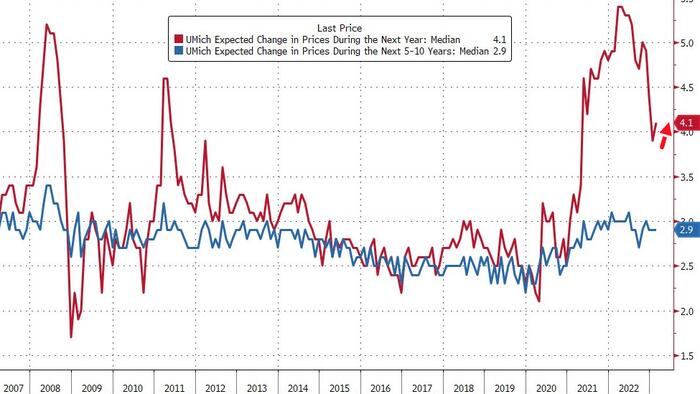

The headline from the University of Michigan sentiment survey continues to be inflation expectations. After the preliminary February print showed an unexpected rebound in short-term inflation expectations, all eyes were on today's final print which slipped a little from flash but is still higher MoM (4.1% final vs 4.2% flash vs 3.9% prior)...

Source: Bloomberg

Consumer sentiment confirmed the preliminary February reading, rising a modest 3% above January. After lifting for the third consecutive month, sentiment is now 17 index points above the all-time low from June 2022 but remains almost 20 points below its historical average.

Source: Bloomberg

Consumers with larger stock holdings exhibited particularly large increases in sentiment. Overall, February’s reading was supported by a 12% improvement in the short-run economic outlook, while all other index components were essentially unchanged.

Buying Conditions held on to their modest improvements off the lows...

Source: Bloomberg

Finally, we note that Republicans and Independents are seeing sentiment soar in recent months while Democrats' confidence has been flat...

Source: Bloomberg

So overall, add this to the list of things that don't support a Fed pivot!