After a rather forgettable 2Y auction yesterday, moments ago the Treasury sold $70BN in yet another subpar coupon auction.

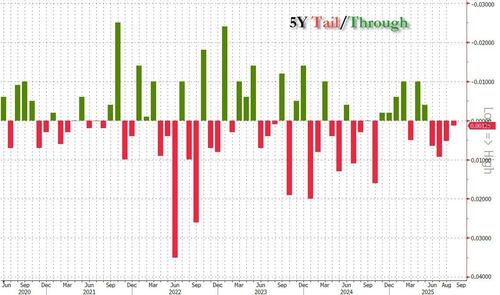

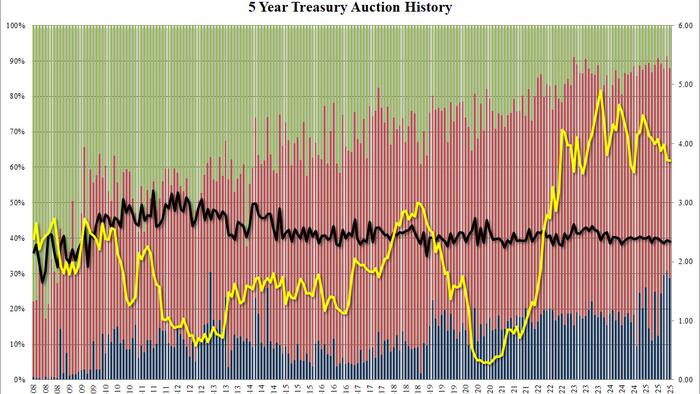

The auction stopped at a high yield of 3.710%, down from 3.724% in August and the lowest since last September. It also tailed then When Issued 3.709% by 0.1bps, the 4th consecutive tailing 5Y auction in a row.

The bid to cover was 2.34, down from 2.36 last month and just below the 2.36 recent average.

The internals were also subpar, with Indirects awarded 59.42%, also below last month's 60.48% and well below the 66.9% recent average. And with Directs once again printing at an impressively high 28.6% (the Directs across all auctions have soared after Liberation Day), Dealers were left with just 11.9%, one of the lowest on record.

In summary: after yesterday's subpart 2Y auction, today's sale of US debt was just as unremarkable, and not surprisingly the market was not impressed, with yields sticking to session highs after the break. The only silver lining: the auction wasn't too ugly to force a blow out in yields to session highs.