One week after the latest Q2 GDP revision came in hotter than expected on the back of what was supposedly a surge in consumer spending, which helped push US economic growth to a 3.0% pace in Q2, more than double the 1.4% in Q1, moments ago the Fed published the latest Beige Book reports according to which US economic activity "grew slightly" in three Districts, while the number of Districts that reported flat or declining activity rose from five in the prior period to nine in the current period, refuting any speculation of a recovery in the economy.

While economic activity was stagnant at best, the labor market was also disappointing, with the Beige Book noting that while employment levels were steady overall, there were isolated reports that firms filled only necessary positions, reduced hours and shifts, or lowered overall employment levels through attrition. Still, reports of layoffs remained rare while wage growth was modest, and increases in nonlabor input costs and selling prices ranged from slight to moderate.

More ominously, "consumer spending ticked down in most Districts, having generally held steady during the prior reporting period" or in other words, deteriorating. Auto sales continued to vary by District, with some noting increases in sales and others reporting slowing sales because of elevated interest rates and high vehicle prices. Manufacturing activity declined in most Districts, and two Districts noted that these declines were part of ongoing contractions in the sector.

While residential construction and real estate activity was reportedly "mixed", most Districts' reports indicated softer home sales. Likewise, reports on commercial construction and real estate activity were "mixed."

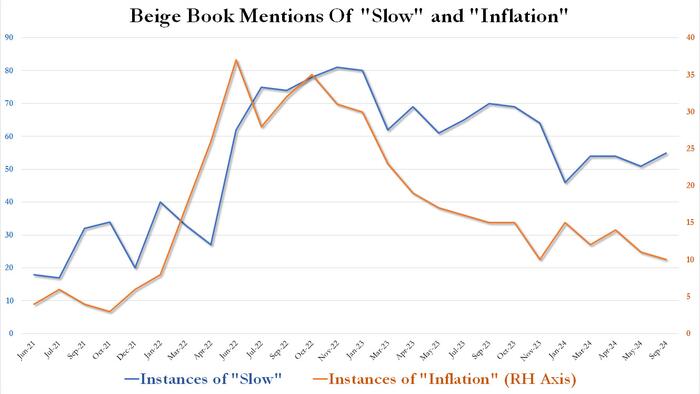

The chart below summarizes the Fed's mandate dilemma best: while mentions of "slow" have been consistently rising since troughing in January, Beige Book mentions of "inflation" are tied for the lowest in two years.

Looking ahead, the Fed's district contacts "expected economic activity to remain stable or to improve somewhat in the coming months" - these will be very disappointed - though contacts in three Districts, i.e., the realists, anticipated slight declines.

Taking a closer look at the two key Fed mandates, jobs and inflation, we first turn to labor markets where the Beige Book made the following downbeat observations:

As for prices, it appears that we are on the edge of disinflation if not outright deflation:

For those curious what individual regional Fed had to say, here is a snapshot:

More in the full Beige Book.