Two weeks after the preliminary UMichigan survey found that "Women, Democrats, & Low-Income Americans Are Out Of Their TDS-Addled Minds", and one week after Goldman finally called out the idiocy of the UMich survey, slamming its "partisanship" and the "sample design break starting from June 2024"...

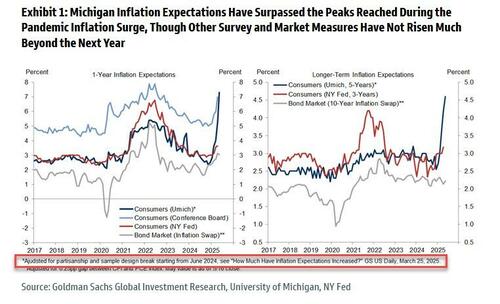

... not to mention that it has been chronically wrong, warning that "Michigan inflation expectations have already risen even more than in 2022 and this time long-term expectations have risen sharply too, all before tariffs have even meaningfully boosted consumer prices" while "technicalities have exaggerated the increase in the Michigan [inflation] survey, as other survey measures and market-implied inflation compensation have not risen much at horizons beyond the next year", moments ago the final UMich survey for the month of May saw sharp revisions to the prelim prints, to wit:

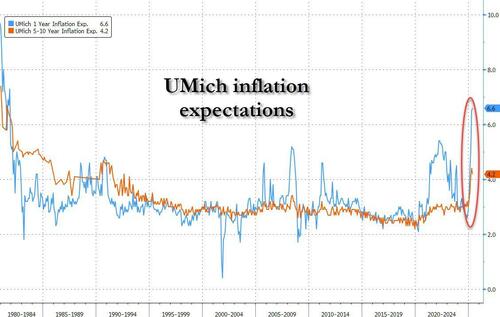

And visually:

“Sentiment had ebbed at the preliminary reading for May but turned a corner in the latter half of the month following the temporary pause on some tariffs on China goods,” Joanne Hsu, director of the survey, said in a statement.

Still, “consumers see the outlook for the economy as no worse than last month, but they remained quite worried about the future,” Hsu said.

There was more moderation also in the survey's expectations for inflation: consumers (read democrats) were more sanguine about the longer-term inflation outlook. They saw costs rising by 6.6% over the next year, down from 7.3% in the prelim print, and below estimates of 7.1%. Same thing with long-term (5-10 year) inflation expectations, which dropped to 4.2% down from 4.6% in the prelim print, and down from 4.4% in the prior month, and also well below estimates of 4.6%. More importantly, it was the first drop this year.

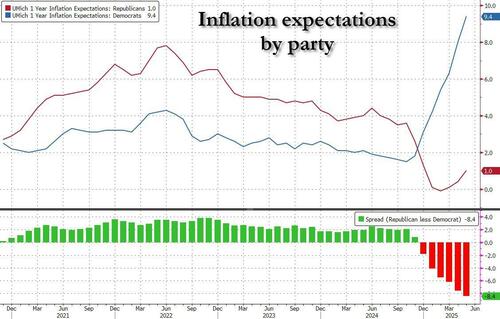

Yet even with the decline, the staggering gap between democrat and republican inflation expectations remains: Democrats still expect an idiotic 9.4% surge in inflation in the coming year (down from 9.6% in the prelim print), while Republicans realize that demand destruction is coming and see inflation rising by only 1% in the coming year (down from 1.2% in the prelim print).

That said, Democrats still have to temper their TDS aggressively: spot the odd one out - UMich Democrats, The NY Fed, or The Market

One more for fun - comparing Democrats view of the inflationary outlook to the 'hard' inflationary data

Finally, given their historic track record (completely refusing to acknowledge the surge in inflation under Biden), should we simply be ignoring the manic Democrats screaming about inflation now? (spoiler: yes)

Earlier on Friday, the government reported continued declines in the Fed's preferred inflation metric, the core PCE with the supercore print coming at the lowest level since covid. Sooner or later, the market will learn that the UMich index was nothing more than a propaganda tool used by its overpaid marxist professors such as Justin Wolfers, meant to hammer stocks but really just offering a constant opportunity for dip buyers, and sure enough, futures are once again at session highs.