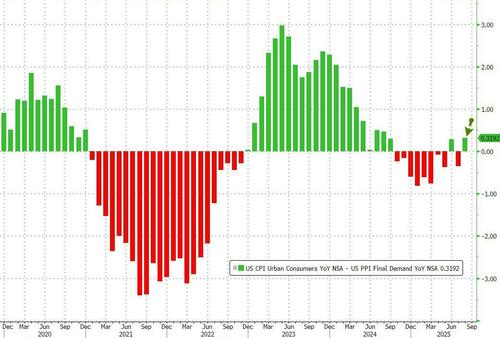

Comparing CPI to PPI shows that there is no margin pressure on firms and could suggest price pressures being passed through to end users...

Source: Bloomberg

Together with August PPI, the CPI report suggests that the Fed’s preferred inflation gauge, the core PCE deflator (due out Sept. 26) will edge up to 3.0% for August year over year...

All of this is to say, while the overall inflation numbers are in line with what economists had expected, within the details there are pockets of price pressure.

We highlighted auto repairs and airline tickets earlier, but take a look at fruit and vegetable costs: up 1.6% on the month. Motor fuel rose by 1.8%, while tobacco costs rose 1.0%, and food-at-home jumped 0.6% on the month, the biggest gain in almost three years.

To be clear, the overall number won’t hold the Fed from cutting, but it’s clear there’s inflation pressure in some corners of the economy.

...not enough to scare The Fed from its rate-cutting path.