Back in September, the otherwise sleepy and mostly boring report that is the Fed's Beige Book report (which nobody otherwise reads due to its sheer size) got a sudden boost of notoriety and popularity when none other than Jerome Powell explained after the Fed's 50bps rate cut, that he had been closely following the Beige Book which had emerged as a driving force behind the Fed's unexpected "jumbo" 50bps rate cut. And unlike others, we actually do read the Beige Book, which is why two weeks before the FOMC rate cut we titled our analysis of the latest report as follows: "Ugly Beige Book Reveals Economic Activity "Flat Or Declining", Consumer Spending Slowing In Most Districts." So one can see why Powell panicked.

Fast forward to today when moments ago the Fed published its latest, October, Beige Book which indicated a continuation of the "ugly" sluggish conditions observed in September, and which on its own, will likely be sufficient to enable further rate cuts in coming months.

According to the Fed's latest report, economic activity on balance was "little changed in nearly all Districts since early September, though two Districts reported modest growth." Worse, "most Districts reported declining manufacturing activity." Additionally, reports on consumer spending were mixed, "with some Districts noting shifts in the composition of purchases, mostly toward less expensive alternatives" indicating the Fed will likely have to ease further to boost the low-end income consumer.

It wasn't all bad, as activity in the banking sector was "generally steady to up slightly, and loan demand was mixed, with some Districts noting an improvement in the outlook due to the decline in interest rates." Also, housing market activity has generally held up: inventory continued to expand in much of the nation, "and home values largely held steady or rose slightly. Still, uncertainty about the path of mortgage rates kept some buyers on the sidelines, and the lack of affordable housing remained a persistent problem in many communities." At the same time, commercial real estate markets were generally flat, "although data center and infrastructure projects boosted activity in a few Districts."

Elsewhere, agricultural activity also called for easier conditions, as it was "flat to down modestly, with some crop prices remaining unprofitably low. Energy activity was also unchanged or down modestly, and lower energy prices reportedly compressed producers’ margins." Despite elevated uncertainty, the Fed founds that its contacts were somewhat more optimistic about the longer-term outlook, surely the result of the recent easing cycle.

Turning to one-time items, the Fed wrote that "the short-lived dockworkers strike caused only minor temporary disruptions. Hurricane damage impacted crops and prompted pauses in business activity and tourism in the Southeast."

Some more details from the Beige Book, starting with Labor Markets:

Turning to prices:

Here are the main highlights by Fed District

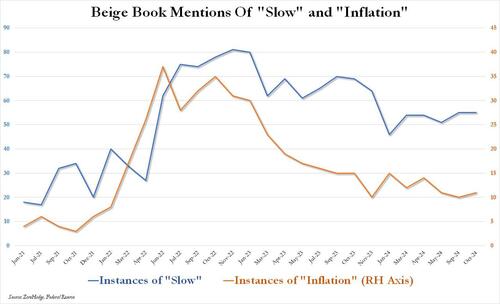

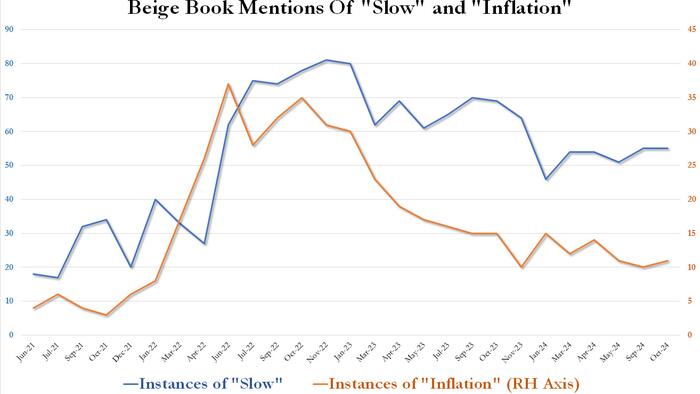

A quick semantic analysis finds that there were virtually no material changes across the two most important metrics tracked by the Fed: inflation and an economic slowdown, with terms discussing the former barely moving (from 11 to 12), while the latter was unchanged at 55.

Bottom line: if the September Beige Book is what ultimately tipped the scales for the Fed to cut 50bps, then the October Beige Book is really even more of the same (with the added kicker of a fullblown manufacturing recession), assuring more rate cuts in coming months.