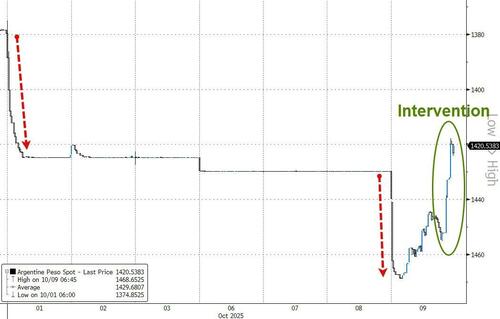

With the Argentine Peso imploding in recent weeks - but not as fast as it would have had the Milei government not backstopped it with relentless central bank interventions which quickly drained the country's dollar reserves - and the country's bond market in freefall, the Latin American country was facing a full-blown market collapse if it didn't get quick and generous access to a source of USD funding. It did just that moments ago when US Treasury Secretary Scott Bessent said he had "finalized a $20 billion currency swap framework with Argentina’s central bank" adding that the U.S. Treasury "is prepared, immediately, to take whatever exceptional measures are warranted to provide stability to markets." That much was expected, and was already discssed previously. More importantly, Bessent noted that today the US "directly purchased Argentine pesos" which will likely spark outrage among those wondering how bailing out Argentina is part of the "America First" agenda, especially when Argentina had been quietly exporting soybeans to China while US farmers are stuck nursing huge losses, now that China is no longer a key customer, and is instead purchasing from such countries rescued by the US as... Argentina.

This is what Bessent wrote moments ago on X:

The @USTreasury has concluded 4 days of intensive meetings with Minister @LuisCaputoAR and his team in DC. We discussed Argentina’s strong economic fundamentals, including structural changes already underway that will generate significant dollar-denominated exports and foreign exchange reserves.

Argentina faces a moment of acute illiquidity. The international community – including @IMFNews – is unified behind Argentina and its prudent fiscal strategy, but only the United States can act swiftly. And act we will.

To that end, today we directly purchased Argentine pesos.

Additionally, we have finalized a $20 billion currency swap framework with Argentina’s central bank. The U.S. Treasury is prepared, immediately, to take whatever exceptional measures are warranted to provide stability to markets.

I emphasized to Minister Caputo that @POTUS @realDonaldTrump’s America First economic leadership is committed to strengthening our allies who welcome fair trade and American investment.

I continue to hear from American business leaders who, thanks to President Milei’s leadership, are eager to tie the American and Argentine economies more closely together. The Trump administration is resolute in our support for allies of the United States, and to that end we also discussed Argentina’s investment incentives, and U.S. tools to powerfully support investment in our strategic partners.

Minister Caputo informed me of his close coordination with the IMF on Argentina’s commitments under its program. Argentina’s policies, when anchored on fiscal discipline, are sound. Its exchange rate band remains fit for purpose.

We reviewed the broad political consensus in Argentina for the second half of President @JMilei’s term. I was encouraged by their focus on achieving fiscally sound economic freedom for the people of Argentina via lower taxes, higher investment, private sector job creation, and partnering with allies. As Argentina lifts the dead weight of the state and stops spending into inflation, great things are possible.

The success of Argentina’s reform agenda is of systemic importance, and a strong, stable Argentina which helps anchor a prosperous Western Hemisphere is in the strategic interest of the United States. Their success should be a bipartisan priority.

I look forward to the meeting between President Trump and President Milei on October 14, and to seeing Minister Caputo again on the margins of the IMF Annual Meetings.

In kneejerk response, Argentine dollar bonds extended earlier gains on Thursday, with notes rising more than 4 cents across the curve. Sovereign bonds due in 2035 rose gained 4.3 cents on the dollar to trade above 60 cents, the highest levels in two weeks.

Of course, Argentina was delighted with the outcome and minister Caputo promptly thanked Bessent for his "unwavering support."

While Trump's decision to bailout Argentina makes geopolitical sense - the country is the last bastion of Anti-Chinese sentiment in Latin America, a continent which is now almost entirely pro-Beijing - Trump is about to get an earful from both sides of the aisle why he is bailing out Argentine farmers (who are exporting soybeans to China) while neglecting to do the same with US farmers.

As a reminder, with silos full and exports drying up, Beijing - fromerly the biggest buyer of US soybeans - has not purchased any this season, diverting orders to Brazil and Argentina instead. In retaliation for Trump’s tariffs on Chinese goods, China imposed a 25% levy on American soybeans in April, further eroding their price competitiveness.

Beyond Beijing, top importers of US soybeans include Mexico, the European Union, Japan and Indonesia. Yet Trump’s team is pushing into untested markets such as India, already burdened by tariffs, as American farmers hunt for buyers from Vietnam to Nigeria.