Back in September, the otherwise sleepy and mostly boring report that is the Fed's Beige Book report (which nobody otherwise reads due to its sheer size and dismal signal-to-noise ratio) got a sudden boost of notoriety and popularity when none other than Jerome Powell explained after the Fed's 50bps rate cut, that he had been closely following the Beige Book which had emerged as a driving force behind the Fed's unexpected "jumbo" 50bps rate cut. And unlike others, we actually do read the Beige Book, which is why two weeks before the FOMC rate cut we titled our analysis of the latest report as follows: "Ugly Beige Book Reveals Economic Activity "Flat Or Declining", Consumer Spending Slowing In Most Districts." So one can see why Powell panicked and why two rate cuts followed in September and November, just days after the election.

Fast forward to today when moments ago the Fed published its latest, December, Beige Book which suggested that a reversal of the sluggish, "flat or declining" conditions observed in September and November is underway, and which together with a strong jobs report on Friday may be sufficient to enable the Fed to pause rate cuts for the foreseeable future, especially now that Donald Trump is in the White House.

According to the Fed's latest report, economic activity "rose slightly in most Districts", a clear improvement from the descriptions used in the previous months, and that "three regions exhibited modest or moderate growth that offset flat or slightly declining activity in two others." Employment levels were flat or up only slightly across districts and prices rose only at a modest pace across Federal Reserve districts.

Reading further, we find yet another indication of the Trump effect, namely that although growth in economic activity was generally small (thank Biden), expectations for growth rose moderately across most geographies and sectors (thanks Trump) and "business contacts expressed optimism that demand will rise in coming months."

Elsewhere, we find that consumer spending was "generally stable" although many consumer-oriented businesses across Districts noted further increases in price sensitivity among consumers, as well as several reports of increased sensitivity to quality. Among the negative aspects, spending on home furnishings was down, which contacts attributed to limited household mobility, while demand for mortgages was low overall, though reports on recent changes in home loan demand were mixed due to volatility in rates. Commercial real estate lending was similarly subdued. Still, contacts generally reported financing remained available.

Turning to capital spending and purchases of raw materials, these were flat or declining in most Districts while sales of farm equipment were a notable headwind to overall investment activity, and several contacts expressed concerns about the future prices of equipment given ongoing weakness in the farm economy.

Energy activity in the oil and gas sector was flat but demand for electricity generation continued to grow at a robust rate. The rise in electricity demand was driven by rapid expansions in data centers and was reportedly planned to be met by investments in renewable generation capacity in coming years.

Some more details from the Beige Book, starting with Labor Markets:

While Friday's jobs report will have more to say about this, today's ADP report which indicated a sharp bounce in wage growth suggests that the Fed is now working on stale wage data.

Turning to prices:

Here are the main highlights by Fed District

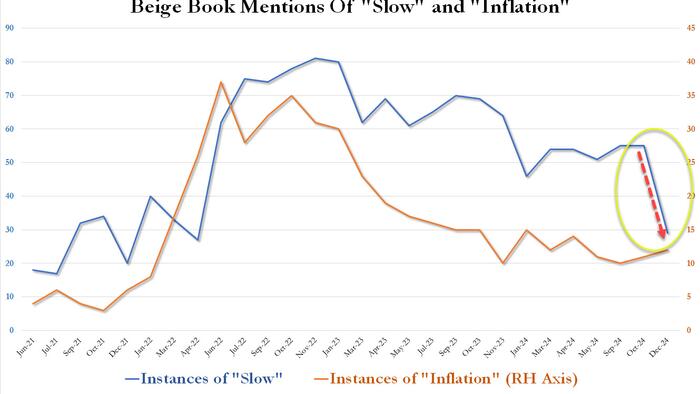

And in keeping with the argument that the Dec Beige Book was much more hawkish than many expected, a quick semantic analysis finds that mentions of "slow" collapsed from 55 in October and an average of 56 in the past year to just 29, the lowest since the covid surge. Meanwhile, "inflation" remained sticky with 12 mentions, up 1 from last month and the highest since April

Bottom line: if the September Beige Book is what ultimately tipped the scales for the Fed to cut 50bps, then the December Beige Book is the first solid hint that a Fed pause may take place as soon as this month (which is perfectly understandable since Trump is now in the White House and the Fed will do everything in its power to make his life miserable).