By Elwin de Groot, Head of Macro Strategy at Rabobank

That we are living in unprecedented times was borne out by events in the last couple of days again. Indeed, it is probably hard to keep up, even by experienced folks.

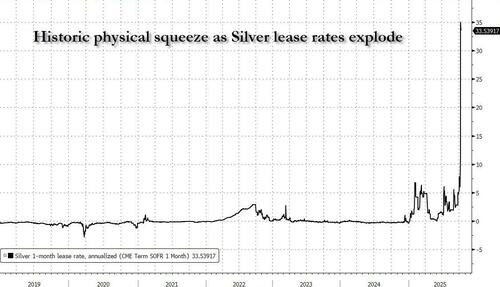

The London silver market saw the spot price of silver pushing above $51 per troy ounce on Friday (and higher again this morning) due to a short squeeze and shortage of silver in London vaults. Some say the situation now, in particular the lack of liquidity, is comparable or even worse than in the early 1980s when the famous Hunt brothers tried to corner the market (after which silver crashed).

Meanwhile, crypto markets saw on Friday what data tracker Coinglass dubbed the “largest liquidation in history”, leading to hefty declines in cryptocurrencies, such as Bitcoin. But significant losses were also recorded in global equity markets, with the S&P500 down 2.7% and investors seeking refuge in ‘safe-haven’ bond markets (10Y USTs -11bp, German Bunds -6bp).

That volatility was clearly driven by the strong-worded warnings by President Trump at the address of China (more on that below), although there were other factors at play, including (geo)political instability. Indeed, just name me one country where the political situation is stable, where there is no ‘polarization’ of society and where policy making is ‘boring’… Still thinking?

In France, newly appointed PM Lecornu, who threw in the towel last week after trying to glue together a group of parties able to steer a budget through parliament was re-appointed by President Macron, again with the same task: …to glue together a group of parties able to steer a budget through parliament. On Sunday President Macron announced the new cabinet, headed by Lecornu.

The turn of events, including Lecornu’s conclusion that it should be possible to reach a deal on the 2026 budget, supported French bonds on Friday. But we think there is not much scope for a further rally in the near term. In fact, as we pointed out last week, we think there is not much scope for a further rally in the near term. Political risks remain until the budget negations are concluded. Both key parties on the far left and right have already indicated they will not support this cabinet and so Lecornu will need all the support he can get elsewhere. It is not to be excluded that he will be toppled again in a no-confidence vote this week. But if he stays, negotiations are likely to remain tough. Most parties underscore the need for a budget, but they will undoubtedly demand (further) concessions, which may weaken fiscal consolidation. In the longer run, that leaves the French curve more vulnerable to future fiscal setbacks.

However, the political focus shifted back to Japan last Friday as the long-standing LDP-Komeito coalition collapsed following Sanae Takaichi’s election as LDP leader. She was set to become Japan’s first female Prime Minister after Shigeru Ishiba stepped down, but Komeito withdrew support over disagreements, particularly on stricter party funding rules. While Takaichi’s leadership is now uncertain, she may still retain power if she can secure backing from parts of the fragmented opposition. Otherwise, snap elections are a real possibility.

This political instability is likely to keep risk premiums elevated, weighing on the yen. However, currency strategist Jane Foley notes that Takaichi may not necessarily favor a weak JPY policy, especially given her concerns about imported inflation and the cost-of-living crisis. A more unifying successor could also trigger a rebound in the yen, which briefly rose above 153 against the USD last week. Finance Minister Kato’s intensified rhetoric has also fueled speculation of potential intervention, especially if yen weakness isn’t driven by fundamentals. Reflecting recent USD strength, we’ve revised our 3-month USD/JPY forecast to 147.00 (from 145), assuming a BoJ rate hike before year-end. Nonetheless, near-term risks point to a possible snapback in JPY value.

But before the market really had had time to start worrying in earnest about the political situation in Japan, the attention shifted back to the US. After waking up (that is, assuming the man sleeps) on Friday, President Trump said he saw “no reason” to meet President Xi of China in October, whilst threatening a restriction on certain US software exports and warning that he would add tariffs of 100% on Chinese goods beginning on Nov 1.

The main reason behind the strongly worded response by Trump – which followed several months in which the US and China had constructive talks and in which it even appeared as if the US administration was trying to stabilize its relation with China – was the renewed tightening of export controls on critical raw materials, particularly rare earth materials, by China. Last week, China also introduced port fees on US ships (in reaction to the port fees levied by the US on Chinese (built/operated) ships). And there were reports that China had been intensifying customs inspections of semiconductor imports. In other words, the Chinese hit a nerve there.

Now the key question is whether this is the re-start of the trade war between the two, or ‘merely’ an opening salvo for the discussion that should ultimately settle things and bring about a more durable stability. Recall that whilst the US and China extended their trade truce for another three months back in August, that was obviously not the final ‘deal’.

The answer to this question, however, is not obvious and, in fact, path-dependent. In other words, it may depend on what other steps each side take and how this is interpreted by the counterparty. And there is an element of randomness here. Or lack of full information. For example, was President Trump fully aware of the actions by his Bureau of Industry and Security department, which on 29 September issued a new rule that strengthens its control over exports? For China may have interpreted this as the US not sticking with the trade truce. Moreover, emotions may be just as important as economic reason, especially when one side is driven by eagerness to strike ‘deals’ whilst the other side is looking for a stable and predictable relationship. But we can make a few observations.

First, both the US and China have offered offramps and clarifications over the weekend. Starting with the US, Trump later posted a statement on Truth Social saying “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!” Whilst US VP Vance called on Beijing to “choose the path of reason”, warning that the US would have significantly more leverage it could use, Trump told reporters on Sunday that “November 1 is an eternity for me. For somebody else, is right around the corner. For me, when I hear November 1, it’s an eternity.” China, meanwhile, clarified its recent decisions to tighten export controls over the weekend, with a Commerce Ministry statement noting that export controls are not the same as a ban on exports. Again, that may be to signal that this decision was not meant to re-ignite a trade war. But of course it’s decision has underscored China’s significant leverage in this particular area: in certain critical raw materials and rare earths – which also serve as key inputs in the US strategic military complex – it can pull all the strings.

Second, with this China is showing its confidence and a willingness to engage in a more confrontational trade-war with the US, if necessary. This is in contrast to how other nations and trade blocs, such as the EU, have engaged with the US. It may thus also give China more leverage vis-à-vis other players in future if it succeeds in demonstrating its statecraft powers.

In any case, it means that all kinds of scenarios still remain possible, even when things appear to be ‘settled’; a sobering conclusion for all global players involved.