Amid a barren landscape of macro data due to the shutdown, the fact that many are strongly focused on the incredibly noisy and historically dismissed University of Michigan sentiment survey for any signals on inflation expectations or job hopes is in itself noteworthy.

So, with a big pinch of salt we dig in and see that the preliminary October headline sentiment index dropped very marginally (but was better than expected - 55.0 vs 54.0 exp vs 55.1 prior) with Current Conditions rising (from 60.4 to 61.0) and Expectations falling (from 51.7 to 51.2)...

Source: Bloomberg

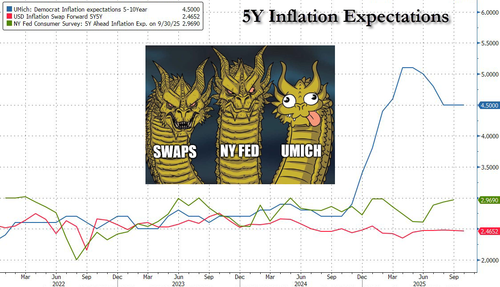

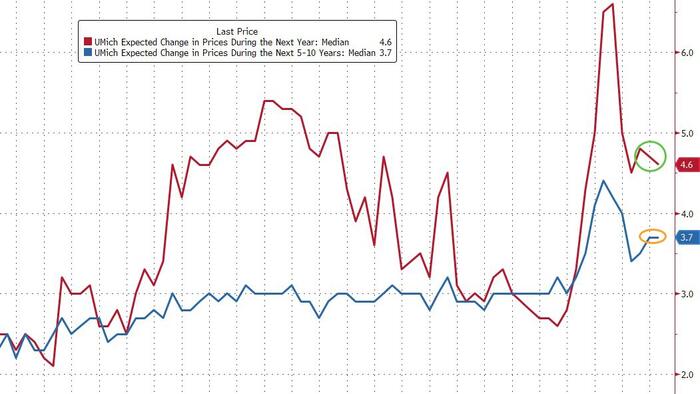

On the inflation side, 1Yr expectations fell to 4.6% from 4.7% (while 5-10Y expectations were flat at 3.7%)...

Source: Bloomberg

Democrats continue to dominate the upside angst for medium-term inflation expectations while the market and other surveys remain unmoved...

On the unemployment side, the balance of respondents who expect a rise in unemployment rose modestly (but remain near multi-year lows)...

Source: Bloomberg

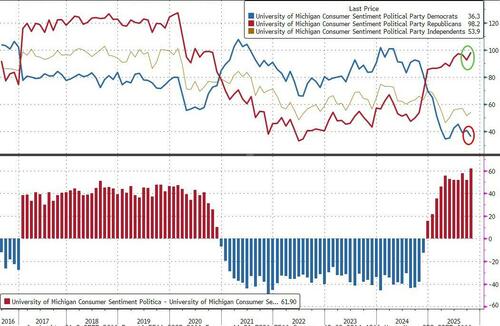

Under the hood, Republicans' confidence is at cycle highs while Democrats' confidence fell to Trump term lows, smashing the spread between the two to a record high...

Source: Bloomberg

UMich Surveys of Consumers Director, Joanne Hsu, noted that "improvements this month in current personal finances and year-ahead business conditions were offset by declines in expectations for future personal finances as well as current buying conditions for durables. Overall, consumers perceive very few changes in the outlook for the economy from last month. Pocketbook issues like high prices and weakening job prospects remain at the forefront of consumers’ minds."

Meanwhile, Hsu notes that "interviews reveal little evidence that the ongoing federal government shutdown has moved consumers’ views of the economy thus far."